My current plan is old over 20 years

This post has been edited by trumpkampung: Mar 12 2025, 08:16 PM

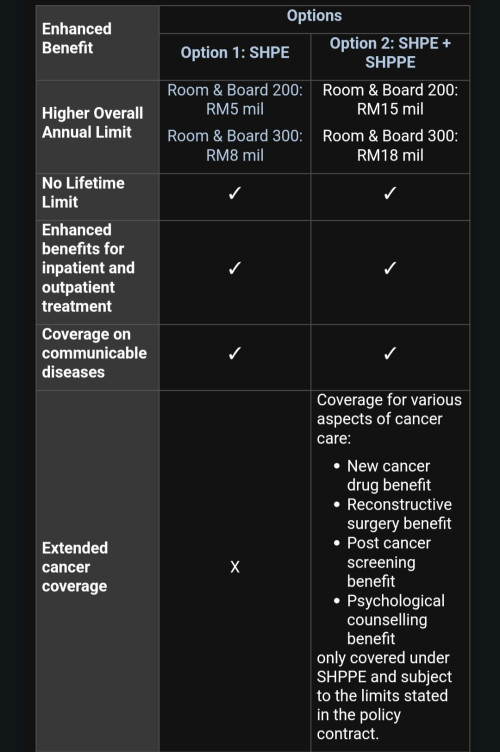

Great Eastern offer to upgrade medical rider

|

|

Mar 12 2025, 08:15 PM, updated 9 months ago Mar 12 2025, 08:15 PM, updated 9 months ago

Show posts by this member only | Post

#1

|

Junior Member

59 posts Joined: Jan 2017 |

|

|

|

|

|

|

Mar 12 2025, 08:25 PM Mar 12 2025, 08:25 PM

Show posts by this member only | IPv6 | Post

#2

|

Senior Member

1,280 posts Joined: Nov 2016 |

|

|

|

Mar 12 2025, 08:40 PM Mar 12 2025, 08:40 PM

Show posts by this member only | IPv6 | Post

#3

|

Senior Member

5,569 posts Joined: Aug 2011 |

|

|

|

Mar 12 2025, 08:53 PM Mar 12 2025, 08:53 PM

Show posts by this member only | Post

#4

|

Junior Member

59 posts Joined: Jan 2017 |

|

|

|

Mar 12 2025, 09:10 PM Mar 12 2025, 09:10 PM

Show posts by this member only | IPv6 | Post

#5

|

Junior Member

266 posts Joined: Jul 2008 |

No free lunch. iSean, contagiouseddie, and 1 other liked this post

|

|

|

Mar 12 2025, 09:12 PM Mar 12 2025, 09:12 PM

Show posts by this member only | Post

#6

|

Junior Member

910 posts Joined: Jun 2005 |

premium got increase right?

|

|

|

|

|

|

Mar 12 2025, 09:13 PM Mar 12 2025, 09:13 PM

Show posts by this member only | IPv6 | Post

#7

|

Senior Member

1,050 posts Joined: Jan 2016 From: Land of floods, Kota Tinggi |

Then next year price also upgrade contagiouseddie and iandope liked this post

|

|

|

Mar 12 2025, 09:16 PM Mar 12 2025, 09:16 PM

Show posts by this member only | Post

#8

|

Junior Member

614 posts Joined: Feb 2018 |

QUOTE(trumpkampung @ Mar 12 2025, 08:15 PM) no underwriting = absolutely go for it, no regrets. I'd also take option 2. The premiums you pay will look like chicken feed in 10 years time when medical costs hit the roof |

|

|

Mar 12 2025, 09:22 PM Mar 12 2025, 09:22 PM

Show posts by this member only | Post

#9

|

Junior Member

59 posts Joined: Jan 2017 |

|

|

|

Mar 12 2025, 09:25 PM Mar 12 2025, 09:25 PM

|

Senior Member

1,407 posts Joined: May 2010 |

u better check the premium instalment got any change in the term of payment for long term

|

|

|

Mar 12 2025, 09:25 PM Mar 12 2025, 09:25 PM

Show posts by this member only | IPv6 | Post

#11

|

Senior Member

5,363 posts Joined: Apr 2005 From: กรุงเทพมหานคร BKK |

"upgrade" means your premium change lettew march4th liked this post

|

|

|

Mar 12 2025, 09:26 PM Mar 12 2025, 09:26 PM

Show posts by this member only | IPv6 | Post

#12

|

Senior Member

5,274 posts Joined: Jun 2008 |

|

|

|

Mar 12 2025, 09:30 PM Mar 12 2025, 09:30 PM

|

Senior Member

2,161 posts Joined: Jul 2006 From: Kuala Lumpur |

|

|

|

|

|

|

Mar 12 2025, 09:34 PM Mar 12 2025, 09:34 PM

|

Junior Member

422 posts Joined: Apr 2010 |

the fact that they are offering you an "upgrade" means that the term they previously set for you is very good to you and bad business for them. there is really no free lunch especially with insurance company. check each and every term they "upgrade" and the premium increment. contagiouseddie, il0ve51, and 1 other liked this post

|

|

|

Mar 12 2025, 09:36 PM Mar 12 2025, 09:36 PM

Show posts by this member only | IPv6 | Post

#15

|

Senior Member

2,506 posts Joined: Apr 2020 |

U Google how many ppl sue GE first blek liked this post

|

|

|

Mar 12 2025, 09:38 PM Mar 12 2025, 09:38 PM

Show posts by this member only | IPv6 | Post

#16

|

Senior Member

2,506 posts Joined: Apr 2020 |

QUOTE(quikstep @ Mar 12 2025, 09:34 PM) the fact that they are offering you an "upgrade" means that the term they previously set for you is very good to you and bad business for them. My mil after kena upgrade when claim insurance company deny claim say she memang want to claim that why take up the offer . Padahal the upgrade is by the insurance company blanket upgrade to all user .there is really no free lunch especially with insurance company. check each and every term they "upgrade" and the premium increment. |

|

|

Mar 12 2025, 09:39 PM Mar 12 2025, 09:39 PM

|

Senior Member

1,327 posts Joined: Jun 2019 |

how much top up?

|

|

|

Mar 12 2025, 09:41 PM Mar 12 2025, 09:41 PM

Show posts by this member only | IPv6 | Post

#18

|

Senior Member

5,569 posts Joined: Aug 2011 |

QUOTE(quikstep @ Mar 12 2025, 09:34 PM) the fact that they are offering you an "upgrade" means that the term they previously set for you is very good to you and bad business for them. If you are coming from an older medical plan (SMX and before), it's a no brainer to upgrade. there is really no free lunch especially with insurance company. check each and every term they "upgrade" and the premium increment. If you have SMM/SMS, not sure if this upgrade will even be offered. It is inferior in some ways (higher deductible). But in general it is slightly more comprehensive, and the premiums are like to like. |

|

|

Mar 12 2025, 09:42 PM Mar 12 2025, 09:42 PM

Show posts by this member only | IPv6 | Post

#19

|

Senior Member

5,569 posts Joined: Aug 2011 |

|

|

|

Mar 12 2025, 10:06 PM Mar 12 2025, 10:06 PM

|

Junior Member

26 posts Joined: May 2013 |

|

|

|

Mar 12 2025, 10:18 PM Mar 12 2025, 10:18 PM

Show posts by this member only | IPv6 | Post

#21

|

Senior Member

1,053 posts Joined: Jan 2008 |

Pay more when you will not die tomorrow.

|

|

|

Mar 12 2025, 10:57 PM Mar 12 2025, 10:57 PM

|

Senior Member

975 posts Joined: Aug 2007 From: Lokap Polis |

15mill limit can send patient to USA aa?

|

|

|

Mar 12 2025, 11:09 PM Mar 12 2025, 11:09 PM

|

Junior Member

112 posts Joined: Jul 2019 |

my one jump 100 ringgit. now paying 450 a month 🤦🏻

|

|

|

Mar 12 2025, 11:18 PM Mar 12 2025, 11:18 PM

|

Junior Member

660 posts Joined: Oct 2008 From: sunset valley |

No wander my GE agent keep calling me and stating want to treat me lunch after of no contact for 10years..

Below is the message.. Dear xxxxx, Congratulations 🎊 You have been specially selected to take part in our *Level Up Medical Coverage Campaign*! 🔥🔥 Through this campaign, you are eligible to enhance your existing medical rider(s) with _*no underwriting, no health questionnaires or no declaration required, and no waiting period*_!🤩 Upon in-force, your new medical plan/rider(s) will be immediately effective with only pre-existing clause based on your old medical plan. In other words, all the medically necessary treatments and conditions that are covered under your old medical plan, will be covered under this new plan with richer benefits. Here are some of the benefits you will enjoy by level-ing up 📈to our latest medical rider(s): 🛡️High Overall Annual Limit 🛡️No Overall Lifetime Limit 🛡️Enhanced Inpatient & Outpatient Benefits with minimal deductible every policy year 🛡️Coverage on Communicable Diseases 🛡️Extended Cancer Coverage ~ Plus many other benefits! You are one of my few lucky🍀customers who are eligible for this great opportunity with hassle-free medical conversion 🆙! This exciting offer is only valid for a limited time ⏰, and I m looking forward to sharing with you more about this campaign. 😀 Let's catch up …. Date & time😊👌 Cheers🫶🏻 This post has been edited by twilight_fever: Mar 12 2025, 11:19 PM |

|

|

Mar 12 2025, 11:26 PM Mar 12 2025, 11:26 PM

|

Junior Member

59 posts Joined: Jan 2017 |

QUOTE(twilight_fever @ Mar 12 2025, 11:18 PM) No wander my GE agent keep calling me and stating want to treat me lunch after of no contact for 10years.. are you considering taking up the offer? the old plan has too limited benefits N limitBelow is the message.. Dear xxxxx, Congratulations 🎊 You have been specially selected to take part in our *Level Up Medical Coverage Campaign*! 🔥🔥 Through this campaign, you are eligible to enhance your existing medical rider(s) with _*no underwriting, no health questionnaires or no declaration required, and no waiting period*_!🤩 Upon in-force, your new medical plan/rider(s) will be immediately effective with only pre-existing clause based on your old medical plan. In other words, all the medically necessary treatments and conditions that are covered under your old medical plan, will be covered under this new plan with richer benefits. Here are some of the benefits you will enjoy by level-ing up 📈to our latest medical rider(s): 🛡️High Overall Annual Limit 🛡️No Overall Lifetime Limit 🛡️Enhanced Inpatient & Outpatient Benefits with minimal deductible every policy year 🛡️Coverage on Communicable Diseases 🛡️Extended Cancer Coverage ~ Plus many other benefits! You are one of my few lucky🍀customers who are eligible for this great opportunity with hassle-free medical conversion 🆙! This exciting offer is only valid for a limited time ⏰, and I m looking forward to sharing with you more about this campaign. 😀 Let's catch up …. Date & time😊👌 Cheers🫶🏻 |

|

|

Mar 13 2025, 12:49 AM Mar 13 2025, 12:49 AM

|

All Stars

18,459 posts Joined: Oct 2010 |

Maybe old plan they cant simply increase premium, but the new one can. blek liked this post

|

|

|

Mar 13 2025, 04:55 AM Mar 13 2025, 04:55 AM

|

Junior Member

8 posts Joined: Feb 2022 |

QUOTE(twilight_fever @ Mar 12 2025, 11:18 PM) No wander my GE agent keep calling me and stating want to treat me lunch after of no contact for 10years.. These agents will disappear the day you purchase a policy and will magically reappear when they want to 'upgrade' your policy or sell you new ones. Anything in between it up to you Below is the message.. Dear xxxxx, Congratulations 🎊 You have been specially selected to take part in our *Level Up Medical Coverage Campaign*! 🔥🔥 Through this campaign, you are eligible to enhance your existing medical rider(s) with _*no underwriting, no health questionnaires or no declaration required, and no waiting period*_!🤩 Upon in-force, your new medical plan/rider(s) will be immediately effective with only pre-existing clause based on your old medical plan. In other words, all the medically necessary treatments and conditions that are covered under your old medical plan, will be covered under this new plan with richer benefits. Here are some of the benefits you will enjoy by level-ing up 📈to our latest medical rider(s): 🛡️High Overall Annual Limit 🛡️No Overall Lifetime Limit 🛡️Enhanced Inpatient & Outpatient Benefits with minimal deductible every policy year 🛡️Coverage on Communicable Diseases 🛡️Extended Cancer Coverage ~ Plus many other benefits! You are one of my few lucky🍀customers who are eligible for this great opportunity with hassle-free medical conversion 🆙! This exciting offer is only valid for a limited time ⏰, and I m looking forward to sharing with you more about this campaign. 😀 Let's catch up …. Date & time😊👌 Cheers🫶🏻 to settle it yourself with the company. il0ve51 liked this post

|

|

|

Mar 13 2025, 10:45 AM Mar 13 2025, 10:45 AM

Show posts by this member only | IPv6 | Post

#28

|

Junior Member

404 posts Joined: Jan 2003 |

|

|

|

Mar 13 2025, 10:51 AM Mar 13 2025, 10:51 AM

Show posts by this member only | IPv6 | Post

#29

|

Junior Member

763 posts Joined: Jan 2003 |

Depending on the upgrade increase in premiums, generally should take. Aside to better features and limit.

The upgrade is offered to healthy, selected group of customers holding of old medical plans. If majority takes up the upgrade, can u imagine who will be left in the old medical plans? And whats the impact to the old medical products ? Slight downside is got 500 deductible lo. But could be a good thing. So ppl dont anyhow go claim for small small thing |

|

|

Mar 13 2025, 11:00 AM Mar 13 2025, 11:00 AM

|

Junior Member

389 posts Joined: Feb 2011 From: kedah...fucuk |

Actually got good and bad ,but one thing is no free lunch from insurance company. Myself I maintain two medical insurance.one is my very old policy Aia (but super easy claim) and one from G. I do have bad experience with G when they reject some of the claim which ended I pay myself .

Da G*E* I bought just 3 year and same dilemma like you ...more coverage , high coverage etc etc .looks good on paper almost can cover everything . But now they keep increasing price which makes me worry I might not be able to afford it on long run. This post has been edited by TRAZE99: Mar 13 2025, 11:06 AM |

|

|

Mar 14 2025, 01:48 PM Mar 14 2025, 01:48 PM

|

Senior Member

1,327 posts Joined: Jun 2019 |

got it... option 2 top up is 3x the option 1.

|

|

|

Mar 14 2025, 02:03 PM Mar 14 2025, 02:03 PM

|

Senior Member

5,569 posts Joined: Aug 2011 |

QUOTE(cms @ Mar 13 2025, 10:51 AM) Depending on the upgrade increase in premiums, generally should take. Aside to better features and limit. You are slightly wrong here.The upgrade is offered to healthy, selected group of customers holding of old medical plans. If majority takes up the upgrade, can u imagine who will be left in the old medical plans? And whats the impact to the old medical products ? Slight downside is got 500 deductible lo. But could be a good thing. So ppl dont anyhow go claim for small small thing The new plan offered as an upgrade to existing policyholders without medical underwriting is Smart Health Protector Exclusive. The new plan that customers can either purchase or upgrade to with full medical underwriting is Smart Health Protector. If you are still healthy and don't have any adverse health issues, I will strongly urge to upgrade to the non-exclusive version of the plan. Reason being? The exclusive and non-exclusive versions of the plan will be monitored in separate cohorts. The repricing will be done separately in the future. Think logically - which pool will have older and sicker customers, and consequently higher claims ratios? Of course the exclusive version. Now, if you already develop adverse health conditions, don't bother with overthinking and just get the upgrade. In either case, be it if you get the exclusive upgrade with no medical underwriting or the non-exclusive version with full medical underwriting, you're better off than staying in any of the pre-2020 medical plans where the claims ratios are terrible and the cohort is old and sick. milolauda liked this post

|

|

|

Mar 14 2025, 02:12 PM Mar 14 2025, 02:12 PM

|

Junior Member

820 posts Joined: Aug 2006 |

QUOTE(ahter @ Mar 12 2025, 09:10 PM) next time got repricing, they gonna charge you kao kao coz your plan higher tier already. if you read the damn super fine print of few pages t&c, you'll realise that there's "no free lunch" written there.This post has been edited by coyouth: Mar 14 2025, 02:13 PM |

|

|

Mar 14 2025, 02:15 PM Mar 14 2025, 02:15 PM

|

Junior Member

820 posts Joined: Aug 2006 |

QUOTE(MrBaba @ Mar 12 2025, 09:38 PM) My mil after kena upgrade when claim insurance company deny claim say she memang want to claim that why take up the offer . Padahal the upgrade is by the insurance company blanket upgrade to all user . which insurance company is this? so cb one.This post has been edited by coyouth: Mar 14 2025, 02:15 PM |

|

|

Mar 14 2025, 02:22 PM Mar 14 2025, 02:22 PM

|

Junior Member

763 posts Joined: Jan 2003 |

QUOTE(contestchris @ Mar 14 2025, 02:03 PM) You are slightly wrong here. Yeah, im aware of course. The new plan offered as an upgrade to existing policyholders without medical underwriting is Smart Health Protector Exclusive. The new plan that customers can either purchase or upgrade to with full medical underwriting is Smart Health Protector. If you are still healthy and don't have any adverse health issues, I will strongly urge to upgrade to the non-exclusive version of the plan. Reason being? The exclusive and non-exclusive versions of the plan will be monitored in separate cohorts. The repricing will be done separately in the future. Think logically - which pool will have older and sicker customers, and consequently higher claims ratios? Of course the exclusive version. Now, if you already develop adverse health conditions, don't bother with overthinking and just get the upgrade. In either case, be it if you get the exclusive upgrade with no medical underwriting or the non-exclusive version with full medical underwriting, you're better off than staying in any of the pre-2020 medical plans where the claims ratios are terrible and the cohort is old and sick. |

|

|

Mar 14 2025, 03:16 PM Mar 14 2025, 03:16 PM

Show posts by this member only | IPv6 | Post

#36

|

Senior Member

2,506 posts Joined: Apr 2020 |

|

|

|

Mar 14 2025, 04:24 PM Mar 14 2025, 04:24 PM

|

Junior Member

59 posts Joined: Jan 2017 |

|

|

|

Mar 14 2025, 04:26 PM Mar 14 2025, 04:26 PM

|

Junior Member

938 posts Joined: Sep 2013 |

can ask for policy wording?

|

|

|

Mar 14 2025, 04:32 PM Mar 14 2025, 04:32 PM

|

Senior Member

1,782 posts Joined: Jul 2022 |

QUOTE(quikstep @ Mar 12 2025, 09:34 PM) the fact that they are offering you an "upgrade" means that the term they previously set for you is very good to you and bad business for them. So err, its all false advertising?there is really no free lunch especially with insurance company. check each and every term they "upgrade" and the premium increment. TS put out the offerings, look good. So what is insurance co will set off in exchange for those better benefits? |

|

|

Mar 14 2025, 05:05 PM Mar 14 2025, 05:05 PM

|

Senior Member

1,327 posts Joined: Jun 2019 |

QUOTE(trumpkampung @ Mar 14 2025, 04:24 PM) Option 2 premium quite significant, for me almost 40% increase. Option 1 12%.I guess that they can’t increase the premium due to public pressure… so they come out with this campaign to entice people to upgrade. milolauda liked this post

|

|

|

Mar 14 2025, 05:08 PM Mar 14 2025, 05:08 PM

Show posts by this member only | IPv6 | Post

#41

|

Junior Member

763 posts Joined: Jan 2003 |

|

|

|

Mar 14 2025, 05:11 PM Mar 14 2025, 05:11 PM

Show posts by this member only | IPv6 | Post

#42

|

Junior Member

284 posts Joined: Aug 2021 |

you accept mean GE has the option to revoke older TAC with newer ones

|

|

|

Mar 14 2025, 06:35 PM Mar 14 2025, 06:35 PM

|

Junior Member

404 posts Joined: Jan 2003 |

|

|

|

Mar 14 2025, 07:32 PM Mar 14 2025, 07:32 PM

|

Junior Member

59 posts Joined: Jan 2017 |

|

|

|

Mar 14 2025, 07:33 PM Mar 14 2025, 07:33 PM

|

Junior Member

59 posts Joined: Jan 2017 |

QUOTE(Matchy @ Mar 14 2025, 05:05 PM) Option 2 premium quite significant, for me almost 40% increase. Option 1 12%. will check mine shortly... the details need to open their portal to download ...I guess that they can’t increase the premium due to public pressure… so they come out with this campaign to entice people to upgrade. |

|

|

Mar 14 2025, 08:59 PM Mar 14 2025, 08:59 PM

|

Junior Member

59 posts Joined: Jan 2017 |

QUOTE(Matchy @ Mar 14 2025, 05:05 PM) Option 2 premium quite significant, for me almost 40% increase. Option 1 12%. just checked my offerI guess that they can’t increase the premium due to public pressure… so they come out with this campaign to entice people to upgrade. increase is really high This post has been edited by trumpkampung: Mar 17 2025, 09:27 AM |

|

|

Mar 17 2025, 09:27 AM Mar 17 2025, 09:27 AM

|

Junior Member

59 posts Joined: Jan 2017 |

QUOTE(Iceman74 @ Mar 12 2025, 09:25 PM) *just checked my offermy old one looks useless approx rm2000 yearly - coverage rm50k per claim/year and lifetime only rm200k. Damn freaking low ( policy started sometime in 2005 and 2015 there was an upgrade) new offer option 1 is appox rm8k per year (5mil) -extra rm6k from current / per year option 2 rm9300 per year (15 mil) extra rm7300 from current/year increase is really high but now i feel not worth even keeping the current policy rm50k/rm200k lifetime. is it better to just cancel this policy? another this is current room n board rm 150 and the new one only rm200. they did not give the rm300 room n board despite the steep hike in premium. look like not worth it at all |

|

|

Mar 17 2025, 10:34 AM Mar 17 2025, 10:34 AM

|

Senior Member

1,407 posts Joined: May 2010 |

QUOTE(trumpkampung @ Mar 17 2025, 09:27 AM) *just checked my offer the insurance policy now is the premium start from low if you are young and going up until the sky and force you to stop the policy.my old one looks useless approx rm2000 yearly - coverage rm50k per claim/year and lifetime only rm200k. Damn freaking low ( policy started sometime in 2005 and 2015 there was an upgrade) new offer option 1 is appox rm8k per year (5mil) -extra rm6k from current / per year option 2 rm9300 per year (15 mil) extra rm7300 from current/year increase is really high but now i feel not worth even keeping the current policy rm50k/rm200k lifetime. is it better to just cancel this policy? another this is current room n board rm 150 and the new one only rm200. they did not give the rm300 room n board despite the steep hike in premium. look like not worth it at all you need to check the premium increase as you getting older + another 10~20% on it(inflation) and see yourself can afford it or not by that time. No use give you figure big big sum insured but later at old aged really needed it but cannot afford the premium anymore. we normal person as we getting older, income will be stagnant/reduce or worse, redundant. A lot young persons only think now and buy the biggest policy but forgot the biggest part, the policy premium will increase in time. the keys point is make sure you buy a basic and can afford it really really long term first. as u going, can just buy another and upgrade and add on whatever you fancy and afford. the bold part me got a similar policy as well like yours. as me is cancer survivor. Me cannot add any insurance anymore from the date me diagnose cancer and got done angioplasty. I still got 1 policy with balance around 40+k lifetime and yearly premium around 3k. Me also need to make decision on this sooner or later. I do foresee myself will use it in 10 years' time as me need do angiogram and colonoscopy in future as precaution step This post has been edited by Iceman74: Mar 17 2025, 11:18 AM |

|

|

Mar 17 2025, 10:40 AM Mar 17 2025, 10:40 AM

Show posts by this member only | IPv6 | Post

#49

|

Junior Member

368 posts Joined: Oct 2008 |

AIA already offer unlimited coverage

|

|

|

Mar 17 2025, 12:31 PM Mar 17 2025, 12:31 PM

Show posts by this member only | IPv6 | Post

#50

|

Junior Member

41 posts Joined: Oct 2010 |

QUOTE(trumpkampung @ Mar 17 2025, 09:27 AM) *just checked my offer why not stick to the old one, rm50k/year or rm200k/maxmy old one looks useless approx rm2000 yearly - coverage rm50k per claim/year and lifetime only rm200k. Damn freaking low ( policy started sometime in 2005 and 2015 there was an upgrade) new offer option 1 is appox rm8k per year (5mil) -extra rm6k from current / per year option 2 rm9300 per year (15 mil) extra rm7300 from current/year increase is really high but now i feel not worth even keeping the current policy rm50k/rm200k lifetime. is it better to just cancel this policy? another this is current room n board rm 150 and the new one only rm200. they did not give the rm300 room n board despite the steep hike in premium. look like not worth it at all come May 2025 , private hospitals will have to do itemise billing and they cannot overcharge and Insurance claims need to be more transparent & that rm50k threshold might be able to sustain most claims, unless its those super expensive ones which you can refer to gomen hospitals as a rakyat to get cheaper rates |

|

|

Apr 28 2025, 03:54 AM Apr 28 2025, 03:54 AM

|

Senior Member

6,356 posts Joined: Jan 2003 |

QUOTE(trumpkampung @ Mar 17 2025, 09:27 AM) *just checked my offer New one got deductible? Higher deductible cheaper premiums.my old one looks useless approx rm2000 yearly - coverage rm50k per claim/year and lifetime only rm200k. Damn freaking low ( policy started sometime in 2005 and 2015 there was an upgrade) new offer option 1 is appox rm8k per year (5mil) -extra rm6k from current / per year option 2 rm9300 per year (15 mil) extra rm7300 from current/year increase is really high but now i feel not worth even keeping the current policy rm50k/rm200k lifetime. is it better to just cancel this policy? another this is current room n board rm 150 and the new one only rm200. they did not give the rm300 room n board despite the steep hike in premium. look like not worth it at all Did you compare your existing one with kaotim.my? Most importantly compare till age 80. But that’s just an indicator lah |

|

|

Apr 28 2025, 09:35 AM Apr 28 2025, 09:35 AM

|

Newbie

7 posts Joined: Jan 2013 |

|

|

|

Apr 28 2025, 09:50 AM Apr 28 2025, 09:50 AM

|

Senior Member

1,759 posts Joined: Mar 2007 From: _|_ |

QUOTE(Iceman74 @ Mar 17 2025, 10:34 AM) the insurance policy now is the premium start from low if you are young and going up until the sky and force you to stop the policy. young or not young, the premium will increase either way due to time and economy factor. you need to check the premium increase as you getting older + another 10~20% on it(inflation) and see yourself can afford it or not by that time. No use give you figure big big sum insured but later at old aged really needed it but cannot afford the premium anymore. we normal person as we getting older, income will be stagnant/reduce or worse, redundant. A lot young persons only think now and buy the biggest policy but forgot the biggest part, the policy premium will increase in time. the keys point is make sure you buy a basic and can afford it really really long term first. as u going, can just buy another and upgrade and add on whatever you fancy and afford. the bold part me got a similar policy as well like yours. as me is cancer survivor. Me cannot add any insurance anymore from the date me diagnose cancer and got done angioplasty. I still got 1 policy with balance around 40+k lifetime and yearly premium around 3k. Me also need to make decision on this sooner or later. I do foresee myself will use it in 10 years' time as me need do angiogram and colonoscopy in future as precaution step no matter how you spin, basic insurance will always be affordable or nobody will purchase them anymore. im not entirely sure why all pipu have the mindset say must die die buy from young because it's cheaper. i don't feel any difference at all since i've purchased my insurance in 20-ish and now im in 30-ish. also, what you bought 10-20 years ago is totally different with new 'upgrades' on current insurance especially medical cards. so yes, you paid cheap premium in the past, but it's also almost equally useless afterward. This post has been edited by a13solut3: Apr 28 2025, 09:51 AM |

|

|

Apr 28 2025, 09:56 AM Apr 28 2025, 09:56 AM

Show posts by this member only | IPv6 | Post

#54

|

Senior Member

4,254 posts Joined: Nov 2011 |

QUOTE(a13solut3 @ Apr 28 2025, 09:50 AM) young or not young, the premium will increase either way due to time and economy factor. the rates in the past are not comparable to rates of todayno matter how you spin, basic insurance will always be affordable or nobody will purchase them anymore. im not entirely sure why all pipu have the mindset say must die die buy from young because it's cheaper. i don't feel any difference at all since i've purchased my insurance in 20-ish and now im in 30-ish. also, what you bought 10-20 years ago is totally different with new 'upgrades' on current insurance especially medical cards. so yes, you paid cheap premium in the past, but it's also almost equally useless afterward. last time early 2010s my annual medical coverage only RM60k was considered "basic". now annual RM1mil is "basic" |

|

|

Apr 28 2025, 09:59 AM Apr 28 2025, 09:59 AM

Show posts by this member only | IPv6 | Post

#55

|

Senior Member

1,280 posts Joined: Nov 2016 |

|

|

|

Apr 28 2025, 10:08 AM Apr 28 2025, 10:08 AM

|

Senior Member

1,759 posts Joined: Mar 2007 From: _|_ |

QUOTE(marfccy @ Apr 28 2025, 09:56 AM) the rates in the past are not comparable to rates of today That's exactly what I'm talking about.last time early 2010s my annual medical coverage only RM60k was considered "basic". now annual RM1mil is "basic" Eventually you still need to 'upgrade' the plan or you stay at your old plan while paying the 'almost' same premium. |

|

|

Apr 28 2025, 10:09 AM Apr 28 2025, 10:09 AM

Show posts by this member only | IPv6 | Post

#57

|

Senior Member

4,254 posts Joined: Nov 2011 |

|

|

|

Apr 28 2025, 01:19 PM Apr 28 2025, 01:19 PM

Show posts by this member only | IPv6 | Post

#58

|

Senior Member

1,407 posts Joined: May 2010 |

QUOTE(a13solut3 @ Apr 28 2025, 09:50 AM) young or not young, the premium will increase either way due to time and economy factor. maybe you too young for now.no matter how you spin, basic insurance will always be affordable or nobody will purchase them anymore. im not entirely sure why all pipu have the mindset say must die die buy from young because it's cheaper. i don't feel any difference at all since i've purchased my insurance in 20-ish and now im in 30-ish. also, what you bought 10-20 years ago is totally different with new 'upgrades' on current insurance especially medical cards. so yes, you paid cheap premium in the past, but it's also almost equally useless afterward. you need to understand, previously there is not so much condition in the insurance plan to be able to take it up and approved even the insurance claim is much straight forward. The clause term in newer insurance plan is getting longer and complex. Now, if your immediate family members got any case of cancer, heart disease or even history of hypertension/high cholesterol, most properly will not accept yours to buy their insurance. If you over 40, they might need you to do medical test and check your background b4 they even want your money buying when young is a way of securing insurance protection earlier before your parents start showing symptom of long term medical complication. In my case, as parent, buying when my kid is young, they have some form of protection if something happens to me. Me got buy a rider during that time, me no need pay anything until my son reach 25 years old since I got diagnosed with cancer during in my 30-ish. Yes, I agreed, the protection is lesser comparing with current policy but that doesn't mean they won't be able to claim. Beside there are many types of medical insurance out there. I have an auntie buying a policy with medical protection of RM100k per year. the condition is premium won't increase. Just need to continue pay in order to be inforce. She have a lot complication now due to kena Covid severely. Last year already claim the max 100k. During Covid era, also got Imaging without this amount insured, how difficult her kids need to fork out this figure. the key words is "future planning" and "spread the risk" Remember, insurance company only insured healthy people. They are after all business entity, not charity biz |

|

|

Apr 28 2025, 01:22 PM Apr 28 2025, 01:22 PM

Show posts by this member only | IPv6 | Post

#59

|

Junior Member

910 posts Joined: Jun 2005 |

QUOTE(Iceman74 @ Apr 28 2025, 01:19 PM) maybe you too young for now. there is always KKM seringgit, which insurance agent like to demonizeyou need to understand, previously there is not so much condition in the insurance plan to be able to take it up and approved even the insurance claim is much straight forward. The clause term in newer insurance plan is getting longer and complex. Now, if your immediate family members got any case of cancer, heart disease or even history of hypertension/high cholesterol, most properly will not accept yours to buy their insurance. If you over 40, they might need you to do medical test and check your background b4 they even want your money buying when young is a way of securing insurance protection earlier before your parents start showing symptom of long term medical complication. In my case, as parent, buying when my kid is young, they have some form of protection if something happens to me. Me got buy a rider during that time, me no need pay anything until my son reach 25 years old since I got diagnosed with cancer during in my 30-ish. Yes, I agreed, the protection is lesser comparing with current policy but that doesn't mean they won't be able to claim. Beside there are many types of medical insurance out there. I have an auntie buying a policy with medical protection of RM100k per year. the condition is premium won't increase. Just need to continue pay in order to be inforce. She have a lot complication now due to kena Covid severely. Last year already claim the max 100k. During Covid era, also got Imaging without this amount insured, how difficult her kids need to fork out this figure. the key words is "future planning" and "spread the risk" Remember, insurance company only insured healthy people. They are after all business entity, not charity biz |

|

|

Apr 28 2025, 02:28 PM Apr 28 2025, 02:28 PM

|

Senior Member

6,356 posts Joined: Jan 2003 |

If you’re young

Buy something that guarantees renewal to 80 at least. Because when you’re young and healthy everything is covered and no exclusion. When you old only buy Maybe got high cholesterol or bp, they might exclude certain illnesses or outright reject you. Yes, you can say buy for what, company provide. Well, when you claim from that company’s policy, the condition is made known and moving forward whatever you buy won’t cover that anymore. Unless you own the company, else realistically you’ll lose it when you leave. Young don’t need buy expensive policy. Got something is better than bare naked 0. |

|

|

Apr 28 2025, 02:44 PM Apr 28 2025, 02:44 PM

Show posts by this member only | IPv6 | Post

#61

|

Senior Member

1,407 posts Joined: May 2010 |

QUOTE(desmond2020 @ Apr 28 2025, 01:22 PM) They good ler.Last month got chance try their services, ok ler Less than 2 hours visit from just drop in no appointment to get the medicines. Go sunway almost need same amount of time tim or longer but pay more than 20x |

|

|

Apr 28 2025, 02:50 PM Apr 28 2025, 02:50 PM

|

Senior Member

975 posts Joined: Aug 2007 From: Lokap Polis |

QUOTE(Iceman74 @ Apr 28 2025, 02:44 PM) They good ler. more like some people dont want to mingle with peasant b40, thats why willing to pay alot more.Last month got chance try their services, ok ler Less than 2 hours visit from just drop in no appointment to get the medicines. Go sunway almost need same amount of time tim or longer but pay more than 20x i remember last time when i visit specialist with company insurance, nak issue guarantee letter take 2 hours, so just jumpa doktor with the risk of needing to self pay |

|

|

Apr 28 2025, 02:54 PM Apr 28 2025, 02:54 PM

|

Junior Member

121 posts Joined: Apr 2011 |

in the end, buy or not buy, you need to talk to a reliable agent.

my advice as a past agent, buy if you want more options in your treatment or better hospital. If you dont buy, make sure you have savings for it. How much? How bad do you want to treat before let go? If you buy, how much depends on risk type and portfolio. No saving? better buy more cause you will never able to form your own emergency fund. If want to cover up to the roof, then all in. If want to buy a middle package, refers back to first question, how much you want to pay before you let yourself go. Anyway, you always have GH there. |

|

|

Apr 28 2025, 11:53 PM Apr 28 2025, 11:53 PM

|

Senior Member

1,759 posts Joined: Mar 2007 From: _|_ |

QUOTE(Iceman74 @ Apr 28 2025, 01:19 PM) maybe you too young for now. I don't have any issue with getting insurance even when my father have diabetes and mother passed away 15 years ago from cancer. I just bought a new medical card like 2 years ago because my 2018 insurance covered way too little at same pricing. It's like 100k vs 1m for RM350!you need to understand, previously there is not so much condition in the insurance plan to be able to take it up and approved even the insurance claim is much straight forward. The clause term in newer insurance plan is getting longer and complex. Now, if your immediate family members got any case of cancer, heart disease or even history of hypertension/high cholesterol, most properly will not accept yours to buy their insurance. If you over 40, they might need you to do medical test and check your background b4 they even want your money buying when young is a way of securing insurance protection earlier before your parents start showing symptom of long term medical complication. In my case, as parent, buying when my kid is young, they have some form of protection if something happens to me. Me got buy a rider during that time, me no need pay anything until my son reach 25 years old since I got diagnosed with cancer during in my 30-ish. Yes, I agreed, the protection is lesser comparing with current policy but that doesn't mean they won't be able to claim. Beside there are many types of medical insurance out there. I have an auntie buying a policy with medical protection of RM100k per year. the condition is premium won't increase. Just need to continue pay in order to be inforce. She have a lot complication now due to kena Covid severely. Last year already claim the max 100k. During Covid era, also got Imaging without this amount insured, how difficult her kids need to fork out this figure. the key words is "future planning" and "spread the risk" Remember, insurance company only insured healthy people. They are after all business entity, not charity biz |

|

|

Apr 28 2025, 11:54 PM Apr 28 2025, 11:54 PM

|

Senior Member

3,678 posts Joined: Apr 2019 |

QUOTE(a13solut3 @ Apr 28 2025, 11:53 PM) I don't have any issue with getting insurance even when my father have diabetes and mother passed away 15 years ago from cancer. I just bought a new medical card like 2 years ago because my 2018 insurance covered way too little at same pricing. It's like 100k vs 1m for RM350! may I know your age group and which provider? usually i heard providers don't like those with family history... |

|

|

Apr 28 2025, 11:57 PM Apr 28 2025, 11:57 PM

|

Senior Member

1,759 posts Joined: Mar 2007 From: _|_ |

QUOTE(Wedchar2912 @ Apr 28 2025, 11:54 PM) may I know your age group and which provider? It was 30-40, from Prudential to GE.usually i heard providers don't like those with family history... Wedchar2912 liked this post

|

|

|

Apr 29 2025, 12:00 AM Apr 29 2025, 12:00 AM

|

Senior Member

1,590 posts Joined: Sep 2011 |

Kena tipu by ge goes ja, invested 50k, now value still not reach 40k.

This post has been edited by kelvinfixx: Apr 29 2025, 12:00 AM |

|

|

Apr 29 2025, 12:07 AM Apr 29 2025, 12:07 AM

Show posts by this member only | IPv6 | Post

#68

|

Junior Member

763 posts Joined: Jan 2003 |

QUOTE(a13solut3 @ Apr 28 2025, 11:53 PM) I don't have any issue with getting insurance even when my father have diabetes and mother passed away 15 years ago from cancer. I just bought a new medical card like 2 years ago because my 2018 insurance covered way too little at same pricing. It's like 100k vs 1m for RM350! Good news l lo for u…..dunno how much effect of family history to underwriting requirements lah. Maybe not so significant, dont know. |

|

|

Apr 29 2025, 09:12 AM Apr 29 2025, 09:12 AM

Show posts by this member only | IPv6 | Post

#69

|

Senior Member

1,407 posts Joined: May 2010 |

QUOTE(a13solut3 @ Apr 28 2025, 11:53 PM) I don't have any issue with getting insurance even when my father have diabetes and mother passed away 15 years ago from cancer. I just bought a new medical card like 2 years ago because my 2018 insurance covered way too little at same pricing. It's like 100k vs 1m for RM350! Good for u.Anyway pls do check the policy clause. Don't want to mention name, some insurance company give big figures but if you read thru the clause, those common and required big amounts like dialysis and cancer have certain limits, cannot claim to the advertise amounts |

| Change to: |  0.0276sec 0.0276sec

0.79 0.79

5 queries 5 queries

GZIP Disabled GZIP Disabled

Time is now: 16th December 2025 - 11:28 PM |