Outline ·

[ Standard ] ·

Linear+

Transfer USD from Outside to Malaysia Account, And keep as USD

|

TSben3003

|

Apr 17 2025, 12:06 PM Apr 17 2025, 12:06 PM

|

|

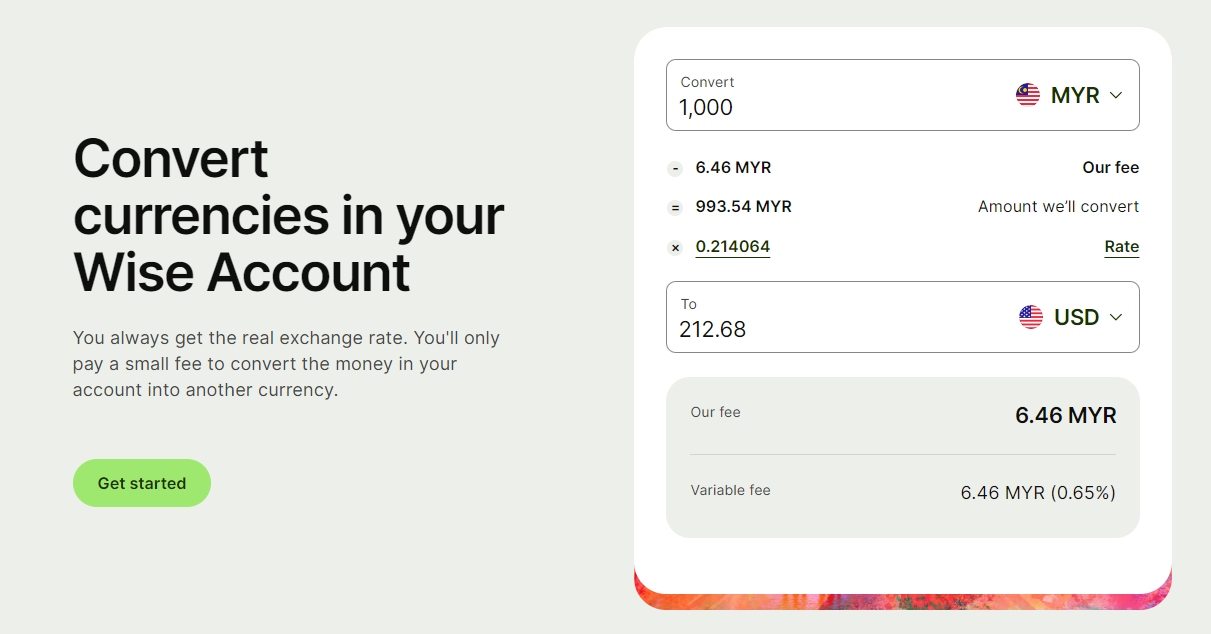

QUOTE(ahchun @ Apr 17 2025, 12:04 PM) so far the money deposited to me from USA-USD to wise i think there is no charges but then mine is not salary. maybe is different this is what i understand as well rate is reasonable and alot better than local bank FX charges and rate Qatar is pegged with USD hence the conversion rate to USD is a fixed rate. but since is outside USA so i believe the transfer in charges applies. but i use the conversion to calculate more or less same like maybank global acc currency converter la. maybe by rm20-30 diff. if 1 go transfer big amount no much different. |

|

|

|

|

|

Medufsaid

|

Apr 17 2025, 12:15 PM Apr 17 2025, 12:15 PM

|

|

yea... ahchun needs to realise that TS' usd might need to use swift/wire (USD6.11 fee) to send to Wise USA. so better use MBB or RHB (RHB pending confirmation)

This post has been edited by Medufsaid: Apr 17 2025, 12:17 PM

|

|

|

|

|

|

dwRK

|

Apr 17 2025, 12:23 PM Apr 17 2025, 12:23 PM

|

|

QUOTE(rx330 @ Apr 17 2025, 11:31 AM) is ur MCA personal or company? Care to share how to receive if personal? do you have a set of account numbers so others can TT to u? individual... just the usual swift code mca account number and name... |

|

|

|

|

|

dwRK

|

Apr 17 2025, 12:28 PM Apr 17 2025, 12:28 PM

|

|

QUOTE(ahchun @ Apr 17 2025, 12:04 PM) so far the money deposited to me from USA-USD to wise i think there is no charges but then mine is not salary. maybe is different this is what i understand as well rate is reasonable and alot better than local bank FX charges and rate i stopped using wise long time liao... rhb mca is simpler/better imho especially for my case... |

|

|

|

|

|

TSben3003

|

Apr 17 2025, 12:30 PM Apr 17 2025, 12:30 PM

|

|

QUOTE(dwRK @ Apr 17 2025, 12:28 PM) i stopped using wise long time liao... rhb mca is simpler/better imho especially for my case... the rhb conversion rate is Multi Currency Account/-i Debit Card Special Counter Rate* this one? |

|

|

|

|

|

dwRK

|

Apr 17 2025, 12:35 PM Apr 17 2025, 12:35 PM

|

|

QUOTE(ben3003 @ Apr 17 2025, 12:30 PM) the rhb conversion rate is Multi Currency Account/-i Debit Card Special Counter Rate* this one? yes |

|

|

|

|

|

TSben3003

|

Apr 17 2025, 12:39 PM Apr 17 2025, 12:39 PM

|

|

QUOTE(dwRK @ Apr 17 2025, 12:35 PM) thanks bro, this is better compare maybank cos extra usd4 saving. conversion rate wise similar also. will keep this in mind. This post has been edited by ben3003: Apr 17 2025, 12:40 PM |

|

|

|

|

|

dwRK

|

Apr 17 2025, 12:40 PM Apr 17 2025, 12:40 PM

|

|

also pls check with your company expat services... some companies, payroll can be split to say usd and myr... and they can bank in the myr per usual locally... but dunno what exchange rate they will use...

|

|

|

|

|

|

TSben3003

|

Apr 17 2025, 12:42 PM Apr 17 2025, 12:42 PM

|

|

QUOTE(dwRK @ Apr 17 2025, 12:40 PM) also pls check with your company expat services... some companies, payroll can be split to say usd and myr... and they can bank in the myr per usual locally... but dunno what exchange rate they will use... yeah finger crossed everything goes well then go over and see how is it. i dont think they can do myr over there. only QAR if not mistaken. cos when i ask for expectation is in USD but they offer is in QAR. |

|

|

|

|

|

dwRK

|

Apr 17 2025, 12:51 PM Apr 17 2025, 12:51 PM

|

|

QUOTE(ben3003 @ Apr 17 2025, 12:39 PM) thanks bro, this is better compare maybank cos extra usd4 saving. conversion rate wise similar also. will keep this in mind. yeah... they probably have the best fx rates locally... |

|

|

|

|

|

rx330

|

Apr 17 2025, 12:54 PM Apr 17 2025, 12:54 PM

|

|

QUOTE(dwRK @ Apr 17 2025, 12:23 PM) individual... just the usual swift code mca account number and name... so meaning my fren in usa wanna transfer me USD from his account, he just need key in our MCA account number n swift code? but will they or us be charged? |

|

|

|

|

|

TSben3003

|

Apr 17 2025, 12:59 PM Apr 17 2025, 12:59 PM

|

|

QUOTE(rx330 @ Apr 17 2025, 12:54 PM) so meaning my fren in usa wanna transfer me USD from his account, he just need key in our MCA account number n swift code? but will they or us be charged? i believe need to see the bank tariff, normally will charge both side for TT. but since then RHB MCA/debit card account mentioned no fees transferring in, so most likely only charge USA side, not unless their bank also offer free TT. |

|

|

|

|

|

dwRK

|

Apr 17 2025, 01:11 PM Apr 17 2025, 01:11 PM

|

|

QUOTE(rx330 @ Apr 17 2025, 12:54 PM) so meaning my fren in usa wanna transfer me USD from his account, he just need key in our MCA account number n swift code? but will they or us be charged? sending/outbound and receiving/inbound... both got fees unless waived or absorbed by the banks... banks may ask for a little bit more info... but yeah the crucial ones are swift code, mca account number and your name... |

|

|

|

|

|

rx330

|

Apr 17 2025, 01:17 PM Apr 17 2025, 01:17 PM

|

|

QUOTE(dwRK @ Apr 17 2025, 01:11 PM) sending/outbound and receiving/inbound... both got fees unless waived or absorbed by the banks... banks may ask for a little bit more info... but yeah the crucial ones are swift code, mca account number and your name... never knew this acc can outbound as well, thanks for the info need to go xxxx my banker dy, told me cannot inbound |

|

|

|

|

|

dwRK

|

Apr 17 2025, 01:19 PM Apr 17 2025, 01:19 PM

|

|

QUOTE(ben3003 @ Apr 17 2025, 12:42 PM) yeah finger crossed everything goes well then go over and see how is it. i dont think they can do myr over there. only QAR if not mistaken. cos when i ask for expectation is in USD but they offer is in QAR. yeah... really depends on the companies and their expat packages... i dont mean they pay myr over in qatar... some companies can split your expat pay, pay usd in qatar and myr in malaysia... this way you don't have to worry about transferring money from qatar to malaysia... anyways, good luck and all the best |

|

|

|

|

|

Pat89

|

Apr 18 2025, 07:58 AM Apr 18 2025, 07:58 AM

|

|

QUOTE(ahchun @ Apr 17 2025, 01:04 PM) so far the money deposited to me from USA-USD to wise i think there is no charges but then mine is not salary. maybe is different this is what i understand as well rate is reasonable and alot better than local bank FX charges and rate And your understanding is correct as mine, and I love wise!  |

|

|

|

|

|

Ramjade

|

Apr 18 2025, 08:49 AM Apr 18 2025, 08:49 AM

|

|

QUOTE(Pat89 @ Apr 17 2025, 10:46 AM) Open wise account maybe? Easier to manage. QUOTE(ahchun @ Apr 17 2025, 10:56 AM) WISE is easier or keep oversea and transfer back when rate is good transfer back to local bank, FX rate n charges is ridiculous Wise not good as limit only RM20k so can't really keep money inside it. |

|

|

|

|

|

gamenoob

|

Apr 18 2025, 09:19 AM Apr 18 2025, 09:19 AM

|

|

QUOTE(ben3003 @ Apr 17 2025, 10:12 AM) qatar do have HSBC, but need premier and advance account only can get everyday global account for free transfer. Probably have to work for few months baru can. Need to pay loan etc in Malaysia side so have to transfer some money back lol. You set up local HSBC premier and ask your RM to setup HSBc premier for Qatar from here with your employment documentation. And setup EGA for both account. Then you can get paid USD into Qatar HSBC and transfer it to MY HSBC as MYR without charges. You can also do the DCI to take advantage of fluctuating FX rate by earning short term interest at a selection of FX rates table when converting USD back to MYR. This is based on my experience with HSBC when I set up my kid banking for UK. |

|

|

|

|

|

Medufsaid

|

Apr 18 2025, 09:30 AM Apr 18 2025, 09:30 AM

|

|

there are 2 fees involved in transfer+forex - transfer fee

- marked up forex rate

usually when financial entities say no charges they just meant item 1 is waived. if you can prove 2 is FOC (via real time screenshot with HSBC vs actual mid-rate quote from wise, as wise will show both the mid-rate + the actual cut they are getting from you) that'll be great QUOTE(Medufsaid @ Jun 29 2023, 11:53 AM) QUOTE(RJdio @ Nov 30 2024, 08:16 AM) HSBC has a multi-currency account. QUOTE(Ramjade @ Nov 30 2024, 08:34 AM) Rhb multi currency have better rates for overseas transaction. |

|

|

|

|

|

dwRK

|

Apr 18 2025, 05:34 PM Apr 18 2025, 05:34 PM

|

|

QUOTE(gamenoob @ Apr 18 2025, 09:19 AM) You set up local HSBC premier and ask your RM to setup HSBc premier for Qatar from here with your employment documentation. And setup EGA for both account. Then you can get paid USD into Qatar HSBC and transfer it to MY HSBC as MYR without charges. You can also do the DCI to take advantage of fluctuating FX rate by earning short term interest at a selection of FX rates table when converting USD back to MYR. This is based on my experience with HSBC when I set up my kid banking for UK. since you have it... what is the latest buy/sell USD exchange rate for EGA? |

|

|

|

|

Apr 17 2025, 12:06 PM

Apr 17 2025, 12:06 PM

Quote

Quote

0.0150sec

0.0150sec

0.37

0.37

5 queries

5 queries

GZIP Disabled

GZIP Disabled