Coupon 6.0%.

Any comment from you guys?

Qualitas Sukuk Berhad – PNC5 Subordinated Sukuk Wakalah 🌟

🔹 Key Investment Details

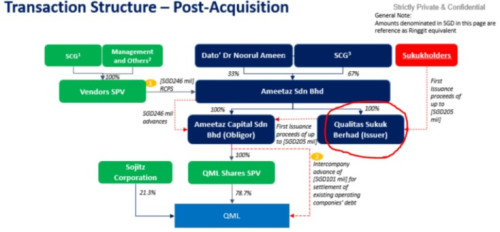

* 📌 Issuer: Qualitas Sukuk Berhad

* 📌 Obligor: Ameetaz Capital Sdn Bhd

* 📌 Issuer Rating: 🟢 A2/Stable (RAM)

* 📌 Facility Size: RM2.5 billion

* 📌 Indicative Issue Size: RM665 million

* 📌 Instrument: Sukuk Wakalah

* 📌 Tenure: Perpetual (Callable after 5 years) 🔄

* 📌 Pricing: 💰 101.20

* 📌 Yield to Call (YTC): 📈 5.42% – 5.52% p.a.

* 📌 Indicative Coupon Rate: 📉 5.7% – 5.8% p.a.

* 📌 Ranking: ⚠️ Perpetual Subordinated

* 📌 Profit Distribution: 📅 Semi-Annual

* 📌 Minimum Investment: RM250,000

Attached File(s)

Qualitas___Investor_Presentation__final_.pdf ( 2.44mb )

Number of downloads: 72

Qualitas___Investor_Presentation__final_.pdf ( 2.44mb )

Number of downloads: 72 RAMR_RAT_QualitasSukukBerhad_20241209.pdf ( 1.08mb )

Number of downloads: 75

RAMR_RAT_QualitasSukukBerhad_20241209.pdf ( 1.08mb )

Number of downloads: 75

Mar 18 2025, 01:30 PM, updated 4w ago

Mar 18 2025, 01:30 PM, updated 4w ago

Quote

Quote

0.0171sec

0.0171sec

0.79

0.79

6 queries

6 queries

GZIP Disabled

GZIP Disabled