This post has been edited by premier239: Mar 10 2025, 12:33 PM

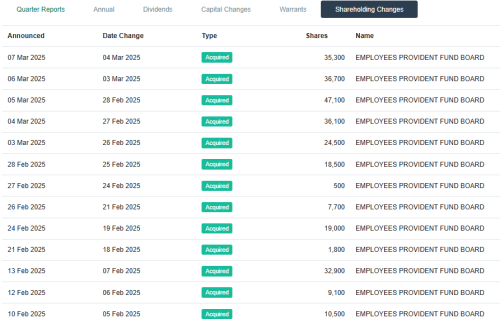

Nestle below RM70, lowest in 10y, EPF keep buying, confused...

|

|

Mar 10 2025, 12:30 PM, updated 9 months ago Mar 10 2025, 12:30 PM, updated 9 months ago

Show posts by this member only | Post

#1

|

Junior Member

173 posts Joined: Sep 2021 |

|

|

|

|

|

|

Mar 10 2025, 12:31 PM Mar 10 2025, 12:31 PM

Show posts by this member only | IPv6 | Post

#2

|

Senior Member

4,884 posts Joined: Jan 2003 From: Petaling Jaya |

Buy the dip

|

|

|

Mar 10 2025, 12:34 PM Mar 10 2025, 12:34 PM

Show posts by this member only | Post

#3

|

Senior Member

3,186 posts Joined: Jan 2008 |

More like epf force to buy

|

|

|

Mar 10 2025, 12:35 PM Mar 10 2025, 12:35 PM

Show posts by this member only | Post

#4

|

Senior Member

889 posts Joined: Jun 2008 |

Drop because of boycott ?

|

|

|

Mar 10 2025, 12:37 PM Mar 10 2025, 12:37 PM

Show posts by this member only | Post

#5

|

Junior Member

173 posts Joined: Sep 2021 |

|

|

|

Mar 10 2025, 12:41 PM Mar 10 2025, 12:41 PM

Show posts by this member only | Post

#6

|

Junior Member

418 posts Joined: Jun 2022 |

EPF buy i also buy!!!!! Quazacolt, Commander Shinzo, and 4 others liked this post

|

|

|

|

|

|

Mar 10 2025, 12:42 PM Mar 10 2025, 12:42 PM

Show posts by this member only | IPv6 | Post

#7

|

Junior Member

565 posts Joined: Mar 2011 |

obviously behind the scene, Nestle sudah roger EPF something big is happening sooner or later..share market is for sharks we ikan bilis just watch

|

|

|

Mar 10 2025, 12:46 PM Mar 10 2025, 12:46 PM

Show posts by this member only | Post

#8

|

Junior Member

79 posts Joined: Jun 2010 |

wait for 20

|

|

|

Mar 10 2025, 12:47 PM Mar 10 2025, 12:47 PM

Show posts by this member only | Post

#9

|

Junior Member

362 posts Joined: Jul 2013 |

wait for uncle eunuch to issue statement soon on why buying stock which is dropping price

|

|

|

Mar 10 2025, 12:47 PM Mar 10 2025, 12:47 PM

|

Junior Member

944 posts Joined: Jul 2005 |

weird indeed... this really doesnt make sense...

Even my awesome TA, indicator still showing continuous drop without end.. why buy soo early??.. |

|

|

Mar 10 2025, 12:49 PM Mar 10 2025, 12:49 PM

Show posts by this member only | IPv6 | Post

#11

|

Senior Member

1,645 posts Joined: Aug 2005 From: Vault 13 |

Why ? Boycotted?

|

|

|

Mar 10 2025, 12:49 PM Mar 10 2025, 12:49 PM

Show posts by this member only | IPv6 | Post

#12

|

Junior Member

11 posts Joined: Feb 2020 |

|

|

|

Mar 10 2025, 12:52 PM Mar 10 2025, 12:52 PM

Show posts by this member only | IPv6 | Post

#13

|

Junior Member

213 posts Joined: Dec 2008 |

I'll wait @ rm20

|

|

|

|

|

|

Mar 10 2025, 12:52 PM Mar 10 2025, 12:52 PM

|

Senior Member

7,617 posts Joined: Mar 2009 |

Coco price naik. netmatrix liked this post

|

|

|

Mar 10 2025, 12:53 PM Mar 10 2025, 12:53 PM

Show posts by this member only | IPv6 | Post

#15

|

Junior Member

101 posts Joined: Oct 2022 |

Ask y'all support & eat Maggi, y'all say Korean noodles nicer to eat..

|

|

|

Mar 10 2025, 12:53 PM Mar 10 2025, 12:53 PM

Show posts by this member only | IPv6 | Post

#16

|

Junior Member

734 posts Joined: Jul 2013 From: Kuala Lumpur |

Buy low sell high not right meh?

|

|

|

Mar 10 2025, 12:53 PM Mar 10 2025, 12:53 PM

|

Senior Member

1,406 posts Joined: Dec 2004 From: Living Hell |

Sell father mother sister all in buy the dip xCM liked this post

|

|

|

Mar 10 2025, 12:54 PM Mar 10 2025, 12:54 PM

|

Senior Member

4,539 posts Joined: Feb 2006 From: LocOmoT|oN.L0co|oti0N |

Heard their Q4 2024 business was good

Institution might got insider news Disclaimer - I don't hv insider cable This post has been edited by yehlai: Mar 10 2025, 12:55 PM |

|

|

Mar 10 2025, 12:55 PM Mar 10 2025, 12:55 PM

Show posts by this member only | IPv6 | Post

#19

|

Junior Member

100 posts Joined: Aug 2021 |

Dang the stock is down 30% YTD. Those who put 100k here, 30k wiped out already, luckily I sold off last year.. consumer related stocks really GG now due to inflation and weak consumer spending, I’ll avoid it for now or maybe DCA slowly

|

|

|

Mar 10 2025, 12:57 PM Mar 10 2025, 12:57 PM

Show posts by this member only | IPv6 | Post

#20

|

Junior Member

444 posts Joined: Nov 2014 |

I picking up nestle so hard right now. I wish I had more money. But I can't coz need to keep bullet for trump

|

|

|

Mar 10 2025, 12:58 PM Mar 10 2025, 12:58 PM

|

Junior Member

666 posts Joined: Oct 2017 |

Epf please buy more, is a good call.

|

|

|

Mar 10 2025, 12:59 PM Mar 10 2025, 12:59 PM

|

Senior Member

4,539 posts Joined: Feb 2006 From: LocOmoT|oN.L0co|oti0N |

|

|

|

Mar 10 2025, 01:00 PM Mar 10 2025, 01:00 PM

|

Junior Member

72 posts Joined: Jul 2012 From: Eastern Kingdom |

Might be averaging down.

|

|

|

Mar 10 2025, 01:00 PM Mar 10 2025, 01:00 PM

|

Senior Member

4,539 posts Joined: Feb 2006 From: LocOmoT|oN.L0co|oti0N |

|

|

|

Mar 10 2025, 01:03 PM Mar 10 2025, 01:03 PM

Show posts by this member only | IPv6 | Post

#25

|

Senior Member

1,344 posts Joined: Oct 2005 |

Meanwhile, its holding company Nestle SA (in Switzerland) starts to show an uptrend. Is this a signal to something about to uncover in Malaysia?

|

|

|

Mar 10 2025, 01:04 PM Mar 10 2025, 01:04 PM

Show posts by this member only | IPv6 | Post

#26

|

Junior Member

323 posts Joined: May 2020 |

buying nestle stock is blue chip yo, commonly i know ppl who buy this are old boomer / boomer mindset one

the concept is , necessary product / service are essential in the economy recession , so the stock wont die. |

|

|

Mar 10 2025, 01:06 PM Mar 10 2025, 01:06 PM

|

Senior Member

1,374 posts Joined: Feb 2016 From: Milky Way |

All in at RM50

|

|

|

Mar 10 2025, 01:07 PM Mar 10 2025, 01:07 PM

|

Senior Member

4,539 posts Joined: Feb 2006 From: LocOmoT|oN.L0co|oti0N |

QUOTE(FlamingFox @ Mar 10 2025, 01:03 PM) Meanwhile, its holding company Nestle SA (in Switzerland) starts to show an uptrend. Is this a signal to something about to uncover in Malaysia? Not only Nestle... you find some of their competitorsalso hv similar trend 2023-2024 they hit by Semaglutide mania now seems like fading This post has been edited by yehlai: Mar 10 2025, 01:11 PM |

|

|

Mar 10 2025, 01:08 PM Mar 10 2025, 01:08 PM

Show posts by this member only | IPv6 | Post

#29

|

Junior Member

127 posts Joined: Oct 2011 |

Can't go wrong with Nestle

Jew run company and has been purchasing and accumulating water rights in various countries |

|

|

Mar 10 2025, 01:09 PM Mar 10 2025, 01:09 PM

|

Junior Member

666 posts Joined: Oct 2017 |

|

|

|

Mar 10 2025, 01:14 PM Mar 10 2025, 01:14 PM

|

Senior Member

4,539 posts Joined: Feb 2006 From: LocOmoT|oN.L0co|oti0N |

QUOTE(nelson969 @ Mar 10 2025, 01:04 PM) buying nestle stock is blue chip yo, commonly i know ppl who buy this are old boomer / boomer mindset one Remember.. Nokia, Motorola, IBM also used to be blue chipthe concept is , necessary product / service are essential in the economy recession , so the stock wont die. nothing last forever if fundamental changed.. better recalibrate |

|

|

Mar 10 2025, 01:15 PM Mar 10 2025, 01:15 PM

Show posts by this member only | IPv6 | Post

#32

|

Junior Member

863 posts Joined: Apr 2019 |

Consumer staples. This is the kind of stock Buffett will buy hand over fist at times like this

|

|

|

Mar 10 2025, 01:16 PM Mar 10 2025, 01:16 PM

Show posts by this member only | IPv6 | Post

#33

|

Junior Member

863 posts Joined: Apr 2019 |

QUOTE(yehlai @ Mar 10 2025, 01:14 PM) Remember.. Nokia, Motorola, IBM also used to be blue chip Those are tech company subject to obsolescence. Another reason Buffett avoids tech.nothing last forever if fundamental changed.. better recalibrate nelson969 liked this post

|

|

|

Mar 10 2025, 01:20 PM Mar 10 2025, 01:20 PM

Show posts by this member only | IPv6 | Post

#34

|

All Stars

21,458 posts Joined: Jul 2012 |

During minions boycott, BMX didn't standup for businesses. Plus rise in minimum wages, etc. Many mnc are relocating their production to Thailand.

This post has been edited by icemanfx: Mar 10 2025, 01:21 PM |

|

|

Mar 10 2025, 01:20 PM Mar 10 2025, 01:20 PM

|

Junior Member

470 posts Joined: Jan 2003 From: UM, KL, PJ, 14 |

|

|

|

Mar 10 2025, 01:24 PM Mar 10 2025, 01:24 PM

|

Senior Member

1,973 posts Joined: Dec 2007 From: Cheat Enabled! |

BBBBBBBBBBBBBBBBBBBB

|

|

|

Mar 10 2025, 01:28 PM Mar 10 2025, 01:28 PM

|

Junior Member

257 posts Joined: Dec 2008 From: Malaysia |

maybe because halal ?

|

|

|

Mar 10 2025, 01:29 PM Mar 10 2025, 01:29 PM

|

Senior Member

4,707 posts Joined: May 2008 |

#KitaMenang

|

|

|

Mar 10 2025, 01:29 PM Mar 10 2025, 01:29 PM

|

Senior Member

2,162 posts Joined: Sep 2004 |

EPF: BBBUUU

|

|

|

Mar 10 2025, 01:32 PM Mar 10 2025, 01:32 PM

|

Senior Member

1,040 posts Joined: Dec 2008 |

Nestle, best dividend stock still

|

|

|

Mar 10 2025, 01:34 PM Mar 10 2025, 01:34 PM

|

Senior Member

4,539 posts Joined: Feb 2006 From: LocOmoT|oN.L0co|oti0N |

QUOTE(diffyhelman2 @ Mar 10 2025, 01:16 PM) What you said is not wrongbut don't underestimate consumer sentiment + boikot issue their business confirm won't die like Nokia but if revenue drop and falling knife.. personally I won't take the risk Risk Reward is not good (as they are not high growth stock) Some consumer complaint milo is not taste same as last time Maggi also hit by Korean and Indonesia brands It's staple but still have a lot substitute   This post has been edited by yehlai: Mar 10 2025, 01:41 PM |

|

|

Mar 10 2025, 01:35 PM Mar 10 2025, 01:35 PM

|

Junior Member

173 posts Joined: Sep 2021 |

QUOTE(diffyhelman2 @ Mar 10 2025, 01:16 PM) dun simply stuck up shit to Buffett lettewNestle Msia has indeed faced a fundamental shift, alot of ppl are seriously able to live off without it, due to abundance of alternative brands the "indestructible Nestle" story we had decades ago no longer applicable This post has been edited by premier239: Mar 10 2025, 01:37 PM |

|

|

Mar 10 2025, 01:40 PM Mar 10 2025, 01:40 PM

|

Senior Member

7,617 posts Joined: Mar 2009 |

QUOTE(yehlai @ Mar 10 2025, 01:00 PM) Its net profit for the fourth quarter plunged 72.2% y-o-y to RM41.10 million – the lowest since 2013. yehlai liked this post

|

|

|

Mar 10 2025, 01:41 PM Mar 10 2025, 01:41 PM

Show posts by this member only | IPv6 | Post

#44

|

Junior Member

863 posts Joined: Apr 2019 |

QUOTE(premier239 @ Mar 10 2025, 01:35 PM) dun simply stuck up shit to Buffett lettew for consumer staples, scale matters... eventually the suppliers boil down to a few consolidated mega corps. those alternative brands...eventually will also consolidate and be bought over, or get "investement".Nestle Msia has indeed faced a fundamental shift, alot of ppl are seriously able to live off without it, due to abundance of alternative brands the "indestructible Nestle" story we had decades ago no longer applicable |

|

|

Mar 10 2025, 01:44 PM Mar 10 2025, 01:44 PM

|

Senior Member

3,626 posts Joined: Nov 2007 From: Hornbill land |

QUOTE(soul78 @ Mar 10 2025, 12:47 PM) weird indeed... this really doesnt make sense... 0.618 + Monthly RSI oversold.Even my awesome TA, indicator still showing continuous drop without end.. why buy soo early??.. This is my version of buying the dip TS thanks for head up. This is a buy opportunity. But abit too early. Wait for bounce. This post has been edited by mois: Mar 10 2025, 01:47 PM |

|

|

Mar 10 2025, 01:52 PM Mar 10 2025, 01:52 PM

|

Junior Member

105 posts Joined: Jul 2013 |

badmilk come share your insider story. Worth to buy or not

|

|

|

Mar 10 2025, 01:55 PM Mar 10 2025, 01:55 PM

|

Junior Member

592 posts Joined: Oct 2018 |

so what u want EPF to do? buy high sell low??

|

|

|

Mar 10 2025, 04:58 PM Mar 10 2025, 04:58 PM

Show posts by this member only | IPv6 | Post

#48

|

Junior Member

57 posts Joined: Jun 2009 From: Georgetown,Penang |

QUOTE(Dweller @ Mar 10 2025, 01:52 PM) Lol- i am now collecting funds - to buy as much as possible- Don’t quote me - But April 25 , we will announce the highest sales in 10 years history-for Q1 2025 Some fucker leaked our internal sales data to EPF - now they hoarding Cibai This post has been edited by badmilk: Mar 10 2025, 04:58 PM keyibukeyi, Icehart, and 5 others liked this post

|

|

|

Mar 10 2025, 05:07 PM Mar 10 2025, 05:07 PM

|

Junior Member

96 posts Joined: Feb 2021 |

is it? Then I WTB also.. NBDRE!

|

|

|

Mar 10 2025, 05:08 PM Mar 10 2025, 05:08 PM

Show posts by this member only | IPv6 | Post

#50

|

Junior Member

569 posts Joined: Apr 2010 |

wow dipped?

|

|

|

Mar 10 2025, 05:13 PM Mar 10 2025, 05:13 PM

|

Junior Member

342 posts Joined: Jan 2013 |

39 PE with 2.5% DY still too overvalued ler. Wait RM40 maybe la

|

|

|

Mar 10 2025, 05:14 PM Mar 10 2025, 05:14 PM

Show posts by this member only | IPv6 | Post

#52

|

Junior Member

118 posts Joined: Dec 2021 |

QUOTE(badmilk @ Mar 10 2025, 04:58 PM) Lol- i am now collecting funds - to buy as much as possible- And now tis fker leaking it all onlineDon’t quote me - But April 25 , we will announce the highest sales in 10 years history-for Q1 2025 Some fucker leaked our internal sales data to EPF - now they hoarding Cibai |

|

|

Mar 10 2025, 05:14 PM Mar 10 2025, 05:14 PM

|

Senior Member

1,176 posts Joined: May 2006 From: Memesia |

wat happen these days.. why all shares got a dip? when will rebound?

|

|

|

Mar 10 2025, 05:16 PM Mar 10 2025, 05:16 PM

|

Senior Member

2,294 posts Joined: Sep 2011 |

Maggi milo nescafe

Hnnnghh |

|

|

Mar 10 2025, 05:23 PM Mar 10 2025, 05:23 PM

|

Senior Member

3,626 posts Joined: Nov 2007 From: Hornbill land |

|

|

|

Mar 10 2025, 05:25 PM Mar 10 2025, 05:25 PM

Show posts by this member only | IPv6 | Post

#56

|

Junior Member

57 posts Joined: Jun 2009 From: Georgetown,Penang |

|

|

|

Mar 10 2025, 05:30 PM Mar 10 2025, 05:30 PM

Show posts by this member only | IPv6 | Post

#57

|

Senior Member

3,599 posts Joined: Jun 2009 From: MYBoleh.NET |

QUOTE(badmilk @ Mar 10 2025, 04:58 PM) Lol- i am now collecting funds - to buy as much as possible- Thank you so much Nestle shareholder, I will buy so that you can offload itDon’t quote me - But April 25 , we will announce the highest sales in 10 years history-for Q1 2025 Some fucker leaked our internal sales data to EPF - now they hoarding Cibai |

|

|

Mar 10 2025, 05:32 PM Mar 10 2025, 05:32 PM

Show posts by this member only | IPv6 | Post

#58

|

Junior Member

57 posts Joined: Jun 2009 From: Georgetown,Penang |

QUOTE(MasBoleh! @ Mar 10 2025, 05:30 PM) I just wanna make 20%… hopefully can collect enough money to buy. I saw epf today keep buying- jesus- NON STOP - will make a killing on april- fucker epf buy 100k units Good to have unlimited money This post has been edited by badmilk: Mar 10 2025, 05:34 PM MasBoleh! liked this post

|

|

|

Mar 10 2025, 05:34 PM Mar 10 2025, 05:34 PM

|

Junior Member

577 posts Joined: Feb 2006 |

Kito sudah menong!!

|

|

|

Mar 10 2025, 05:35 PM Mar 10 2025, 05:35 PM

Show posts by this member only | IPv6 | Post

#60

|

Senior Member

1,009 posts Joined: Mar 2019 |

Mixue took their marker share ka?,

|

|

|

Mar 10 2025, 05:39 PM Mar 10 2025, 05:39 PM

|

Junior Member

131 posts Joined: May 2020 |

QUOTE(badmilk @ Mar 10 2025, 04:58 PM) Lol- i am now collecting funds - to buy as much as possible- Insider trading law is non existent in Malaysia. Even if proven, who dare to sue EPF.Don’t quote me - But April 25 , we will announce the highest sales in 10 years history-for Q1 2025 Some fucker leaked our internal sales data to EPF - now they hoarding Cibai |

|

|

Mar 10 2025, 05:42 PM Mar 10 2025, 05:42 PM

Show posts by this member only | IPv6 | Post

#62

|

Junior Member

57 posts Joined: Jun 2009 From: Georgetown,Penang |

QUOTE(Mixxomon @ Mar 10 2025, 05:39 PM) I am hoping my salary up 10% at least- Will know in two weeks times Nestle is too god damn strong- otherwise companies wish they were us. Fuck- i can’t leave this company at all. MasBoleh! liked this post

|

|

|

Mar 10 2025, 05:42 PM Mar 10 2025, 05:42 PM

|

Junior Member

94 posts Joined: Sep 2020 |

QUOTE(badmilk @ Mar 10 2025, 05:32 PM) I just wanna make 20% epf is buying on behalf of all malaysians la… hopefully can collect enough money to buy. I saw epf today keep buying- jesus- NON STOP - will make a killing on april- fucker epf buy 100k units Good to have unlimited money they untung we untung also lol badmilk liked this post

|

|

|

Mar 10 2025, 05:43 PM Mar 10 2025, 05:43 PM

Show posts by this member only | IPv6 | Post

#64

|

Junior Member

323 posts Joined: May 2020 |

|

|

|

Mar 10 2025, 05:43 PM Mar 10 2025, 05:43 PM

|

Junior Member

173 posts Joined: Sep 2021 |

|

|

|

Mar 10 2025, 05:44 PM Mar 10 2025, 05:44 PM

|

Junior Member

131 posts Joined: May 2020 |

QUOTE(badmilk @ Mar 10 2025, 05:42 PM) I am hoping my salary up 10% at least- I heard salary is slightly above average, but benefit is very good. Buy house company will subsidize a part of the loan repayment.Will know in two weeks times Nestle is too god damn strong- otherwise companies wish they were us. Fuck- i can’t leave this company at all. |

|

|

Mar 10 2025, 05:50 PM Mar 10 2025, 05:50 PM

Show posts by this member only | IPv6 | Post

#67

|

Junior Member

57 posts Joined: Jun 2009 From: Georgetown,Penang |

QUOTE(Mixxomon @ Mar 10 2025, 05:44 PM) I heard salary is slightly above average, but benefit is very good. Buy house company will subsidize a part of the loan repayment. We scrap out the loan repayment already for new comers..But gold standard la MANAGEMENT TRAINEE- Paying basic 6k for fresh grad- of coz the cream level ya After all in abt 7/8k per month at 23-24 years old …..thats why u see some below 30 at mnc like this make 20k per month Wtf- if u guys got kids - apply these top 3 mnc- Petronas/shell/ nestle Also 1 can pinjam money from them to buy car myvi- no interest- Crazy This post has been edited by badmilk: Mar 10 2025, 05:51 PM |

|

|

Mar 10 2025, 05:50 PM Mar 10 2025, 05:50 PM

|

Junior Member

101 posts Joined: Oct 2022 |

Too many choices nowadays, once those price sensitive consumers found their cheaper alternatives, it's hard to win them back d.

|

|

|

Mar 10 2025, 05:51 PM Mar 10 2025, 05:51 PM

|

Senior Member

2,529 posts Joined: Sep 2013 |

Want to know something ?

Nestle’s secretary just declared sapu RM7million ringgit + of shares today Something brewing ? |

|

|

Mar 10 2025, 05:52 PM Mar 10 2025, 05:52 PM

|

Junior Member

361 posts Joined: Jun 2007 |

Quick, all contributors buy Milo to support.....

|

|

|

Mar 10 2025, 05:52 PM Mar 10 2025, 05:52 PM

Show posts by this member only | IPv6 | Post

#71

|

Junior Member

57 posts Joined: Jun 2009 From: Georgetown,Penang |

|

|

|

Mar 10 2025, 05:53 PM Mar 10 2025, 05:53 PM

|

Junior Member

173 posts Joined: Sep 2021 |

QUOTE(kkk8787 @ Mar 10 2025, 05:51 PM) Want to know something ? topkek brewing wat? obviously foreign funds are selling (continuously for 20 weeks), leaving all the local funds n epf still cricle jerking behindNestle’s secretary just declared sapu RM7million ringgit + of shares today Something brewing ? |

|

|

Mar 10 2025, 05:54 PM Mar 10 2025, 05:54 PM

|

Junior Member

101 posts Joined: Oct 2022 |

|

|

|

Mar 10 2025, 05:57 PM Mar 10 2025, 05:57 PM

|

Senior Member

2,043 posts Joined: Jul 2005 |

Nestle SA P/E only 21. Nestle Malaysia P/E almost 40. Still twice as expensive. Wait till RM35 as entry price ba.

|

|

|

Mar 10 2025, 05:59 PM Mar 10 2025, 05:59 PM

Show posts by this member only | IPv6 | Post

#75

|

Junior Member

57 posts Joined: Jun 2009 From: Georgetown,Penang |

QUOTE(Atrocious @ Mar 10 2025, 05:54 PM) Not even 0.05% of milo total salesWill take a while- anyway they r currently distributed into retail with uniliver help- hope they pick up traction Too boring no competition |

|

|

Mar 10 2025, 06:01 PM Mar 10 2025, 06:01 PM

Show posts by this member only | IPv6 | Post

#76

|

Junior Member

40 posts Joined: Aug 2010 |

EPF also keep buying CTOS

But shares also keep failing. |

|

|

Mar 10 2025, 06:02 PM Mar 10 2025, 06:02 PM

|

Senior Member

2,529 posts Joined: Sep 2013 |

QUOTE(badmilk @ Mar 10 2025, 05:59 PM) Not even 0.05% of milo total sales I have been averaging down since 130 stopped at 80Will take a while- anyway they r currently distributed into retail with uniliver help- hope they pick up traction Too boring no competition Cont average down? Rosy outlook long term? You see it recovering to at least 80-90 ringgit in short term ie 3/4 months ? |

|

|

Mar 10 2025, 06:02 PM Mar 10 2025, 06:02 PM

|

Junior Member

101 posts Joined: Oct 2022 |

|

|

|

Mar 10 2025, 06:03 PM Mar 10 2025, 06:03 PM

|

Junior Member

57 posts Joined: Jun 2009 From: Georgetown,Penang |

|

|

|

Mar 10 2025, 06:04 PM Mar 10 2025, 06:04 PM

|

Senior Member

1,925 posts Joined: Feb 2016 |

|

|

|

Mar 10 2025, 06:05 PM Mar 10 2025, 06:05 PM

|

Junior Member

57 posts Joined: Jun 2009 From: Georgetown,Penang |

|

|

|

Mar 10 2025, 06:06 PM Mar 10 2025, 06:06 PM

|

Senior Member

1,782 posts Joined: Jul 2022 |

|

|

|

Mar 10 2025, 06:07 PM Mar 10 2025, 06:07 PM

|

Junior Member

536 posts Joined: Oct 2010 From: 4:44 am |

|

|

|

Mar 10 2025, 06:07 PM Mar 10 2025, 06:07 PM

|

Senior Member

1,925 posts Joined: Feb 2016 |

|

|

|

Mar 10 2025, 06:19 PM Mar 10 2025, 06:19 PM

Show posts by this member only | IPv6 | Post

#85

|

Senior Member

3,626 posts Joined: Nov 2007 From: Hornbill land |

|

|

|

Mar 10 2025, 06:21 PM Mar 10 2025, 06:21 PM

|

Senior Member

1,406 posts Joined: Dec 2004 From: Living Hell |

|

|

|

Mar 10 2025, 06:25 PM Mar 10 2025, 06:25 PM

Show posts by this member only | IPv6 | Post

#87

|

Junior Member

57 posts Joined: Jun 2009 From: Georgetown,Penang |

|

|

|

Mar 10 2025, 08:37 PM Mar 10 2025, 08:37 PM

|

Senior Member

4,539 posts Joined: Feb 2006 From: LocOmoT|oN.L0co|oti0N |

|

|

|

Mar 10 2025, 08:39 PM Mar 10 2025, 08:39 PM

|

Senior Member

1,617 posts Joined: Apr 2010 |

|

|

|

Mar 10 2025, 08:49 PM Mar 10 2025, 08:49 PM

|

Junior Member

323 posts Joined: May 2020 |

|

|

|

Mar 10 2025, 08:50 PM Mar 10 2025, 08:50 PM

|

Senior Member

3,626 posts Joined: Nov 2007 From: Hornbill land |

QUOTE(badmilk @ Mar 10 2025, 06:25 PM) I just check. $70 is the resistance for 3 years. From October 2012 to January 2015. Turned to support. Thanks for tip. Very very rare to see asset monthly RSI oversold like that. Some more it is Nestle. This post has been edited by mois: Mar 10 2025, 08:55 PM |

|

|

Mar 10 2025, 09:12 PM Mar 10 2025, 09:12 PM

|

Senior Member

1,837 posts Joined: May 2010 |

|

|

|

Mar 10 2025, 09:20 PM Mar 10 2025, 09:20 PM

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Senior Member

1,837 posts Joined: May 2010 |

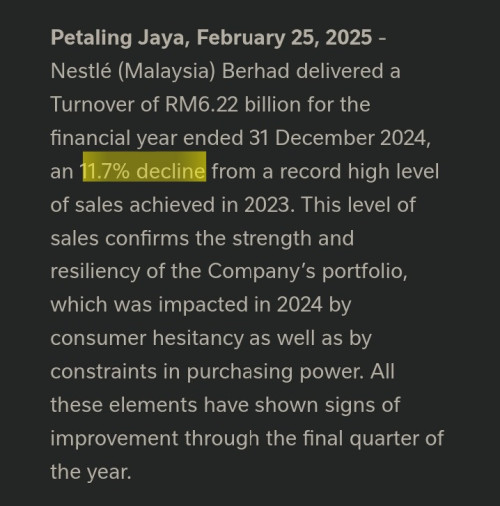

QUOTE(badmilk @ Mar 10 2025, 04:58 PM) Lol- i am now collecting funds - to buy as much as possible- Its net profit for the fourth quarter plunged 72.2% y-o-y to RM41.10 million – the lowest since 2013.Don’t quote me - But April 25 , we will announce the highest sales in 10 years history-for Q1 2025 Some fucker leaked our internal sales data to EPF - now they hoarding Cibai https://www.nestle.com.my/media/pressreleas...cialresults2024 Company protects its market leadership, scales up innovation and continues extensive community support programmes Petaling Jaya, October 24, 2024 - Nestlé Malaysia reported a turnover of RM4.75 billion for its first 9M ended 30 September 2024. This represents a **decline of 11.4% vs the first 9M of 2023 **** , which marked a historically high level of sales. Exports continued to show strong dynamism while local sales continued to be impacted by consumer hesitancy amidst cautious spending and affordability concerns. Beyond the current headwinds, Nestlé Malaysia reiterates its confidence in returning to healthy growth latest by end of H1 2025, on the base of the Company’s solid fundamentals and signs of progressive improvement in overall consumer confidence. ________________________________________________ Petaling Jaya, July 25, 2024 – Against a background defined by constrained purchasing power, subdued consumer sentiment and cautious spending throughout the Chinese New Year and Hari Raya festive seasons, Nestlé Malaysia sales reached RM3.3 billion for the first half of 2024 (H1), a correction of 8% versus the historically high record sales achieved for the first half of 2023. The cumulated sales are on par with the very solid sales achieved in the first half of 2022. Meanwhile, sales for the second quarter ended 30 June 2024 reached RM1.52 billion, **** down from RM1.75 billion achieved in the equivalent period of 2023. ***** https://www.nestle.com.my/media/pressreleas...cialresults2024 https://www.nestle.com.my/media/pressreleas...cialresults2024 ________________________ ________________________ Nestlé Malaysia delivers resilient Q1 2024 results Turnover of RM1.78 billion for Q1 2024, slightly lower than last year’s corresponding quarter, attributable mainly to timing of festive periods and prudent consumer spending amid a challenging environment. Profit After Tax remained resilient at RM195.5 million in Q1 2024, fundamentally stable vs the corresponding quarter of 2023. PETALING JAYA, April 29, 2024 – Nestlé (Malaysia) Berhad recorded a resilient performance in its first quarter ended 31 March 2024 (Q1 2024), against a backdrop of constrained consumer purchasing power and heightened competition. Review of performance: Quarter 1, 2024 vs Quarter 1, 2023 In Q1 2024, the Group recorded a turnover of RM1.78 billion, **** Slightly lower by 3.2% ***** from RM1.84 billion in the previous year’s corresponding quarter. This was primarily due to a slight decline in domestic sales compared to the same quarter last year. https://www.smartkarma.com/home/newswire/ea...-41-1m-ringgit/ https://www.bursamalaysia.com/market_inform...?ann_id=3467434 ### **Summary of Key Financial Information (As of 30 Jun 2024)** #### **Individual & Cumulative Period Performance**

#### **Financial Position**

________________________ ________________________ https://www.bursamalaysia.com/market_inform...?ann_id=3494123 ### **Summary of Key Financial Information (As of 30 Sep 2024)** #### **Individual & Cumulative Period Performance**

#### **Financial Position**

________________________ ________________________ https://www.bursamalaysia.com/market_inform...?ann_id=3526802 ### **Summary of Key Financial Information (As of 31 Dec 2024)** #### **Individual & Cumulative Period Performance**

#### **Financial Position**

### **Key Insights**

### Overall Observations Across 3 Quarters

This confirms a clear downtrend across all financial metrics in **2024 vs 2023**. I listed all the past 3 quarters' financial results from the Bursa Malaysia website for Nestlé Berhad. I do not think the last quarter will have a big result to cover the profit reduction in all three previous quarters compared to 2023. Are you sure??? This post has been edited by plouffle0789: Mar 11 2025, 01:55 AM |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Mar 10 2025, 09:22 PM Mar 10 2025, 09:22 PM

Show posts by this member only | IPv6 | Post

#94

|

Senior Member

3,460 posts Joined: Nov 2009 From: KL |

|

|

|

Mar 10 2025, 09:23 PM Mar 10 2025, 09:23 PM

|

All Stars

12,287 posts Joined: Oct 2010 |

WoW! From high of over Rm150 to 70!

|

|

|

Mar 10 2025, 09:28 PM Mar 10 2025, 09:28 PM

|

Senior Member

1,861 posts Joined: Dec 2008 From: In The HELL FIRE |

efp avg price Rm40, they dont look at price in the last few years, but their avg price since 20 years ago and the dividend .

|

|

|

Mar 10 2025, 09:29 PM Mar 10 2025, 09:29 PM

Show posts by this member only | IPv6 | Post

#97

|

Junior Member

613 posts Joined: Jun 2011 |

i got rm 500k fresh funds.. all in this stock? badmilk liked this post

|

|

|

Mar 10 2025, 09:40 PM Mar 10 2025, 09:40 PM

|

Junior Member

479 posts Joined: May 2010 |

Tempted to buy the dip.

But looking at the results for past 3 quarters is very worrying. If 1 quarter cialat, it can be a one-off kind of thing, 2 quarters is a trend, and 3 quarters where each quarter is lower than previous is a confirmation of something is really wrong. Also dividend dropped from RM1.28/share to RM0.74/share for same quarter. Their net cash from operations in 2024 is less than half of 2023. Either competition is eating their profits or they have mismanaged their sales so bad they are making 4x LESS profit in the last quarter compared to their 1st quarter. Like 9 months can crash so badly meh? |

|

|

Mar 10 2025, 09:55 PM Mar 10 2025, 09:55 PM

|

Junior Member

57 posts Joined: Jun 2009 From: Georgetown,Penang |

QUOTE(plouffle0789 @ Mar 10 2025, 09:20 PM) Its net profit for the fourth quarter plunged 72.2% y-o-y to RM41.10 million – the lowest since 2013. don't believe it la...https://www.nestle.com.my/media/pressreleas...cialresults2024 Company protects its market leadership, scales up innovation and continues extensive community support programmes Petaling Jaya, October 24, 2024 - Nestlé Malaysia reported a turnover of RM4.75 billion for its first 9M ended 30 September 2024. This represents a **decline of 11.4% vs the first 9M of 2023 **** , which marked a historically high level of sales. Exports continued to show strong dynamism while local sales continued to be impacted by consumer hesitancy amidst cautious spending and affordability concerns. Beyond the current headwinds, Nestlé Malaysia reiterates its confidence in returning to healthy growth latest by end of H1 2025, on the base of the Company’s solid fundamentals and signs of progressive improvement in overall consumer confidence. Petaling Jaya, July 25, 2024 – Against a background defined by constrained purchasing power, subdued consumer sentiment and cautious spending throughout the Chinese New Year and Hari Raya festive seasons, Nestlé Malaysia sales reached RM3.3 billion for the first half of 2024 (H1), a correction of 8% versus the historically high record sales achieved for the first half of 2023. The cumulated sales are on par with the very solid sales achieved in the first half of 2022. Meanwhile, sales for the second quarter ended 30 June 2024 reached RM1.52 billion, **** down from RM1.75 billion achieved in the equivalent period of 2023. ***** https://www.nestle.com.my/media/pressreleas...cialresults2024 https://www.nestle.com.my/media/pressreleas...cialresults2024 Nestlé Malaysia delivers resilient Q1 2024 results Turnover of RM1.78 billion for Q1 2024, slightly lower than last year’s corresponding quarter, attributable mainly to timing of festive periods and prudent consumer spending amid a challenging environment. Profit After Tax remained resilient at RM195.5 million in Q1 2024, fundamentally stable vs the corresponding quarter of 2023. PETALING JAYA, April 29, 2024 – Nestlé (Malaysia) Berhad recorded a resilient performance in its first quarter ended 31 March 2024 (Q1 2024), against a backdrop of constrained consumer purchasing power and heightened competition. Review of performance: Quarter 1, 2024 vs Quarter 1, 2023 In Q1 2024, the Group recorded a turnover of RM1.78 billion, **** Slightly lower by 3.2% ***** from RM1.84 billion in the previous year’s corresponding quarter. This was primarily due to a slight decline in domestic sales compared to the same quarter last year. Are you sure??? *DON'T TAG ME GUYS WHEN QUARTER Q1 25 RESULT OUT NEXT MONTH. just live ur life well....ENJOY LIFE TO MAX <<<< MONEY IS MEANT TO BE SPEND. |

|

|

Mar 10 2025, 09:55 PM Mar 10 2025, 09:55 PM

Show posts by this member only | IPv6 | Post

#100

|

Senior Member

3,599 posts Joined: Jun 2009 From: MYBoleh.NET |

|

|

|

Mar 10 2025, 10:01 PM Mar 10 2025, 10:01 PM

|

Junior Member

57 posts Joined: Jun 2009 From: Georgetown,Penang |

|

|

|

Mar 10 2025, 10:05 PM Mar 10 2025, 10:05 PM

|

Junior Member

325 posts Joined: Feb 2022 |

Nestle the evil company? No thabks

|

|

|

Mar 10 2025, 10:24 PM Mar 10 2025, 10:24 PM

|

Junior Member

338 posts Joined: Mar 2017 |

|

|

|

Mar 10 2025, 10:37 PM Mar 10 2025, 10:37 PM

Show posts by this member only | IPv6 | Post

#104

|

Junior Member

577 posts Joined: May 2012 |

|

|

|

Mar 10 2025, 10:43 PM Mar 10 2025, 10:43 PM

|

Senior Member

1,481 posts Joined: Dec 2014 |

US market and tech stock all red again

damn |

|

|

Mar 10 2025, 11:01 PM Mar 10 2025, 11:01 PM

Show posts by this member only | IPv6 | Post

#106

|

Junior Member

577 posts Joined: May 2012 |

|

|

|

Mar 11 2025, 12:04 AM Mar 11 2025, 12:04 AM

Show posts by this member only | IPv6 | Post

#107

|

Junior Member

266 posts Joined: May 2012 |

QUOTE(Skidd Chung @ Mar 10 2025, 09:40 PM) Tempted to buy the dip. Likely due to boycott impact. Which started about 2 years ago during Israel-Hamas war, and being reflected now. All meleis around me try hard not to buy nestle products, from their cereals, milo, coffee etc. And it will continue for at least 1-2 years until the war stops. See starbucksBut looking at the results for past 3 quarters is very worrying. If 1 quarter cialat, it can be a one-off kind of thing, 2 quarters is a trend, and 3 quarters where each quarter is lower than previous is a confirmation of something is really wrong. Also dividend dropped from RM1.28/share to RM0.74/share for same quarter. Their net cash from operations in 2024 is less than half of 2023. Either competition is eating their profits or they have mismanaged their sales so bad they are making 4x LESS profit in the last quarter compared to their 1st quarter. Like 9 months can crash so badly meh? |

|

|

Mar 11 2025, 01:32 AM Mar 11 2025, 01:32 AM

|

Senior Member

1,837 posts Joined: May 2010 |

QUOTE(Pain4UrsinZ @ Mar 10 2025, 09:28 PM) efp avg price Rm40, they dont look at price in the last few years, but their avg price since 20 years ago and the dividend . Similar to * Malaysia pension fund EPF scrutinised over up to $212m ‘losses’ in airport privatisation deal * ?EPF must explain why its "sell low, buy high" of MAHB shares were so close together in time, resulting in losses, says Ayer Itam MP Dr Wee Ka Siong QUOTE EPF must explain why its "sell low, buy high" of MAHB shares were so close together in time, resulting in losses, says Ayer Itam MP Dr Wee Sunday, 16 Feb 2025 KUALA LUMPUR: The Employees' Provident Fund (EPF) needs to explain its decision-making process to buy Malaysia Airports Bhd (MAHB) shares at RM11 each in 2024, a mere year after selling it for RM6 in 2023, said Datuk Seri Dr Wee Ka Siong. "It is said the buying back of shares at RM11 was for privatisation purposes. "Who was responsible for this decision which incurred losses of between RM539mil and RM694mil? "If EPF had not sold off its shares at RM6 in 2023 and reduced its holdings (in MAHB), then, they would not have needed to fork out and buy it back," said the MCA president in a four-minute long video that was posted on his Facebook page on Sunday (Feb 16). Several sources in the know about the hearing told The Straits Times that the committee also grilled EPF on why it had slashed its MAHB stake from 15.6 per cent to 5.8 per cent between December 2022 and December 2023, before then raising its stake to 30 per cent as part of the consortium taking the Malaysian company private. Critics say these sales, transacted at between RM6.80 and RM7.70 apiece, had resulted in “losses” ranging from RM500 million to RM700 million when EPF needed to repurchase the 163 million shares back at a higher price under the privatisation exercise. EPF has held shares in MAHB, which runs 40 airports nationwide, since its listing in 1999. It had never reduced its holdings as drastically as it did in 2023, shedding nearly 10 percentage points. Aside from this, in the two decades since 2005, it has never divested more than two percentage points in a year. Finance Minister II Amir Hamzah Azizan, who was EPF’s CEO during the period when the fund slashed its stake in MAHB up until he joined the Cabinet in December 2023, has denied any wrongdoing. On Feb 20 in Parliament, he defended the share divestment, saying that ****** “Chinese walls” ****** were in place at the fund to keep EPF’s **** trading ***** and ****** strategic investment teams ****** from sharing sensitive information with each other and ***** prevent insider trading, in accordance with the Capital Markets and Services Act (CMSA). ********* This post has been edited by plouffle0789: Mar 11 2025, 01:37 AM |

|

|

Mar 11 2025, 01:39 AM Mar 11 2025, 01:39 AM

|

||||||||||||||||||||||||||||||||||||||

Senior Member

1,837 posts Joined: May 2010 |

QUOTE(Skidd Chung @ Mar 10 2025, 09:40 PM) Tempted to buy the dip. https://forum.lowyat.net/index.php?showtopi...ost&p=111324390But looking at the results for past 3 quarters is very worrying. If 1 quarter cialat, it can be a one-off kind of thing, 2 quarters is a trend, and 3 quarters where each quarter is lower than previous is a confirmation of something is really wrong. Also dividend dropped from RM1.28/share to RM0.74/share for same quarter. Their net cash from operations in 2024 is less than half of 2023. Either competition is eating their profits or they have mismanaged their sales so bad they are making 4x LESS profit in the last quarter compared to their 1st quarter. Like 9 months can crash so badly meh? ### **Key Insights**

### Overall Observations Across 3 Quarters

This confirms a clear downtrend across all financial metrics in **2024 vs 2023**. I listed all the past 3 quarters' financial results from the Bursa Malaysia website for Nestlé Berhad. I do not think the last quarter will have a big result to cover the profit reduction in all three previous quarters compared to 2023. This post has been edited by plouffle0789: Mar 11 2025, 01:52 AM |

||||||||||||||||||||||||||||||||||||||

|

|

Mar 11 2025, 01:42 AM Mar 11 2025, 01:42 AM

|

Senior Member

1,837 posts Joined: May 2010 |

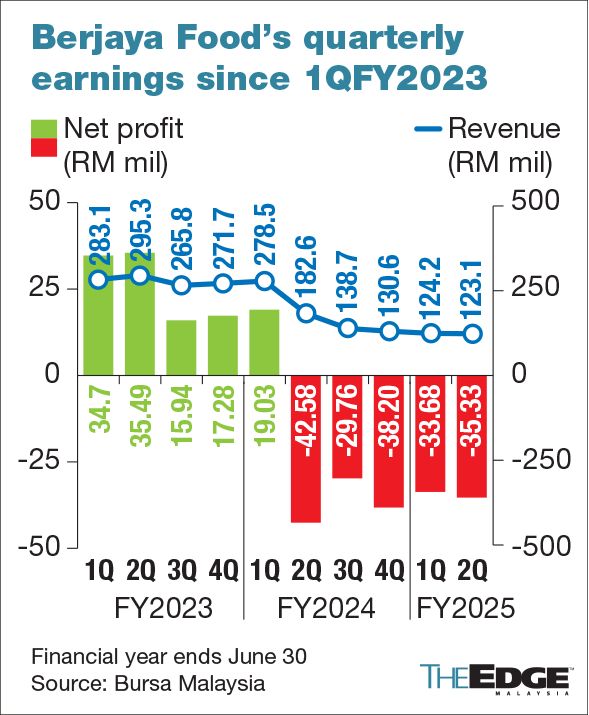

QUOTE(daidragon12 @ Mar 11 2025, 12:04 AM) Likely due to boycott impact. Which started about 2 years ago during Israel-Hamas war, and being reflected now. All meleis around me try hard not to buy nestle products, from their cereals, milo, coffee etc. And it will continue for at least 1-2 years until the war stops. See starbucks https://theedgemalaysia.com/node/745275Kesian BJFood  |

|

|

Mar 11 2025, 01:46 AM Mar 11 2025, 01:46 AM

|

||||||||||||||||||||||||||||||||||||||

Senior Member

1,837 posts Joined: May 2010 |

QUOTE(Ayambetul @ Mar 10 2025, 10:24 PM)  ### **Key Insights**

### Overall Observations Across 3 Quarters

This confirms a clear downtrend across all financial metrics in **2024 vs 2023**. I listed all the past 3 quarters' financial results from the Bursa Malaysia website for Nestlé Berhad. I do not think that the announcement on 25 April 2025 for Nestlé Bhd [4707.KL] will show good results. Just look back at the last three quarters and see how many reductions in profit there were. It's impossible for one quarter to account for all three negative quarter results. This post has been edited by plouffle0789: Mar 11 2025, 01:56 AM |

||||||||||||||||||||||||||||||||||||||

|

|

Mar 11 2025, 07:20 AM Mar 11 2025, 07:20 AM

Show posts by this member only | IPv6 | Post

#112

|

Junior Member

323 posts Joined: May 2020 |

checking epf buy how many share today

|

|

|

Mar 11 2025, 07:28 AM Mar 11 2025, 07:28 AM

|

Senior Member

2,529 posts Joined: Sep 2013 |

|

|

|

Mar 11 2025, 07:30 AM Mar 11 2025, 07:30 AM

|

Junior Member

479 posts Joined: May 2010 |

QUOTE(plouffle0789 @ Mar 11 2025, 01:46 AM)  ### **Key Insights** Just look back at the last three quarters and see how many reductions in profit there were. It's impossible for one quarter to account for all three negative quarter results. Means selling same amount but a lot LESS profit. |

|

|

Mar 11 2025, 07:36 AM Mar 11 2025, 07:36 AM

|

Senior Member

566 posts Joined: Oct 2006 |

QUOTE(yehlai @ Mar 10 2025, 01:34 PM) Some consumer complaint milo is not taste same as last time Indeed now I don't make milo ice or drink it anymore. 1st I thought maybe is the way I made it then retried it 2nd 3rd time still taste weird from before hard to describe how weird it is but different no matter how many teaspoons I put it in.This post has been edited by quintesson: Mar 11 2025, 07:39 AM |

|

|

Mar 11 2025, 07:38 AM Mar 11 2025, 07:38 AM

Show posts by this member only | IPv6 | Post

#116

|

||||||||||||||||||||||||||||||||||||||

Junior Member

57 posts Joined: Jun 2009 From: Georgetown,Penang |

QUOTE(plouffle0789 @ Mar 11 2025, 01:46 AM)  ### **Key Insights**

I listed all the past 3 quarters' financial results from the Bursa Malaysia website for Nestlé Berhad. I do not think that the announcement on 25 April 2025 for Nestlé Bhd [4707.KL] will show good results. Just look back at the last three quarters and see how many reductions in profit there were. It's impossible for one quarter to account for all three negative quarter results. U want side bet? Let /k be witness loh. This post has been edited by badmilk: Mar 11 2025, 07:40 AM Skidd Chung liked this post

|

||||||||||||||||||||||||||||||||||||||

|

|

Mar 11 2025, 07:42 AM Mar 11 2025, 07:42 AM

|

Junior Member

479 posts Joined: May 2010 |

|

|

|

Mar 11 2025, 07:45 AM Mar 11 2025, 07:45 AM

Show posts by this member only | IPv6 | Post

#118

|

Junior Member

57 posts Joined: Jun 2009 From: Georgetown,Penang |

|

|

|

Mar 11 2025, 08:28 AM Mar 11 2025, 08:28 AM

Show posts by this member only | IPv6 | Post

#119

|

Junior Member

173 posts Joined: Sep 2021 |

QUOTE(quintesson @ Mar 11 2025, 07:36 AM) Indeed now I don't make milo ice or drink it anymore. 1st I thought maybe is the way I made it then retried it 2nd 3rd time still taste weird from before hard to describe how weird it is but different no matter how many teaspoons I put it in. easy... milo now has palm oil increased, coco reduced, sugar increased |

|

|

Mar 11 2025, 08:30 AM Mar 11 2025, 08:30 AM

Show posts by this member only | IPv6 | Post

#120

|

Junior Member

687 posts Joined: Jul 2010 |

EPF have million of MYR fund. EPF can cut loss just like one click. But we all is cut loss our hard earn money. So be wise. Buy only when the share is uptrend.

|

|

|

Mar 11 2025, 09:22 AM Mar 11 2025, 09:22 AM

|

Junior Member

338 posts Joined: Mar 2017 |

|

|

|

Mar 11 2025, 09:40 AM Mar 11 2025, 09:40 AM

|

Senior Member

3,466 posts Joined: Jan 2003 From: PJ, Malaysia |

y confused? buy low sell high

|

|

|

Mar 11 2025, 09:45 AM Mar 11 2025, 09:45 AM

|

Senior Member

1,925 posts Joined: Feb 2016 |

Nice. I favour this timing of the year. Bulk collections prior to CNY and this. Hoseh liow.

Just brought back the good memory of covid 2020, also around this time of the year This post has been edited by jojolicia: Mar 11 2025, 09:51 AM |

|

|

Mar 11 2025, 09:45 AM Mar 11 2025, 09:45 AM

Show posts by this member only | IPv6 | Post

#124

|

Senior Member

1,050 posts Joined: Jan 2016 From: Land of floods, Kota Tinggi |

Kasi pump and dump

|

|

|

Mar 11 2025, 09:46 AM Mar 11 2025, 09:46 AM

|

Senior Member

974 posts Joined: Jan 2007 |

last time got one guy inside topglove ask people to buy... in the end...

|

|

|

Mar 11 2025, 10:06 AM Mar 11 2025, 10:06 AM

|

Junior Member

0 posts Joined: Mar 2025 |

I'll buy when the dividend yield is better than EPF, maybe when DY reach 5%

|

|

|

Mar 11 2025, 10:08 AM Mar 11 2025, 10:08 AM

|

Junior Member

479 posts Joined: May 2010 |

Buy now will get dividend on 16th April.

So current price is actually with 74 sens dividend priced in. If can maintain around RM70, means 10% return. Edit: I am mistaken and corrected by the post below. It isn't 10%, only 1%. This post has been edited by Skidd Chung: Mar 11 2025, 11:50 AM |

|

|

Mar 11 2025, 10:16 AM Mar 11 2025, 10:16 AM

|

Junior Member

0 posts Joined: Mar 2025 |

|

|

|

Mar 11 2025, 11:51 AM Mar 11 2025, 11:51 AM

|

Junior Member

479 posts Joined: May 2010 |

|

|

|

Mar 11 2025, 11:02 PM Mar 11 2025, 11:02 PM

|

Junior Member

323 posts Joined: May 2020 |

|

|

|

Mar 11 2025, 11:06 PM Mar 11 2025, 11:06 PM

|

Junior Member

52 posts Joined: Jun 2011 |

so buy or not

|

|

|

Mar 11 2025, 11:14 PM Mar 11 2025, 11:14 PM

Show posts by this member only | IPv6 | Post

#132

|

Senior Member

1,537 posts Joined: Jul 2008 |

How u predict Q1 will be good when its barely mid march is beyond me

|

|

|

Mar 11 2025, 11:17 PM Mar 11 2025, 11:17 PM

|

Junior Member

552 posts Joined: Aug 2010 |

|

|

|

Mar 11 2025, 11:34 PM Mar 11 2025, 11:34 PM

Show posts by this member only | IPv6 | Post

#134

|

Junior Member

500 posts Joined: Dec 2019 |

waiting for Trump shit show to settle down first lol

maybe Friday see how |

|

|

Mar 12 2025, 07:09 AM Mar 12 2025, 07:09 AM

|

Junior Member

479 posts Joined: May 2010 |

Actually not sure how the heck the results is so bad even worse than Covid Period.

|

|

|

Mar 12 2025, 07:25 AM Mar 12 2025, 07:25 AM

|

Junior Member

640 posts Joined: Sep 2011 |

This counter used to be king king ....alot of retirees buying it coz of strong dividend and can attend AGM and get freebie...

For me PE still high ler....even though at 70 per piece.. |

|

|

Mar 12 2025, 08:35 AM Mar 12 2025, 08:35 AM

Show posts by this member only | IPv6 | Post

#137

|

Junior Member

325 posts Joined: Feb 2022 |

|

|

|

Mar 17 2025, 11:46 AM Mar 17 2025, 11:46 AM

|

Junior Member

275 posts Joined: Aug 2011 |

Nestle dropped RM2+ today until RM65+ now. Any news badmilk?

|

|

|

Mar 17 2025, 01:36 PM Mar 17 2025, 01:36 PM

|

Senior Member

985 posts Joined: Jul 2010 From: Bolehland |

|

|

|

Mar 17 2025, 03:12 PM Mar 17 2025, 03:12 PM

|

Senior Member

1,072 posts Joined: Jun 2018 |

See you at RM44, cant wait next year EPF = 3%.

|

|

|

Mar 17 2025, 03:16 PM Mar 17 2025, 03:16 PM

|

Junior Member

944 posts Joined: Jul 2005 |

|

|

|

Apr 18 2025, 10:50 AM Apr 18 2025, 10:50 AM

|

Senior Member

3,626 posts Joined: Nov 2007 From: Hornbill land |

|

|

|

Apr 18 2025, 10:51 AM Apr 18 2025, 10:51 AM

Show posts by this member only | IPv6 | Post

#143

|

Junior Member

57 posts Joined: Jun 2009 From: Georgetown,Penang |

QUOTE(mois @ Apr 18 2025, 10:50 AM) Hold- next week we release q1 result stock up lagi-Easy money- i already put 400k inside- mois liked this post

|

|

|

Apr 18 2025, 01:31 PM Apr 18 2025, 01:31 PM

|

Junior Member

275 posts Joined: Aug 2011 |

|

|

|

Apr 18 2025, 01:33 PM Apr 18 2025, 01:33 PM

|

Senior Member

1,523 posts Joined: Apr 2005 From: too far to see |

at this juncture, it wil be best to get EPF to use it controlling company to buy Nestle...and change name...lol

|

|

|

Apr 18 2025, 02:04 PM Apr 18 2025, 02:04 PM

Show posts by this member only | IPv6 | Post

#146

|

Junior Member

57 posts Joined: Jun 2009 From: Georgetown,Penang |

QUOTE(bigwolf @ Apr 18 2025, 01:31 PM) dayummm... if it goes to rm90, can officially call you choy san yeh (god of wealth) oledi Scheduled 25 april-Any idea next week which day is the announcement? I make alot of my friends rich- Hahah - i hope u guys too Make 30% easy noien, DoomCognition, and 1 other liked this post

|

|

|

Apr 18 2025, 02:07 PM Apr 18 2025, 02:07 PM

|

Junior Member

309 posts Joined: May 2006 |

I remember some dumbass nestle staff penjilat here saying nestle is fmcg god here.. no effect boikotte or whatever u do, will be stronk forever. Pui sekali melungkup jugak.

|

|

|

Apr 22 2025, 07:20 PM Apr 22 2025, 07:20 PM

Show posts by this member only | IPv6 | Post

#148

|

Junior Member

737 posts Joined: Nov 2010 |

QUOTE(badmilk @ Mar 10 2025, 04:58 PM) Lol- i am now collecting funds - to buy as much as possible- Will PBT be good too? Or only revenue?Don’t quote me - But April 25 , we will announce the highest sales in 10 years history-for Q1 2025 Some fucker leaked our internal sales data to EPF - now they hoarding Cibai |

|

|

Apr 22 2025, 07:27 PM Apr 22 2025, 07:27 PM

Show posts by this member only | IPv6 | Post

#149

|

Junior Member

57 posts Joined: Jun 2009 From: Georgetown,Penang |

|

|

|

Apr 22 2025, 07:29 PM Apr 22 2025, 07:29 PM

|

Senior Member

2,294 posts Joined: Sep 2011 |

Epf next year hoh sei liao

|

|

|

Apr 22 2025, 07:41 PM Apr 22 2025, 07:41 PM

Show posts by this member only | IPv6 | Post

#151

|

Junior Member

173 posts Joined: Sep 2021 |

QUOTE(cms @ Apr 22 2025, 07:36 PM) U post like this, not worried it becomes public ah? just patiently wait another month for the release of QR to see whether it is all tokokImagine al your colleagues and bosses read what you posted above ? If i am you, i would either edit the post or just create a dupe and delete the old account. Too risky, now maybe small kuli, one day become big kuli leh? if it's tokok, he got nothing to afraid, otherwise... u know wat to do |

|

|

Apr 22 2025, 07:42 PM Apr 22 2025, 07:42 PM

Show posts by this member only | IPv6 | Post

#152

|

Junior Member

57 posts Joined: Jun 2009 From: Georgetown,Penang |

QUOTE(cms @ Apr 22 2025, 07:36 PM) U post like this, not worried it becomes public ah? Not scared - coz already too big - Imagine al your colleagues and bosses read what you posted above ? If i am you, i would either edit the post or just create a dupe and delete the old account. Too risky, now maybe small kuli, one day become big kuli leh? 11 years with this company - i am getting bored - Will change soon- |

|

|

Apr 22 2025, 07:44 PM Apr 22 2025, 07:44 PM

Show posts by this member only | IPv6 | Post

#153

|

Junior Member

57 posts Joined: Jun 2009 From: Georgetown,Penang |

QUOTE(premier239 @ Apr 22 2025, 07:41 PM) just patiently wait another month for the release of QR to see whether it is all tokok Lol - those who buy earlier make already 20/30% if it's tokok, he got nothing to afraid, otherwise... u know wat to do Keep holding - big money coming - fucking bored of money and nestle Sometimes i wish we can lose - unfortunately- malaysia have no companies able to challenge us- Oh well-take this as a grain of salt. This post has been edited by badmilk: Apr 22 2025, 07:45 PM |

|

|

Apr 22 2025, 07:54 PM Apr 22 2025, 07:54 PM

Show posts by this member only | IPv6 | Post

#154

|

Junior Member

763 posts Joined: Jan 2003 |

QUOTE(badmilk @ Apr 22 2025, 07:42 PM) Not scared - coz already too big - Post like this also bot scared ah? Take care and dont underestimate ppl online. 11 years with this company - i am getting bored - Will change soon- “Muahahahah- suck it take it well- malay r easy to control. Thank to muda lupa people. “ |

|

|

Apr 22 2025, 07:56 PM Apr 22 2025, 07:56 PM

Show posts by this member only | IPv6 | Post

#155

|

Junior Member

763 posts Joined: Jan 2003 |

|

|

|

Apr 22 2025, 08:05 PM Apr 22 2025, 08:05 PM

Show posts by this member only | IPv6 | Post

#156

|

Junior Member

57 posts Joined: Jun 2009 From: Georgetown,Penang |

QUOTE(cms @ Apr 22 2025, 07:56 PM) Aaw- r u sad? Do u felt it?Don’t worry- you will get over it soon enough-ppl forget easily and senang dikawal is a famous quote- Perhaps your too young or naive to hear it Its preety common for their kind - some leader told me abt it years ago. |

|

|

Apr 22 2025, 08:07 PM Apr 22 2025, 08:07 PM

Show posts by this member only | IPv6 | Post

#157

|

Junior Member

57 posts Joined: Jun 2009 From: Georgetown,Penang |

|

|

|

Apr 22 2025, 08:15 PM Apr 22 2025, 08:15 PM

Show posts by this member only | IPv6 | Post

#158

|

Junior Member

737 posts Joined: Nov 2010 |

QUOTE(badmilk @ Apr 22 2025, 07:27 PM) OK. Hope Thursday will be good. badmilk liked this post

|

|

|

Apr 22 2025, 08:32 PM Apr 22 2025, 08:32 PM

|

Junior Member

338 posts Joined: Mar 2017 |

|

|

|

Apr 22 2025, 08:51 PM Apr 22 2025, 08:51 PM

|

Senior Member

1,523 posts Joined: Apr 2005 From: too far to see |

|

|

|

Apr 22 2025, 10:15 PM Apr 22 2025, 10:15 PM

Show posts by this member only | IPv6 | Post

#161

|

Junior Member

57 posts Joined: Jun 2009 From: Georgetown,Penang |

|

|

|

Apr 22 2025, 10:18 PM Apr 22 2025, 10:18 PM

Show posts by this member only | IPv6 | Post

#162

|

Senior Member

4,539 posts Joined: Feb 2006 From: LocOmoT|oN.L0co|oti0N |

Nice 30% jump

|

|

|

Apr 22 2025, 10:20 PM Apr 22 2025, 10:20 PM

|

Junior Member

737 posts Joined: Nov 2010 |

|

|

|

Apr 22 2025, 10:56 PM Apr 22 2025, 10:56 PM

|

Junior Member

309 posts Joined: May 2006 |

|

|

|

Apr 26 2025, 09:12 AM Apr 26 2025, 09:12 AM

|

Junior Member

763 posts Joined: Jan 2003 |

And gone ahahahhaha

|

|

|

Apr 26 2025, 09:15 AM Apr 26 2025, 09:15 AM

|

Senior Member

3,186 posts Joined: Jan 2008 |

Lol what happened to the sus

|

|

|

Apr 26 2025, 09:30 AM Apr 26 2025, 09:30 AM

|

Junior Member

375 posts Joined: Mar 2008 From: Selangor |

|

|

|

Apr 26 2025, 10:39 AM Apr 26 2025, 10:39 AM

Show posts by this member only | IPv6 | Post

#168

|

Junior Member

94 posts Joined: Sep 2020 |

Why badmilk sus

I bought all the way down to 63-67 thanks to his “insider news” lol |

|

|

Apr 26 2025, 10:40 AM Apr 26 2025, 10:40 AM

Show posts by this member only | IPv6 | Post

#169

|

Junior Member

338 posts Joined: Mar 2017 |

|

|

|

Apr 26 2025, 02:50 PM Apr 26 2025, 02:50 PM

Show posts by this member only | IPv6 | Post

#170

|

Junior Member

737 posts Joined: Nov 2010 |

|

|

|

Apr 26 2025, 03:24 PM Apr 26 2025, 03:24 PM

|

Junior Member

615 posts Joined: Feb 2018 |

|

|

|

Apr 27 2025, 07:29 AM Apr 27 2025, 07:29 AM

|

Junior Member

94 posts Joined: Sep 2020 |

|

|

|

Apr 27 2025, 07:34 AM Apr 27 2025, 07:34 AM

Show posts by this member only | IPv6 | Post

#173

|

Junior Member

148 posts Joined: Oct 2009 |

NBDRE

|

|

|

Apr 27 2025, 08:07 AM Apr 27 2025, 08:07 AM

Show posts by this member only | IPv6 | Post

#174

|

Junior Member

453 posts Joined: Feb 2014 |

Cibai, I missed the boat.

Should have spent moar taim in /k/ |

|

|

Apr 28 2025, 09:49 AM Apr 28 2025, 09:49 AM

Show posts by this member only | IPv6 | Post

#175

|

Junior Member

737 posts Joined: Nov 2010 |

|

|

|

Apr 28 2025, 09:51 AM Apr 28 2025, 09:51 AM

|

Senior Member

1,072 posts Joined: Jun 2018 |

|

|

|

Apr 28 2025, 05:58 PM Apr 28 2025, 05:58 PM

Show posts by this member only | IPv6 | Post

#177

|

Junior Member

737 posts Joined: Nov 2010 |

Guess badmilk's news is not fully correct.

|

|

|

Apr 28 2025, 06:00 PM Apr 28 2025, 06:00 PM

|

Junior Member

361 posts Joined: Jun 2007 |

Sapu habis until Nestle belong to Malaysia.....oh yeah

|

|

|

Apr 28 2025, 06:05 PM Apr 28 2025, 06:05 PM

Show posts by this member only | IPv6 | Post

#179

|

Senior Member

3,971 posts Joined: Nov 2007 |

|

|

|

Apr 28 2025, 06:16 PM Apr 28 2025, 06:16 PM

Show posts by this member only | IPv6 | Post

#180

|

Junior Member

323 posts Joined: May 2020 |

oh no why he got sused, nuuuuuuuuuuuuuuuu

but nestle going strong, seeing KWSP keep buying !!! |

|

|

Apr 28 2025, 06:37 PM Apr 28 2025, 06:37 PM

Show posts by this member only | IPv6 | Post

#181

|

Senior Member

7,106 posts Joined: Jan 2003 |

QUOTE(DoomCognition @ Apr 28 2025, 09:49 AM) https://www.businesstoday.com.my/2025/04/28...ut-down-17-yoy/ |

|

|

Apr 28 2025, 10:31 PM Apr 28 2025, 10:31 PM

|

Junior Member

275 posts Joined: Aug 2011 |

QUOTE(fuzzy @ Apr 28 2025, 06:37 PM) https://www.thestar.com.my/business/busines...ging-1q-resultsNot the spectacular blockbuster as implied by badmilk but quite good oso lah. If we take the 17% drop compared against 1Q24, then the share price should be around RM100 mark? Right now RM80 macam undervalued oh? Masuk again tomolo |

|

|

Apr 28 2025, 10:34 PM Apr 28 2025, 10:34 PM

Show posts by this member only | IPv6 | Post

#183

|

Senior Member

7,106 posts Joined: Jan 2003 |

QUOTE(bigwolf @ Apr 28 2025, 10:31 PM) https://www.thestar.com.my/business/busines...ging-1q-results To me Nestle is just for dividend play - don't care too much about price appreciation due to its blue chip status. Not the spectacular blockbuster as implied by badmilk but quite good oso lah. If we take the 17% drop compared against 1Q24, then the share price should be around RM100 mark? Right now RM80 macam undervalued oh? Masuk again tomolo As long as the yield is good for you, can masuk jer. bigwolf liked this post

|

|

|

Apr 29 2025, 05:38 PM Apr 29 2025, 05:38 PM

Show posts by this member only | IPv6 | Post

#184

|

Junior Member

105 posts Joined: Jul 2013 |

4.78% today

|

|

|

Apr 29 2025, 05:41 PM Apr 29 2025, 05:41 PM

|

Junior Member

131 posts Joined: May 2020 |

Guess this shows the difference between veteran investor EPF and short term thinking doomsayer OP.

This post has been edited by Mixxomon: Apr 29 2025, 05:42 PM |

|

|

Apr 30 2025, 12:22 AM Apr 30 2025, 12:22 AM

|

Junior Member

680 posts Joined: Sep 2010 |

Geez @ badmilk thanks bro... guess you wanted a break from /k too.

May you have a good break at bora bora. Thanks to you, earn some small money. I remember I need to post to let you know and say Thanks. |

|

|

Apr 30 2025, 01:09 AM Apr 30 2025, 01:09 AM

|

Senior Member

1,523 posts Joined: Apr 2005 From: too far to see |

|

|

|

Apr 30 2025, 06:02 PM Apr 30 2025, 06:02 PM

|

Junior Member

275 posts Joined: Aug 2011 |

QUOTE(skywardsword @ Apr 30 2025, 12:22 AM) Geez @ badmilk thanks bro... guess you wanted a break from /k too. Closed at RM87 today. Yeah, thanks bro badmilk for letting us earn some small money. Have a good rest from /k before coming back huat again May you have a good break at bora bora. Thanks to you, earn some small money. I remember I need to post to let you know and say Thanks. |

|

|

Apr 30 2025, 08:47 PM Apr 30 2025, 08:47 PM

|

Junior Member

680 posts Joined: Sep 2010 |

QUOTE(Mixxomon @ Apr 29 2025, 05:41 PM) Was talking to my wife. If throw all the money into this... Bla bla bla... Can untung so many many percent.At last no such thing as know in advance only after past than you know. Because the opposite is losing all the money and ...13th floor... |

|

|

Apr 30 2025, 08:55 PM Apr 30 2025, 08:55 PM

|

Junior Member

7 posts Joined: Aug 2021 From: i love youuu |

ayam buy rm7000 now sell rm8700

|

|

|

Apr 30 2025, 09:48 PM Apr 30 2025, 09:48 PM

|

Junior Member

275 posts Joined: Aug 2011 |

|

|

|

Apr 30 2025, 09:50 PM Apr 30 2025, 09:50 PM

|

Junior Member

680 posts Joined: Sep 2010 |

QUOTE(bigwolf @ Apr 30 2025, 09:48 PM) very tempted to sell myself, but I see epf still buying as of 25 apr? Hv always wondered why epf buying non stop until now. maybe because, folks also contributing to EPF ... and they have no other better option to buy at this moment? This one is like basic necessity food, or closest to basic necessity food buisness.I think probably wait until epf start selling? |

|

|

Apr 30 2025, 10:03 PM Apr 30 2025, 10:03 PM

|

Junior Member

275 posts Joined: Aug 2011 |

QUOTE(skywardsword @ Apr 30 2025, 09:50 PM) maybe because, folks also contributing to EPF ... and they have no other better option to buy at this moment? This one is like basic necessity food, or closest to basic necessity food buisness. Possible, but I noticed epf only buy but never sell (except for that one 22 Apr where it bought 100k shares and sold 46k). Other than that it had been steadily accumulating. Very curious tbh, coz other counters like maybank/public bank/etc, can see epf buying and selling consistently almost on daily basis |

|

|

May 1 2025, 07:48 AM May 1 2025, 07:48 AM

Show posts by this member only | IPv6 | Post

#194

|

Senior Member

1,902 posts Joined: Sep 2012 |

QUOTE(Dweller @ Apr 29 2025, 05:38 PM) QUOTE(bigwolf @ Apr 30 2025, 06:02 PM) Closed at RM87 today. Yeah, thanks bro badmilk for letting us earn some small money. Have a good rest from /k before coming back huat again we all owe badmilk a round of drinkThis post has been edited by JimbeamofNRT: May 1 2025, 07:49 AM |

|

|

May 1 2025, 07:59 AM May 1 2025, 07:59 AM

|

Senior Member

3,186 posts Joined: Jan 2008 |

Common, go unsus him

He just make everyone earn some pocket money |

|

|

May 1 2025, 08:48 AM May 1 2025, 08:48 AM

Show posts by this member only | IPv6 | Post

#196

|

Junior Member

105 posts Joined: Jul 2013 |

|

|

|

May 1 2025, 09:26 AM May 1 2025, 09:26 AM

|

Senior Member

3,626 posts Joined: Nov 2007 From: Hornbill land |

Who ban badmilk? Haiya.

|

|

|

May 1 2025, 11:28 AM May 1 2025, 11:28 AM

Show posts by this member only | IPv6 | Post

#198

|

Junior Member

323 posts Joined: May 2020 |

|

|

|

May 1 2025, 11:29 AM May 1 2025, 11:29 AM

Show posts by this member only | IPv6 | Post

#199

|

Junior Member

500 posts Joined: Dec 2019 |

the hero that /ktards need but do not deserve

|

|

|

May 6 2025, 03:41 PM May 6 2025, 03:41 PM

Show posts by this member only | IPv6 | Post

#200

|

Junior Member

737 posts Joined: Nov 2010 |

Anyone still holding? Target price?

|

|

|

May 6 2025, 03:56 PM May 6 2025, 03:56 PM

|

Junior Member

460 posts Joined: Oct 2008 |

If you look at the numbers, their result is not that good anyway.

Q1 always the best quarter. Latest result worse than last 2 years. The rebound also mainly because it was oversold from previous selldown. |

|

|

May 6 2025, 03:57 PM May 6 2025, 03:57 PM

|

Junior Member

70 posts Joined: Aug 2014 |

deathTh3Cannon and Rusty Nail liked this post

|

|

|

May 6 2025, 05:15 PM May 6 2025, 05:15 PM

|

Junior Member

275 posts Joined: Aug 2011 |

QUOTE(DoomCognition @ May 6 2025, 03:41 PM) Just sold 2/3 today when i saw the news epf sold 200k units on 29 apr. The balance 1/3 just let it ride n see how it goes. But ok la, peace of mind with some pocket money in the pocket liao, thanks badmilk, hope you back from bora2 soon |

|

|

Jul 25 2025, 06:06 PM Jul 25 2025, 06:06 PM

|

Junior Member

131 posts Joined: May 2020 |

Suddenly UUU again

Badmilk why no give tips this quarter |

|

|

Jul 25 2025, 06:09 PM Jul 25 2025, 06:09 PM

|

All Stars

11,058 posts Joined: Jun 2008 |

|

|

|

Jul 25 2025, 06:33 PM Jul 25 2025, 06:33 PM

Show posts by this member only | IPv6 | Post

#206

|

Junior Member

80 posts Joined: Oct 2021 |

Didnt kwsp sapu many shares last time .?

|

|

|

Jul 25 2025, 06:46 PM Jul 25 2025, 06:46 PM

Show posts by this member only | IPv6 | Post

#207

|

Junior Member

57 posts Joined: Jun 2009 From: Georgetown,Penang |

|

|

|

Jul 25 2025, 06:49 PM Jul 25 2025, 06:49 PM

Show posts by this member only | IPv6 | Post

#208

|

Senior Member

2,245 posts Joined: Apr 2005 |

|

|

|

Jul 25 2025, 06:52 PM Jul 25 2025, 06:52 PM

|

Junior Member

150 posts Joined: Oct 2009 From: Klang, Selangor D.E Status: Work Everyday |

ada buy ada UUU

|

|

|

Jul 25 2025, 07:13 PM Jul 25 2025, 07:13 PM

|

Senior Member

846 posts Joined: Nov 2006 |

UUUU doing better

|

|

|

Jul 28 2025, 06:07 PM Jul 28 2025, 06:07 PM

Show posts by this member only | IPv6 | Post

#211

|

Junior Member

105 posts Joined: Jul 2013 |

UUU

|

|

|

Aug 22 2025, 10:15 AM Aug 22 2025, 10:15 AM

|

Junior Member

131 posts Joined: May 2020 |

Now RM90+ liao.

EPF time the market so chun one. So next year can get 10% dividend? This post has been edited by Mixxomon: Aug 22 2025, 10:16 AM |

|

|

Oct 8 2025, 06:04 PM Oct 8 2025, 06:04 PM

|

Junior Member

131 posts Joined: May 2020 |

|

|

|

Oct 14 2025, 11:48 AM Oct 14 2025, 11:48 AM

|

Junior Member

275 posts Joined: Aug 2011 |

Nestle rm101 now

I've oledi exited last time around rm80+ before the pullback so can just watch and clap for the holders. badmilk for pm! |

|

|

Oct 14 2025, 02:07 PM Oct 14 2025, 02:07 PM

Show posts by this member only | IPv6 | Post

#215

|

Junior Member

57 posts Joined: Jun 2009 From: Georgetown,Penang |

|

|

|

Oct 14 2025, 02:14 PM Oct 14 2025, 02:14 PM

Show posts by this member only | IPv6 | Post

#216

|

Junior Member

57 posts Joined: Jun 2009 From: Georgetown,Penang |

QUOTE(bigwolf @ Oct 14 2025, 11:48 AM) Nestle rm101 now Actually - our sales not really improved- but we r reshuffling and vss our operation soon for 2026I've oledi exited last time around rm80+ before the pullback so can just watch and clap for the holders. badmilk for pm! That will improved our fiscal year Cost we slashed this year. 1) end harvest gourmet brand/ this vegan line is bleeding us dry 2) retired some over paid fuckers 3) DISSOLVED out RTD department and merge it back to existing brand ( milo cans to milo brand - and Nescafe cans to nescafe brand) Previously rtd had its own unit which functions a diff cost . 4) move our pay and trade marketing to Philippines for paymen and trade expenses. 5) cutting our sales force by 2026 - move to digitalisation 6) freeze hiring for all sales positions effectively immediately Our operations cost will save quite a bit… this will help us close 2025 with a win over 2024. |

|

|

Oct 14 2025, 02:14 PM Oct 14 2025, 02:14 PM

Show posts by this member only | IPv6 | Post

#217

|

Junior Member

57 posts Joined: Jun 2009 From: Georgetown,Penang |

Lol- anyway my pay up 2k …

Not much but hey- i pass more tax - no feel. This post has been edited by badmilk: Oct 14 2025, 02:15 PM |

|

|

Oct 14 2025, 02:18 PM Oct 14 2025, 02:18 PM

|

Senior Member

1,035 posts Joined: Feb 2007 |

QUOTE(badmilk @ Oct 14 2025, 02:14 PM) Actually - our sales not really improved- but we r reshuffling and vss our operation soon for 2026 What's RTD?That will improved our fiscal year Cost we slashed this year. 1) end harvest gourmet brand/ this vegan line is bleeding us dry 2) retired some over paid fuckers 3) DISSOLVED out RTD department and merge it back to existing brand ( milo cans to milo brand - and Nescafe cans to nescafe brand) Previously rtd had its own unit which functions a diff cost . 4) move our pay and trade marketing to Philippines for paymen and trade expenses. 5) cutting our sales force by 2026 - move to digitalisation 6) freeze hiring for all sales positions effectively immediately Our operations cost will save quite a bit… this will help us close 2025 with a win over 2024. |

|

|

Oct 14 2025, 02:21 PM Oct 14 2025, 02:21 PM

Show posts by this member only | IPv6 | Post

#219

|

Junior Member

57 posts Joined: Jun 2009 From: Georgetown,Penang |

QUOTE(9m2w @ Oct 14 2025, 02:18 PM) Ready to drink department.Its one of our 8 major category. Company so big we have 8 sub division that serves the brands in malaysia Each sub division has their own beo / brand executive officer Like ceo but smaller / ( salary about a million per year>800k) Any of our sub division sales r equal to the entire company of most fmcg in malaysia- So yea This post has been edited by badmilk: Oct 14 2025, 02:22 PM |

|

|

Oct 14 2025, 02:21 PM Oct 14 2025, 02:21 PM

|

Junior Member

773 posts Joined: Dec 2010 From: isudahinsap.flac |

badmilk liked this post

|

|

|

Oct 14 2025, 02:27 PM Oct 14 2025, 02:27 PM

|

Senior Member

1,035 posts Joined: Feb 2007 |

QUOTE(badmilk @ Oct 14 2025, 02:21 PM) Ready to drink department. I see. And this is why from day 1 i say never bet against FMCG especially FMCGs like NestleIts one of our 8 major category. Company so big we have 8 sub division that serves the brands in malaysia Each sub division has their own beo / brand executive officer Like ceo but smaller / ( salary about a million per year>800k) Any of our sub division sales r equal to the entire company of most fmcg in malaysia- So yea This even with the boycott at full affect. They will outspend you, out market intelligence you, out efficient you, just out perform you in every metric Its like clubbing baby seals kek QUOTE(DValentine @ Oct 14 2025, 02:21 PM) Got it rtk73 liked this post

|

|

|

Oct 14 2025, 02:29 PM Oct 14 2025, 02:29 PM

Show posts by this member only | IPv6 | Post

#222

|

Junior Member

57 posts Joined: Jun 2009 From: Georgetown,Penang |

QUOTE(badmilk @ Oct 14 2025, 02:14 PM) Actually - our sales not really improved- but we r reshuffling and vss our operation soon for 2026 Oh yea point number 7 -That will improved our fiscal year Cost we slashed this year. 1) end harvest gourmet brand/ this vegan line is bleeding us dry 2) retired some over paid fuckers 3) DISSOLVED out RTD department and merge it back to existing brand ( milo cans to milo brand - and Nescafe cans to nescafe brand) Previously rtd had its own unit which functions a diff cost . 4) move our pay and trade marketing to Philippines for paymen and trade expenses. 5) cutting our sales force by 2026 - move to digitalisation 6) freeze hiring for all sales positions effectively immediately Our operations cost will save quite a bit… this will help us close 2025 with a win over 2024. Our new appointed Sales director TIM from UK- decided to slash ppl quietly via audit of their expenses and norms. Lol fuck you tim - if your reading this - there many more ways to extract funds - Piece of shit guai lou- wait till we sabo ur ass come 2026 q1 numbers . Cb betul . This post has been edited by badmilk: Oct 14 2025, 02:29 PM |

|

|

Oct 14 2025, 02:32 PM Oct 14 2025, 02:32 PM

|

Junior Member

131 posts Joined: May 2020 |