Ini yang kita mau kan

Pau lagi rakyat, kasi tax banyak2

Janji, Malaysia masih aman kanMedusakia

Govt to impose 10% sales tax on non-essentials, service tax expanded

Govt to impose 10% sales tax on non-essentials, service tax expanded

|

|

Jun 9 2025, 07:31 PM Jun 9 2025, 07:31 PM

Show posts by this member only | IPv6 | Post

#41

|

Junior Member

436 posts Joined: Mar 2005 |

Ini yang kita mau kan

Pau lagi rakyat, kasi tax banyak2 Janji, Malaysia masih aman kanMedusakia |

|

|

|

|

|

Jun 9 2025, 07:31 PM Jun 9 2025, 07:31 PM

|

Junior Member

933 posts Joined: Jul 2005 |

|

|

|

Jun 9 2025, 07:32 PM Jun 9 2025, 07:32 PM

Show posts by this member only | IPv6 | Post

#43

|

Junior Member

303 posts Joined: Aug 2005 |

Jakim happy , next year they will get 3Billions.

|

|

|

Jun 9 2025, 07:32 PM Jun 9 2025, 07:32 PM

Show posts by this member only | IPv6 | Post

#44

|

Senior Member

5,614 posts Joined: Jun 2006 From: Cyberjaya, Shah Alam, Ipoh |

|

|

|

Jun 9 2025, 07:34 PM Jun 9 2025, 07:34 PM

Show posts by this member only | IPv6 | Post

#45

|

Junior Member

4 posts Joined: Feb 2022 |

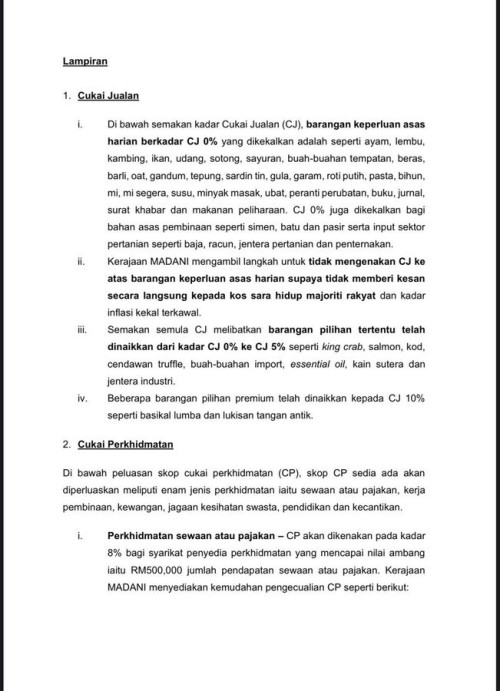

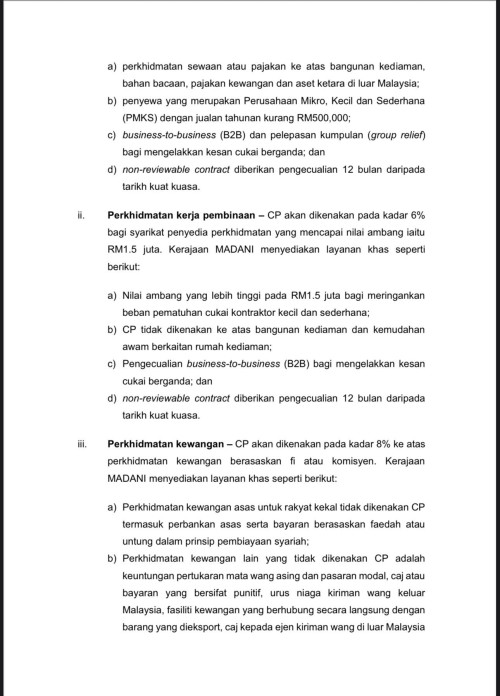

QUOTE(Srbn @ Jun 9 2025, 06:47 PM) Govt to impose 10% sales tax on non-essentials, service tax expanded Call Ahmad Mazlan je laPETALING JAYA: The 0% sales tax rate for basic necessities will be maintained while a 5% to 10% rate will be imposed on non-essential goods, the finance ministry announced this evening. Meanwhile, the service tax will be expanded to include rent, lease, construction, financial services, private healthcare and education. “This expansion however would come with some exemptions to avoid double taxation and ensure that Malaysians are not taxed for certain services,” finance minister II Amir Hamzah Azizan said in a statement. In November, Amir said the expansion of the sales and services tax was expected to generate RM51.7 billion in revenue in 2025. This would represent an additional revenue of RM5 billion over the current SST collection forecast of RM46.7 billion. sos |

|

|

Jun 9 2025, 07:35 PM Jun 9 2025, 07:35 PM

Show posts by this member only | IPv6 | Post

#46

|

Junior Member

166 posts Joined: Jun 2014 |

|

|

|

|

|

|

Jun 9 2025, 07:37 PM Jun 9 2025, 07:37 PM

Show posts by this member only | IPv6 | Post

#47

|

Junior Member

303 posts Joined: Aug 2005 |

Trump coming out with tax cut bill. PMX coming out with more tax bill. So apa macam ? haven't including the petrol subsidies cut later BNM still yet to cut the interest rate.. must be they are too comfortable in air cond room, when EU cut 8 x already. twosocks liked this post

|

|

|

Jun 9 2025, 07:38 PM Jun 9 2025, 07:38 PM

|

Junior Member

321 posts Joined: May 2020 |

|

|

|

Jun 9 2025, 07:39 PM Jun 9 2025, 07:39 PM

|

Senior Member

5,827 posts Joined: Jan 2003 From: Selayang, Selangor |

I was gonna ask Luxury Tax mana, keep delay????

But seems like some of the luxury tax they include in this already. Put luxury tax on cars also lah... why people buy Porsche, Lambo, Lotus EV all got no sales tax sebab EV. There should be additional luxury tax on these cars above 500k or something. |

|

|

Jun 9 2025, 07:39 PM Jun 9 2025, 07:39 PM

Show posts by this member only | IPv6 | Post

#50

|

Junior Member

436 posts Joined: Dec 2021 |

The most important kuestyen, 2feidei ada tax ke tidak?

|

|

|

Jun 9 2025, 07:39 PM Jun 9 2025, 07:39 PM

|

Senior Member

774 posts Joined: Nov 2010 |

they will naik existing taxes and intro new one while cutting subsidies as much as possible

all direct impact from the songklaps, tongkats, bailouts, wastages, middle east aids |

|

|

Jun 9 2025, 07:42 PM Jun 9 2025, 07:42 PM

|

Senior Member

1,406 posts Joined: Dec 2004 From: Living Hell |

QUOTE(bubble-tea @ Jun 9 2025, 07:01 PM) Don't forget build hospital and maybe 1bil aid to palatstinkCukur |

|

|

Jun 9 2025, 07:43 PM Jun 9 2025, 07:43 PM

|

Senior Member

774 posts Joined: Nov 2010 |

QUOTE(bubble-tea @ Jun 9 2025, 07:01 PM) it will naik every year conlanfirmu think those drawing salaries from this budget no need increment and bonus ke dik. just don't ask what is their contribution. that one cannot ask |

|

|

|

|

|

Jun 9 2025, 07:43 PM Jun 9 2025, 07:43 PM

|

Junior Member

150 posts Joined: Mar 2008 |

gst je la. why overcomplicate things. ipohps3 liked this post

|

|

|

Jun 9 2025, 07:45 PM Jun 9 2025, 07:45 PM

Show posts by this member only | IPv6 | Post

#55

|

Junior Member

937 posts Joined: Apr 2020 |

petronas dividend drying up, and gov can't control their budget spending.. every year biggest budget in history..lanjiao la edy high income tax then now sales tax la service tax la.. lanjiao la everything also tax..

|

|

|

Jun 9 2025, 07:52 PM Jun 9 2025, 07:52 PM

|

Senior Member

8,652 posts Joined: Sep 2005 From: lolyat |

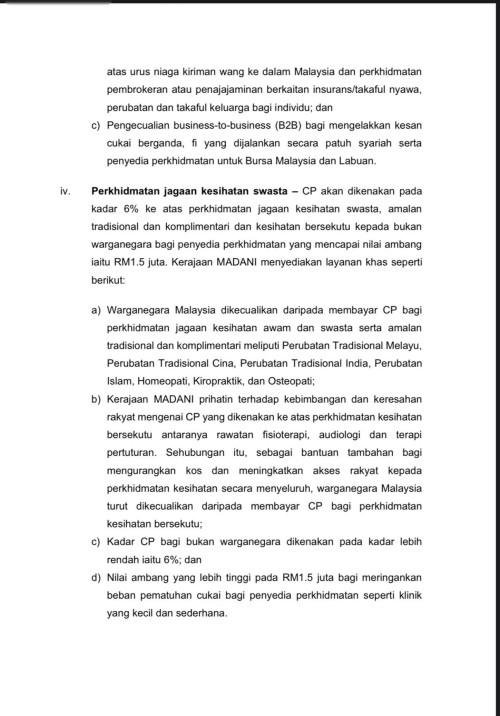

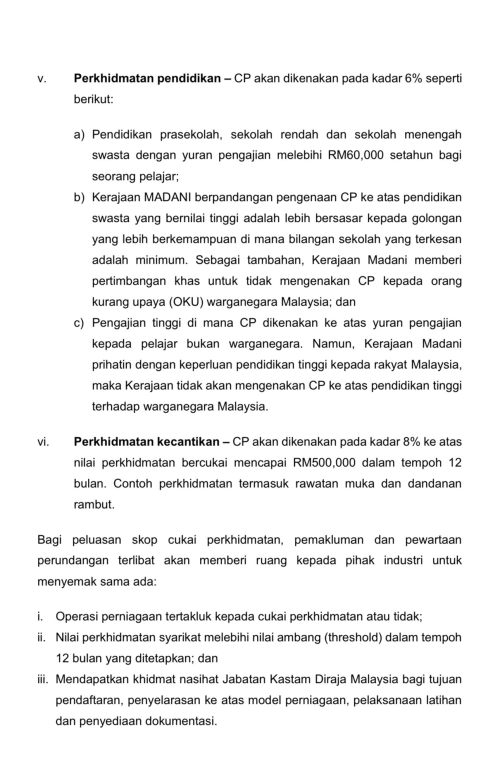

QUOTE(DogeGamingPRO @ Jun 9 2025, 07:05 PM)     AI Summary: This document outlines Malaysia's tax policies, specifically covering two main areas: 1. Sales Tax (Cukai Jualan - CJ) Basic Necessities (0% rate): Essential items like rice, chicken, beef, fish, vegetables, fruits, bread, milk, and basic food staples are exempt from sales tax to ensure affordability for the public. Selected Items (5% rate): Certain goods including king crab, salmon, imported luxury foods, essential oils, and premium fabrics have been increased from 0% to 5% tax rate. Premium Items (10% rate): Luxury goods such as premium skincare and antique items are taxed at 10%. 2. Service Tax (Cukai Perkhidmatan - CP) The document details various service tax rates and exemptions: [b]Rental/Lease Services (8%): Applied to property rentals, with specific exemptions for: - Diplomatic missions and international organizations - Small and medium enterprises (SMEs) with annual turnover under RM500,000 - Business-to-business transactions for tax avoidance prevention - 12-month exemption periods for certain contracts[/B] Construction Services (6%): Applied to construction services above RM1.5 million threshold, with exemptions for small contractors and certain business arrangements. Financial Services (8%): Applied to financial services based on fees or commissions, with exemptions for basic banking services and Shariah-compliant transactions. Healthcare Services (6%): Applied to private healthcare services above RM1.5 million threshold, with special provisions for Malaysian citizens and traditional medicine practices. Education Services (6%): Applied to private education with annual fees exceeding RM60,000, with exemptions for underprivileged Malaysians and considerations for higher education accessibility. Beauty Services (8%): Applied to beauty and wellness services exceeding RM500,000 over 12 months, including treatments like facials and hair styling. The policy aims to balance revenue generation with protecting essential services and supporting small businesses while ensuring broader industry compliance. My boss going to rage because he got tons of property and all start effective 1st July 2025 instead of 1st Jan 2026, within such short notice tenant won't give a fucuk and ask u to absorb the service tax on your own. The healthcare, education and beauty service is fine for me. |

|

|

Jun 9 2025, 07:52 PM Jun 9 2025, 07:52 PM

|

Senior Member

2,992 posts Joined: Feb 2015 |

Lel GST in other form Hahahaha 😂👀🍷🍟🤭 fongsk liked this post

|

|

|

Jun 9 2025, 07:58 PM Jun 9 2025, 07:58 PM

|

Junior Member

34 posts Joined: Apr 2007 |

Waiting for the MCAI fella to quote ‘ you deserve the gomen …..’. !

|

|

|

Jun 9 2025, 08:00 PM Jun 9 2025, 08:00 PM

Show posts by this member only | IPv6 | Post

#59

|

Junior Member

708 posts Joined: Jul 2012 |

安華萬稅萬稅萬萬稅 Srbn liked this post

|

|

|

Jun 9 2025, 08:04 PM Jun 9 2025, 08:04 PM

|

Senior Member

1,260 posts Joined: Sep 2021 |

Already lost count how many taxes got introduced during PH term.. Terbaik PHcais and PHdogs.. don't need always meroyan about B40 enjoying the benefits wokeh. Kan you guys voted and continue supporting this PH Madanon gomen. Means you all are ok with it la. Terbaikkk, next year another 2 more hospital kat gaza, I suggest can put a placard there like how in school we got the big ass donation board. So can tepek PHcais and PHdogs names over there for their contribution to BMX humanitarian efforts This post has been edited by Optizorb: Jun 9 2025, 08:08 PM fongsk liked this post

|

| Change to: |  0.0182sec 0.0182sec

0.49 0.49

5 queries 5 queries

GZIP Disabled GZIP Disabled

Time is now: 15th December 2025 - 10:22 AM |