I have a question regarding calculation for net income of a residential rental property.

which is the correct way calculating the deduction

Income

Rental Condo (Jan-Dec 24) : 20400

Rental House ( Aug to Dec 24): 12,000

Total Income: 32400

Deduction A

Maintenance Condo (Jan to Dec): 6000

Interest on housing loan ( Aug to Dec 24): 10000

Net income: 32400 - (6000+10000)

Deduction B

Maintenance Condo: 6000

Interest on housing loan ( Jan to Dec 24): 24000

Net income: 32400 - (6000+24000)

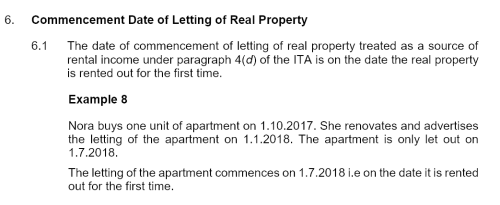

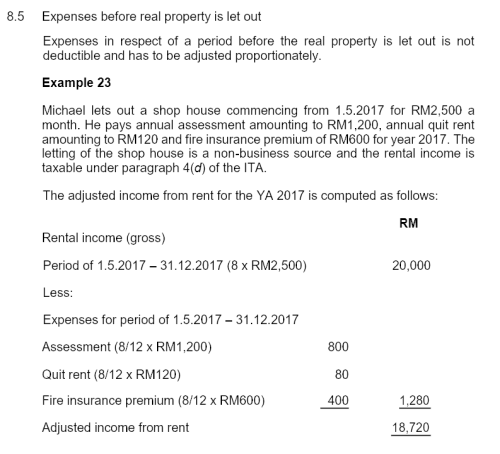

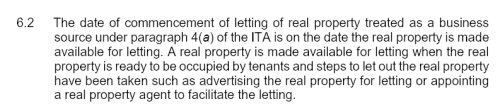

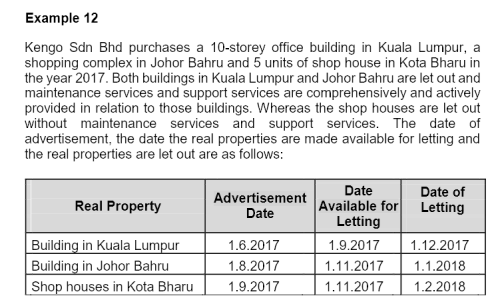

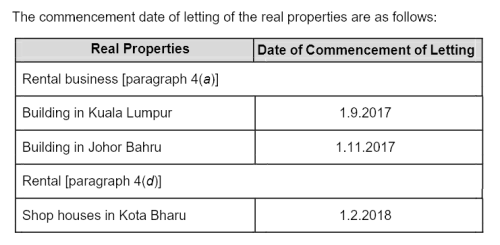

As my house only started to rent out in Aug, can i consider my housing loan interest from Jan to Dec 24 instead of taking only the interest from Aug 24 to Dec 24

This is because i tried to rent out my house but since no taker, house was empty for 7 months while interest continued to be paid to the bank

Appreciate your advise

Thank you so much!!

Calculate Rental income for tax, Rental income

Apr 1 2025, 02:23 PM, updated 9 months ago

Apr 1 2025, 02:23 PM, updated 9 months ago

Quote

Quote

0.0201sec

0.0201sec

0.48

0.48

5 queries

5 queries

GZIP Disabled

GZIP Disabled