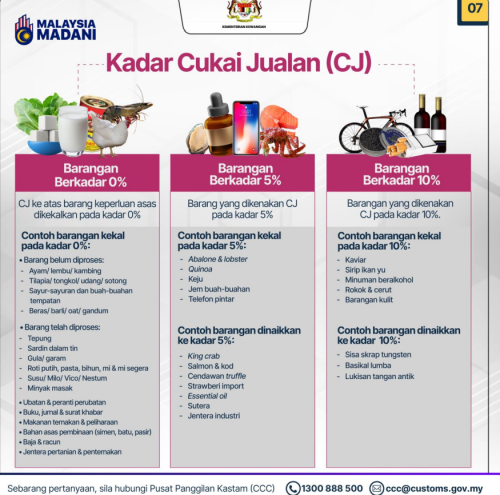

0% Rate (Maintained for Basic Necessities): Includes unprocessed items like chicken, beef, fish, local vegetables, fruits, rice, and processed items like flour, canned sardines, sugar, cooking oil, as well as medicines, books, animal feed, basic construction materials, fertilizers, and agricultural machinery.

5% Rate: Includes items like abalone, lobster, quinoa, cheese, fruit jam, smartphones, and goods with increased rates like king crab, salmon, truffle mushrooms, imported strawberries, essential oils, silk, and industrial machinery.

10% Rate: Includes items like caviar, shark fin soup, alcoholic beverages, tobacco, cigars, leather goods, and goods with increased rates like tungsten scrap, racing bicycles, and antique paintings ( handmade also if follow the edge )

Slide 9: "Rental or Leasing Services"

This slide details the Service Tax on Rental or Leasing Services at an 8% rate.

Registration Requirement: Taxable service value must reach RM500,000 within 12 months.

Non-Taxable Services: Includes residential housing, reading materials, financial leasing, and tangible assets outside Malaysia.

Exemptions: Business-to-business (B2B) exemption and group relief to avoid double taxation. Micro, Small, and Medium Enterprises (MSMEs) with annual sales under RM500,000 are exempt from

service tax. Non-reviewable contracts receive a 12-month exemption from the effective date

Slide 10: "Construction Work Services"

This slide details the Service Tax on Construction Work Services at a 6% rate.

Registration Requirement: Providing infrastructure, commercial, and industrial building construction services. The taxable service value must reach RM1.5 million within 12 months to lighten the tax compliance burden for small and medium contractors.

Non-Taxable Services: Construction work services for residential buildings and public facilities related to residential housing.

Exemptions: Business-to-business (B2B) exemption to avoid double taxation. Non-reviewable contracts receive a 12-month exemption from the effective date

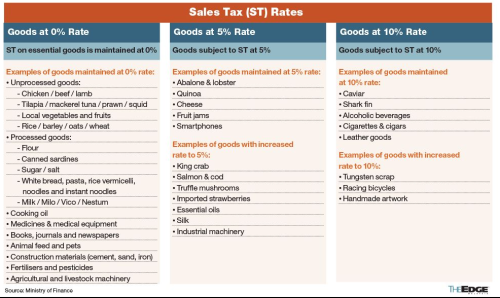

Slide 11: "Financial Services"

This slide details the Service Tax on Financial Services at an 8% rate, noting its phased implementation.

Registration Requirement: Providing fee or commission-based financial services with a total fee or commission value reaching RM500,000 within 12 months.

Non-Taxable Services/Transactions: Includes interest/profit (syariah-based financing), foreign exchange gains and capital markets, brokerage and underwriting for life/family insurance/takaful to individuals, fees on credit and debit cards, basic banking services (savings, current accounts), exported financial services, and penalty charges.

Exemptions: B2B exemption to avoid double taxation. Certain transactions conducted according to Syariah principles. Service tax exemption for Bursa Malaysia and Labuan is maintained.

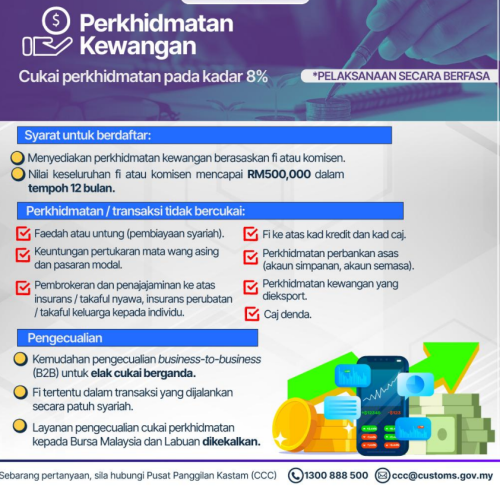

Slide 12: "Private Healthcare Services"

This slide details the Service Tax on Private Healthcare Services at a 6% rate.

Registration Requirement: Providing healthcare services to non-citizens, including services by facilities under the Private Healthcare Facilities and Services Act 1998 (Act 586), traditional and complementary medicine practices, and private allied health services. The taxable service value must reach RM1.5 million within 12 months.

Non-Taxable Providers: Healthcare facilities provided by the Government. Private healthcare facilities under the Universities and University Colleges Act 1971 (Act 30) or MARA University of Technology Act 1976 (Act 173).

Exemptions: Malaysian citizens are exempt from paying service tax for private healthcare services, traditional and complementary medicine practices, and private allied health services.

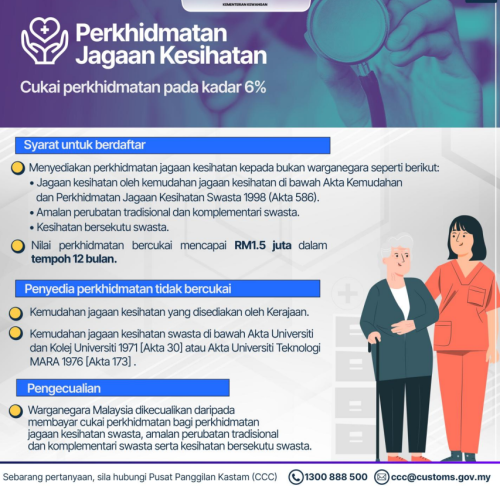

The provided image details the Service Tax for Private Education (Pre-school, Primary, and Secondary Schools). The service tax rate is 6%.

Here are the conditions for registration:

There is no threshold value set for registration.

Private pre-schools, primary schools, and secondary schools that charge tuition fees exceeding RM60,000 per academic year per student are subject to the tax.

Services that are not subject to tax include public education.

An exemption is provided for Malaysian citizens who are OKU cardholders.

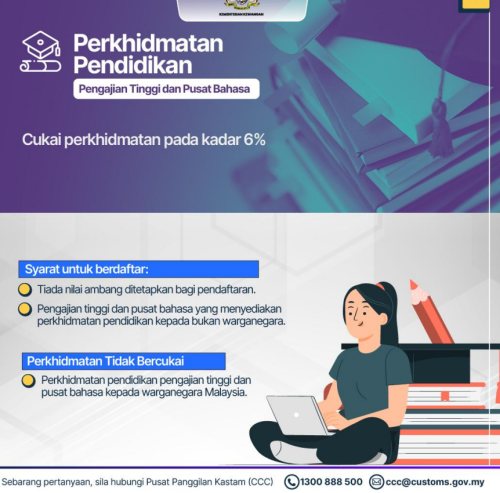

Higher Education and Language Centers (Pengajian Tinggi dan Pusat Bahasa)

Conditions for registration:

No threshold value is set for registration.

Higher education and language centers that provide educational services to non-citizens are subject to this tax.

Non-taxable services: Educational services provided by higher education and language centers to Malaysian citizens are not subject to this tax.

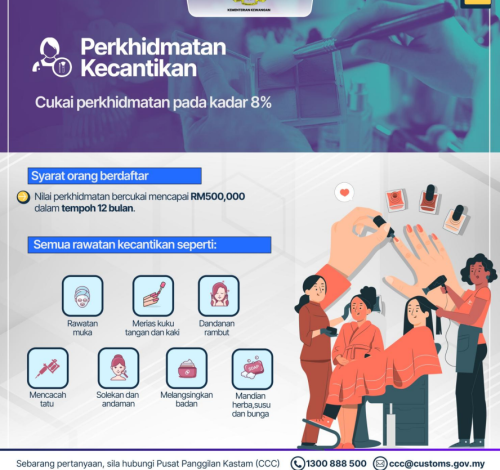

Slide 14: "Beauty Services"

This slide details the Service Tax on Beauty Services at an 8% rate.

Registration Requirement: The taxable service value must reach RM500,000 within 12 months.

All beauty treatments included: Facials, manicures and pedicures, hairstyling, tattooing, makeup and grooming, slimming, and milk/flower baths.

This post has been edited by nelson969: Jun 10 2025, 12:54 AM

Jun 9 2025, 06:15 PM, updated 6 months ago

Jun 9 2025, 06:15 PM, updated 6 months ago

Quote

Quote

0.0420sec

0.0420sec

0.68

0.68

5 queries

5 queries

GZIP Disabled

GZIP Disabled