IPO : ICT ZONE ASIA BERHAD, IPO : ICT ZONE ASIA BERHAD

|

|

May 19 2025, 09:16 AM, updated 8 months ago May 19 2025, 09:16 AM, updated 8 months ago

Show posts by this member only | IPv6 | Post

#1

|

Senior Member

2,834 posts Joined: Apr 2011 |

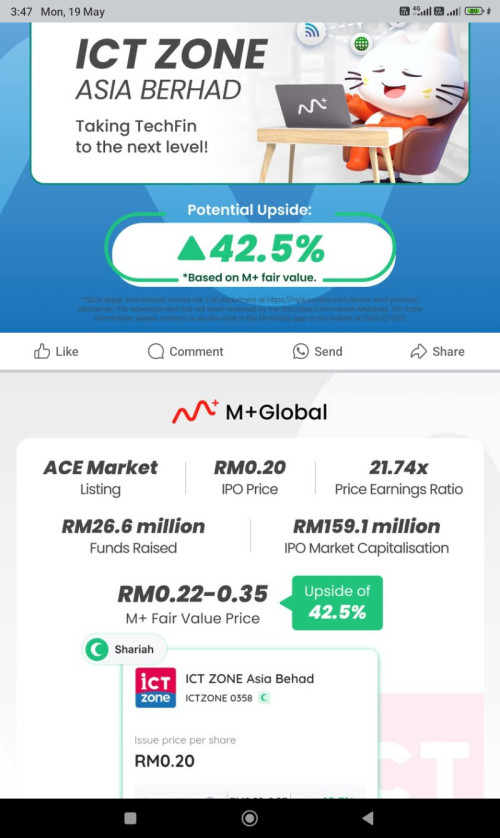

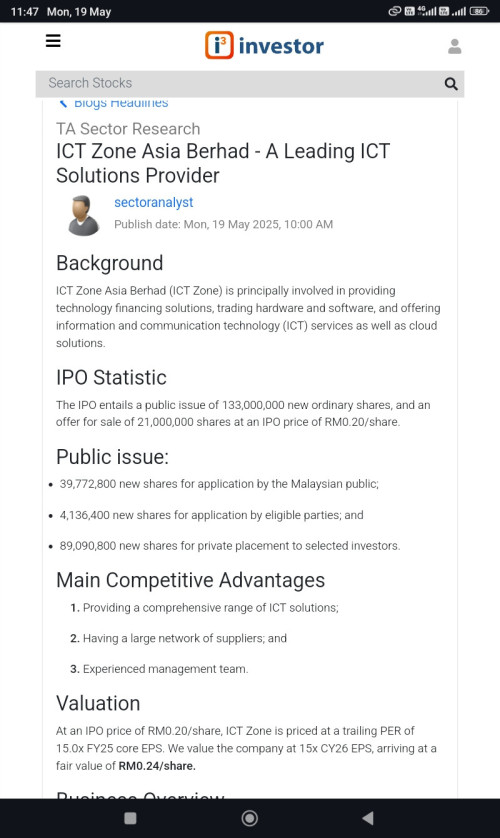

ICT ZONE ASIA BERHAD ICT Zone Asia Berhad provides technology financing solutions, ICT hardware/software trading, ICT services, and cloud solutions. ICT Solutions encompass hardware, software, cloud subscriptions, and services essential for operational tasks and digital transformation. These include desktops, laptops, printers, projectors, operating systems, application software, and consultancy, maintenance, technical support, and device management services. Listing Price :0.20 Closing Date :20 May 2025 Listing Date :03 Jun 2025 PE Ratio :26.32 |

|

|

|

|

|

May 19 2025, 11:51 AM May 19 2025, 11:51 AM

Show posts by this member only | IPv6 | Post

#2

|

Senior Member

2,041 posts Joined: Jan 2022 |

QUOTE(tnang @ May 19 2025, 09:16 AM) ICT ZONE ASIA BERHAD Huatt chaiii ICT Zone Asia Berhad provides technology financing solutions, ICT hardware/software trading, ICT services, and cloud solutions. ICT Solutions encompass hardware, software, cloud subscriptions, and services essential for operational tasks and digital transformation. These include desktops, laptops, printers, projectors, operating systems, application software, and consultancy, maintenance, technical support, and device management services. Listing Price :0.20 Closing Date :20 May 2025 Listing Date :03 Jun 2025 PE Ratio :26.32 FV 24 sen @ 20 %.....looks very PROMISING , a unique/ special complete TECH IPO can't rule out may This company is a tech-fin firm that offers technology financing solutions, trades in hardware and software, and provides ICT services along with cloud solutions. Most of its projects come from the government, which makes it very solid and reliable .... BTW....now can't be overly afraid unlike 2  This post has been edited by IPO ADDICT: May 19 2025, 11:58 AM |

|

|

May 19 2025, 04:00 PM May 19 2025, 04:00 PM

Show posts by this member only | IPv6 | Post

#3

|

Senior Member

2,041 posts Joined: Jan 2022 |

|

|

|

May 20 2025, 09:13 AM May 20 2025, 09:13 AM

Show posts by this member only | Post

#4

|

Junior Member

358 posts Joined: Aug 2020 |

any other write ups ? looks ok wor this

the fair value is such a wide range that it looks strangeeeee..... This post has been edited by Yipeegee: May 20 2025, 09:16 AM |

|

|

May 20 2025, 09:22 AM May 20 2025, 09:22 AM

Show posts by this member only | Post

#5

|

Senior Member

2,041 posts Joined: Jan 2022 |

running no ?...

|

|

|

May 20 2025, 11:00 AM May 20 2025, 11:00 AM

Show posts by this member only | IPv6 | Post

#6

|

Senior Member

2,041 posts Joined: Jan 2022 |

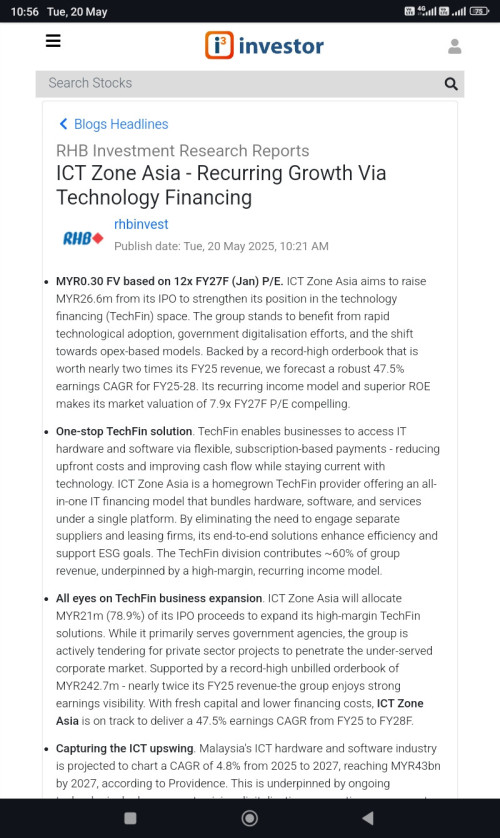

VERY TEMPTING liao....

RHB FV 30 SEN ( 50 % UP ) today just training IPO PEOPLElogy oso what's more with this complete TECH & Financing IPO even dirt cheap 20 sen..... looks very much PROMISING than today PEOPLElogy....hmmm $$$ RUNNING NO please....  This post has been edited by IPO ADDICT: May 20 2025, 11:04 AM |

|

|

|

|

|

May 20 2025, 04:39 PM May 20 2025, 04:39 PM

Show posts by this member only | Post

#7

|

Senior Member

2,041 posts Joined: Jan 2022 |

Hurryyy UPPPPP

50 % up side potential RHB 75 % M+ |

|

|

May 22 2025, 07:50 PM May 22 2025, 07:50 PM

Show posts by this member only | Post

#8

|

Senior Member

2,041 posts Joined: Jan 2022 |

Hmmm....Promising signal.....

Shares in ICT Zone Asia's ACE Market IPO oversubscribed by 1.89 times By John Lai / theedgemalaysia.com 22 May 2025, 06:57 pm KUALA LUMPUR (May 22): ICT Zone Asia Bhd (KL:ICTZONE) announced that its initial public offering (IPO) has been oversubscribed by 1.89 times by public investors, ahead of its ACE Market listing. The tech financing solutions provider scheduled for transfer listing from the LEAP Market to the ACE Market of Bursa Malaysia on June 3, offered 154 million shares in total, comprising 133 million new shares and an offer for sale of 21 million shares. It has received 2,562 applications for 115.06 million shares worth RM23.01 million from the Malaysian public, compared with the 39.77 million shares offered, according to a statement from Malaysian Issuing House Sdn Bhd on Thursday. The Bumiputera portion was oversubscribed by 1.1 times, with 1,107 applications for 41.71 million shares received. The public portion saw 1,545 applications for 73.35 million shares, representing an oversubscription rate of [B]2.69 times. This post has been edited by IPO ADDICT: May 22 2025, 07:51 PM |

|

|

May 23 2025, 05:04 AM May 23 2025, 05:04 AM

Show posts by this member only | Post

#9

|

Senior Member

2,041 posts Joined: Jan 2022 |

According to the research house, 70% of the company’s leasing solutions’ segment revenue is derived from government-linked projects, therefore, it sees that artificial intelligence (AI) personal computer upgrade trend could drive new or renewed contracts for the company. “We project 25-40% revenue growth for the financial year of 2025 forecast (FY2026F) to FY2028F, driven by RM21 million IPO [initial public offering] funded capex to expand leasable assets and new and renewed customer contracts,” Tradeview said in a note on Monday. Tradeview’s target price of 29 sen represents a 44% upside, based on a FY2027 price earnings of 13 times, comparable to peers, given its robust earnings growth from better product mix and slight premium to the non-bank financial institutions due to lower gearing, added Tradeview. RHB Research, meanwhile, has assigned a fair value of 30 sen per share based on 12 times forecast FY2027 earnings, indicating a potential upside of 51% from its IPO price of 20 sen, it said in an IPO note on Tuesday. "Backed by a record-high order book that is worth nearly two times its FY2025 revenue, we forecast a robust 47.5% compounded annual growth rate for FY2025-FY2028," said RHB Research. "Its recurring income model and superior ROE makes its market valuation of 7.9x FY2027 P/E compelling," it saidl. This post has been edited by IPO ADDICT: May 23 2025, 05:06 AM |

|

|

May 29 2025, 11:19 AM May 29 2025, 11:19 AM

Show posts by this member only | IPv6 | Post

#10

|

Senior Member

2,041 posts Joined: Jan 2022 |

ICT Zone Asia’s First-Ever Quarterly Report: Solid Numbers and Promising Growth Ahead

hwangjoey1 Publish date: Wed, 28 May 2025, 11:40 PM ICT Zone has a RM253.4 million unbilled order book in tech financing over the next five years, that’s locked-in future income. There's also another RM5.6 million in cloud services unbilled revenue, so while smaller, it's a nice complement to their core segment. This post has been edited by IPO ADDICT: May 29 2025, 11:19 AM |

|

|

May 30 2025, 09:26 PM May 30 2025, 09:26 PM

|

Senior Member

2,041 posts Joined: Jan 2022 |

This company is a tech-fin firm that offers technology financing solutions, trades in hardware and software, and provides ICT services along with cloud solutions.

Most of its projects come from the government, which makes it very solid and reliable |

|

|

Jun 2 2025, 08:25 PM Jun 2 2025, 08:25 PM

|

Senior Member

2,041 posts Joined: Jan 2022 |

|

|

|

Jun 3 2025, 02:08 PM Jun 3 2025, 02:08 PM

|

Senior Member

4,706 posts Joined: Jan 2003 From: So would I be out of line if I said.... |

just realize ict listing today.

still red color |

|

|

Jun 3 2025, 04:07 PM Jun 3 2025, 04:07 PM

Show posts by this member only | IPv6 | Post

#14

|

Senior Member

3,969 posts Joined: Nov 2016 |

didn't even know it's listing day

No activity in this topic from morning. |

| Change to: |  0.0201sec 0.0201sec

0.41 0.41

5 queries 5 queries

GZIP Disabled GZIP Disabled

Time is now: 20th December 2025 - 09:48 PM |

All Rights Reserved © 2002- 2025 Vijandren Ramadass (~unite against racism~)

Powered by Invision Power Board © 2025 IPS, Inc.

Quote

Quote