I usually invoice them in USD, then they pay me via Wise. According to LHDN's guidelines, I should create an e-Invoice in the USD currency and pick an exchange rate from a platform of choice to use.

The problem is that Wise charges some amount of conversion fee that I absorb. So for example if I invoice $1,000 at exchange rate of 4.4, I don't get RM4,400, I get something like RM4,350 because of RM50 conversion fee from Wise. So how do I tally these amounts? Or is the MYR equivalent not a big deal for an invoice issued in foreign currency because of conversion fluctuations?

The way I see it, there are a couple of options:

1. I invoice as usual using my own format, then once I know the final amount after Wise transfer is in, I create the e-Invoice after the fact with the final amount.

The problem here is I'm not sure that this is allowed.

2. I invoice using e-Invoice, then after the Wise transfer is in, I revise the MYR equivalent amount in the e-invoice via debit/credit note.

This seems to be the sanctioned/approved option, but it's obviously twice the amount of paperwork on my end

3. I invoice using e-Invoice and don't care that there's a mismatch between my estimated MYR vs. the actual MYR amount that I receive.

This is the least amount of work for me, and it'd be nice if this is indeed acceptable because it's only natural to expect foreign exchange rates to fluctuate a little bit after issuance of e-Invoice.

EDIT: I received an email response from LHDN. We don't have to do anything special.

QUOTE

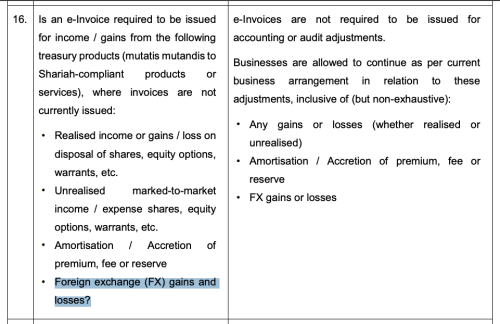

As mentioned in the Specific Industry FAQ – Financial Services, Section A, Item 16, any foreign exchange gain or loss (whether realised or unrealised) does not require the issuance of an e-Invoice.

Since a foreign payer cannot issue a self-billed e-Invoice, the obligation remains with the Malaysian taxpayer to issue the e-Invoice to the foreign payer.

In your case, you should issue the e-Invoice based on the invoiced amount (in MYR equivalent at the exchange rate on the invoice date), without adjusting for the Wise fee or any exchange loss.

The difference caused by the Wise platform fee is considered a normal business expense or foreign exchange loss and does not require a separate e-Invoice.

This post has been edited by KingArthurVI: Apr 28 2025, 02:15 PMSince a foreign payer cannot issue a self-billed e-Invoice, the obligation remains with the Malaysian taxpayer to issue the e-Invoice to the foreign payer.

In your case, you should issue the e-Invoice based on the invoiced amount (in MYR equivalent at the exchange rate on the invoice date), without adjusting for the Wise fee or any exchange loss.

The difference caused by the Wise platform fee is considered a normal business expense or foreign exchange loss and does not require a separate e-Invoice.

Apr 21 2025, 12:24 PM, updated 3d ago

Apr 21 2025, 12:24 PM, updated 3d ago

Quote

Quote

0.0154sec

0.0154sec

0.51

0.51

6 queries

6 queries

GZIP Disabled

GZIP Disabled