QUOTE(Azurues @ Jun 9 2025, 06:54 PM)

What is the taxed product list?

About time madanon take more money then remove again to say government prihatin

About time madanon take more money then remove again to say government prihatin

AI Summary:

This document outlines Malaysia's tax policies, specifically covering two main areas:

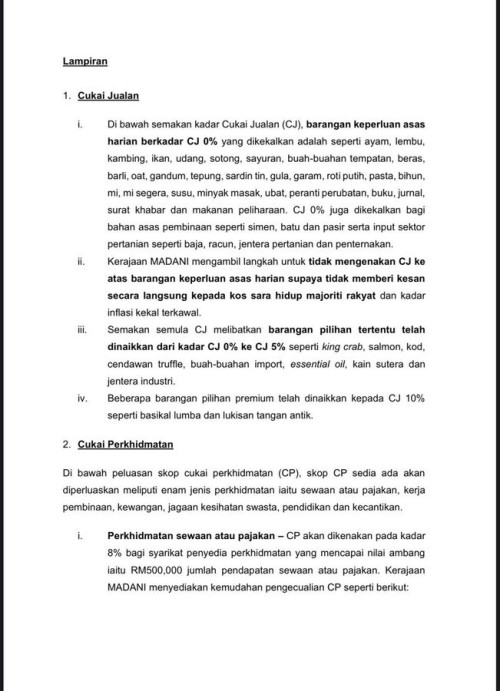

1. Sales Tax (Cukai Jualan - CJ)

Basic Necessities (0% rate): Essential items like rice, chicken, beef, fish, vegetables, fruits, bread, milk, and basic food staples are exempt from sales tax to ensure affordability for the public.

Selected Items (5% rate): Certain goods including king crab, salmon, imported luxury foods, essential oils, and premium fabrics have been increased from 0% to 5% tax rate.

Premium Items (10% rate): Luxury goods such as premium skincare and antique items are taxed at 10%.

2. Service Tax (Cukai Perkhidmatan - CP)

The document details various service tax rates and exemptions:

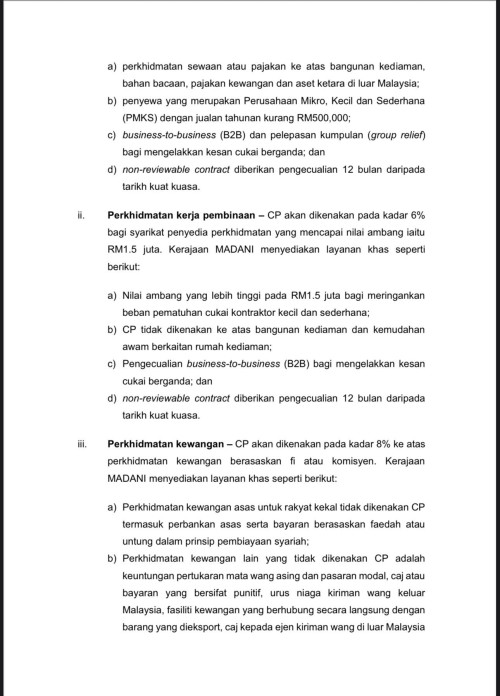

Rental/Lease Services (8%): Applied to property rentals, with specific exemptions for:

- Diplomatic missions and international organizations

- Small and medium enterprises (SMEs) with annual turnover under RM500,000

- Business-to-business transactions for tax avoidance prevention

- 12-month exemption periods for certain contracts

Construction Services (6%): Applied to construction services above RM1.5 million threshold, with exemptions for small contractors and certain business arrangements.

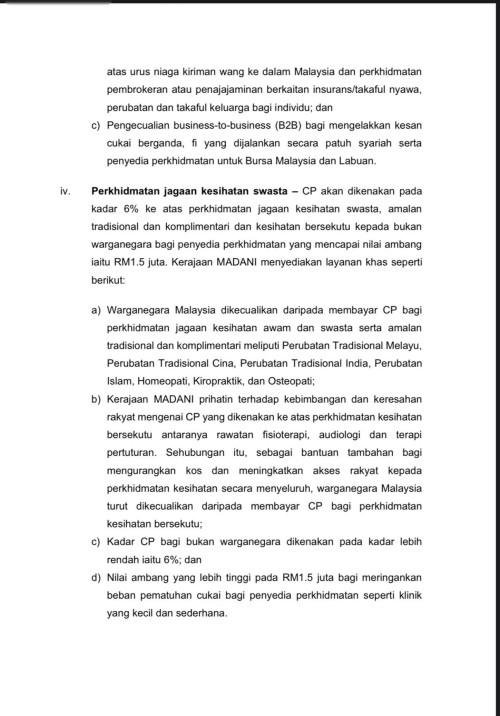

Financial Services (8%): Applied to financial services based on fees or commissions, with exemptions for basic banking services and Shariah-compliant transactions.

Healthcare Services (6%): Applied to private healthcare services above RM1.5 million threshold, with special provisions for Malaysian citizens and traditional medicine practices.

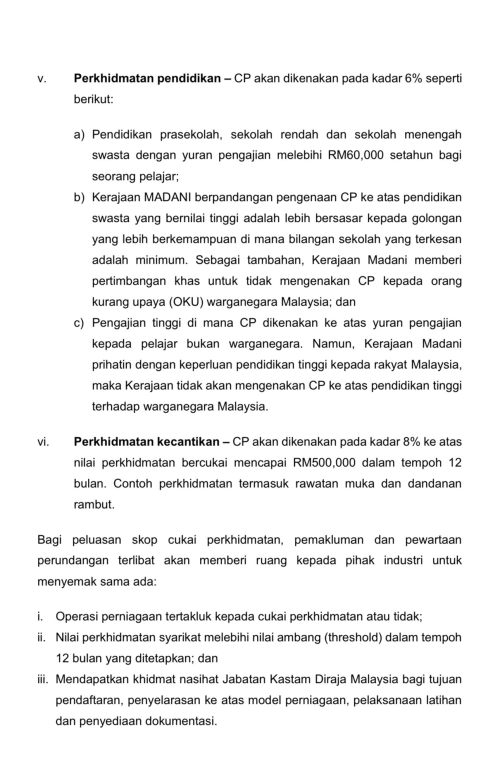

Education Services (6%): Applied to private education with annual fees exceeding RM60,000, with exemptions for underprivileged Malaysians and considerations for higher education accessibility.

Beauty Services (8%): Applied to beauty and wellness services exceeding RM500,000 over 12 months, including treatments like facials and hair styling.

The policy aims to balance revenue generation with protecting essential services and supporting small businesses while ensuring broader industry compliance.

Jun 9 2025, 07:05 PM

Jun 9 2025, 07:05 PM

Quote

Quote 0.0149sec

0.0149sec

0.56

0.56

6 queries

6 queries

GZIP Disabled

GZIP Disabled