QUOTE(thesnake @ Mar 10 2025, 09:29 PM)

making 100k from this is easy money. g0 for it. T15 are here to dominateeeeeeeeeeeeeeeeeeeeeeeeNestle below RM70, lowest in 10y, EPF keep buying, confused...

Nestle below RM70, lowest in 10y, EPF keep buying, confused...

|

|

Mar 10 2025, 10:01 PM Mar 10 2025, 10:01 PM

|

Junior Member

57 posts Joined: Jun 2009 From: Georgetown,Penang |

|

|

|

|

|

|

Mar 10 2025, 10:05 PM Mar 10 2025, 10:05 PM

|

Junior Member

325 posts Joined: Feb 2022 |

Nestle the evil company? No thabks

|

|

|

Mar 10 2025, 10:24 PM Mar 10 2025, 10:24 PM

|

Junior Member

336 posts Joined: Mar 2017 |

|

|

|

Mar 10 2025, 10:37 PM Mar 10 2025, 10:37 PM

Show posts by this member only | IPv6 | Post

#104

|

Junior Member

577 posts Joined: May 2012 |

|

|

|

Mar 10 2025, 10:43 PM Mar 10 2025, 10:43 PM

|

Senior Member

1,481 posts Joined: Dec 2014 |

US market and tech stock all red again

damn |

|

|

Mar 10 2025, 11:01 PM Mar 10 2025, 11:01 PM

Show posts by this member only | IPv6 | Post

#106

|

Junior Member

577 posts Joined: May 2012 |

|

|

|

|

|

|

Mar 11 2025, 12:04 AM Mar 11 2025, 12:04 AM

Show posts by this member only | IPv6 | Post

#107

|

Junior Member

266 posts Joined: May 2012 |

QUOTE(Skidd Chung @ Mar 10 2025, 09:40 PM) Tempted to buy the dip. Likely due to boycott impact. Which started about 2 years ago during Israel-Hamas war, and being reflected now. All meleis around me try hard not to buy nestle products, from their cereals, milo, coffee etc. And it will continue for at least 1-2 years until the war stops. See starbucksBut looking at the results for past 3 quarters is very worrying. If 1 quarter cialat, it can be a one-off kind of thing, 2 quarters is a trend, and 3 quarters where each quarter is lower than previous is a confirmation of something is really wrong. Also dividend dropped from RM1.28/share to RM0.74/share for same quarter. Their net cash from operations in 2024 is less than half of 2023. Either competition is eating their profits or they have mismanaged their sales so bad they are making 4x LESS profit in the last quarter compared to their 1st quarter. Like 9 months can crash so badly meh? |

|

|

Mar 11 2025, 01:32 AM Mar 11 2025, 01:32 AM

|

Senior Member

1,837 posts Joined: May 2010 |

QUOTE(Pain4UrsinZ @ Mar 10 2025, 09:28 PM) efp avg price Rm40, they dont look at price in the last few years, but their avg price since 20 years ago and the dividend . Similar to * Malaysia pension fund EPF scrutinised over up to $212m ‘losses’ in airport privatisation deal * ?EPF must explain why its "sell low, buy high" of MAHB shares were so close together in time, resulting in losses, says Ayer Itam MP Dr Wee Ka Siong QUOTE EPF must explain why its "sell low, buy high" of MAHB shares were so close together in time, resulting in losses, says Ayer Itam MP Dr Wee Sunday, 16 Feb 2025 KUALA LUMPUR: The Employees' Provident Fund (EPF) needs to explain its decision-making process to buy Malaysia Airports Bhd (MAHB) shares at RM11 each in 2024, a mere year after selling it for RM6 in 2023, said Datuk Seri Dr Wee Ka Siong. "It is said the buying back of shares at RM11 was for privatisation purposes. "Who was responsible for this decision which incurred losses of between RM539mil and RM694mil? "If EPF had not sold off its shares at RM6 in 2023 and reduced its holdings (in MAHB), then, they would not have needed to fork out and buy it back," said the MCA president in a four-minute long video that was posted on his Facebook page on Sunday (Feb 16). Several sources in the know about the hearing told The Straits Times that the committee also grilled EPF on why it had slashed its MAHB stake from 15.6 per cent to 5.8 per cent between December 2022 and December 2023, before then raising its stake to 30 per cent as part of the consortium taking the Malaysian company private. Critics say these sales, transacted at between RM6.80 and RM7.70 apiece, had resulted in “losses” ranging from RM500 million to RM700 million when EPF needed to repurchase the 163 million shares back at a higher price under the privatisation exercise. EPF has held shares in MAHB, which runs 40 airports nationwide, since its listing in 1999. It had never reduced its holdings as drastically as it did in 2023, shedding nearly 10 percentage points. Aside from this, in the two decades since 2005, it has never divested more than two percentage points in a year. Finance Minister II Amir Hamzah Azizan, who was EPF’s CEO during the period when the fund slashed its stake in MAHB up until he joined the Cabinet in December 2023, has denied any wrongdoing. On Feb 20 in Parliament, he defended the share divestment, saying that ****** “Chinese walls” ****** were in place at the fund to keep EPF’s **** trading ***** and ****** strategic investment teams ****** from sharing sensitive information with each other and ***** prevent insider trading, in accordance with the Capital Markets and Services Act (CMSA). ********* This post has been edited by plouffle0789: Mar 11 2025, 01:37 AM |

|

|

Mar 11 2025, 01:39 AM Mar 11 2025, 01:39 AM

|

||||||||||||||||||||||||||||||||||||||

Senior Member

1,837 posts Joined: May 2010 |

QUOTE(Skidd Chung @ Mar 10 2025, 09:40 PM) Tempted to buy the dip. https://forum.lowyat.net/index.php?showtopi...ost&p=111324390But looking at the results for past 3 quarters is very worrying. If 1 quarter cialat, it can be a one-off kind of thing, 2 quarters is a trend, and 3 quarters where each quarter is lower than previous is a confirmation of something is really wrong. Also dividend dropped from RM1.28/share to RM0.74/share for same quarter. Their net cash from operations in 2024 is less than half of 2023. Either competition is eating their profits or they have mismanaged their sales so bad they are making 4x LESS profit in the last quarter compared to their 1st quarter. Like 9 months can crash so badly meh? ### **Key Insights**

### Overall Observations Across 3 Quarters

This confirms a clear downtrend across all financial metrics in **2024 vs 2023**. I listed all the past 3 quarters' financial results from the Bursa Malaysia website for Nestlé Berhad. I do not think the last quarter will have a big result to cover the profit reduction in all three previous quarters compared to 2023. This post has been edited by plouffle0789: Mar 11 2025, 01:52 AM |

||||||||||||||||||||||||||||||||||||||

|

|

Mar 11 2025, 01:42 AM Mar 11 2025, 01:42 AM

|

Senior Member

1,837 posts Joined: May 2010 |

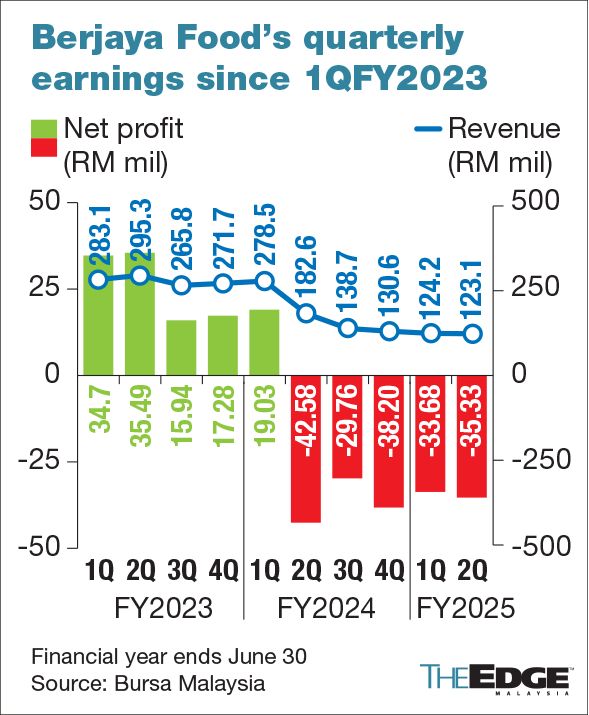

QUOTE(daidragon12 @ Mar 11 2025, 12:04 AM) Likely due to boycott impact. Which started about 2 years ago during Israel-Hamas war, and being reflected now. All meleis around me try hard not to buy nestle products, from their cereals, milo, coffee etc. And it will continue for at least 1-2 years until the war stops. See starbucks https://theedgemalaysia.com/node/745275Kesian BJFood  |

|

|

Mar 11 2025, 01:46 AM Mar 11 2025, 01:46 AM

|

||||||||||||||||||||||||||||||||||||||

Senior Member

1,837 posts Joined: May 2010 |

QUOTE(Ayambetul @ Mar 10 2025, 10:24 PM)  ### **Key Insights**

### Overall Observations Across 3 Quarters

This confirms a clear downtrend across all financial metrics in **2024 vs 2023**. I listed all the past 3 quarters' financial results from the Bursa Malaysia website for Nestlé Berhad. I do not think that the announcement on 25 April 2025 for Nestlé Bhd [4707.KL] will show good results. Just look back at the last three quarters and see how many reductions in profit there were. It's impossible for one quarter to account for all three negative quarter results. This post has been edited by plouffle0789: Mar 11 2025, 01:56 AM |

||||||||||||||||||||||||||||||||||||||

|

|

Mar 11 2025, 07:20 AM Mar 11 2025, 07:20 AM

Show posts by this member only | IPv6 | Post

#112

|

Junior Member

323 posts Joined: May 2020 |

checking epf buy how many share today

|

|

|

Mar 11 2025, 07:28 AM Mar 11 2025, 07:28 AM

|

Senior Member

2,529 posts Joined: Sep 2013 |

|

|

|

|

|

|

Mar 11 2025, 07:30 AM Mar 11 2025, 07:30 AM

|

Junior Member

479 posts Joined: May 2010 |

QUOTE(plouffle0789 @ Mar 11 2025, 01:46 AM)  ### **Key Insights** Just look back at the last three quarters and see how many reductions in profit there were. It's impossible for one quarter to account for all three negative quarter results. Means selling same amount but a lot LESS profit. |

|

|

Mar 11 2025, 07:36 AM Mar 11 2025, 07:36 AM

|

Senior Member

566 posts Joined: Oct 2006 |

QUOTE(yehlai @ Mar 10 2025, 01:34 PM) Some consumer complaint milo is not taste same as last time Indeed now I don't make milo ice or drink it anymore. 1st I thought maybe is the way I made it then retried it 2nd 3rd time still taste weird from before hard to describe how weird it is but different no matter how many teaspoons I put it in.This post has been edited by quintesson: Mar 11 2025, 07:39 AM |

|

|

Mar 11 2025, 07:38 AM Mar 11 2025, 07:38 AM

Show posts by this member only | IPv6 | Post

#116

|

||||||||||||||||||||||||||||||||||||||

Junior Member

57 posts Joined: Jun 2009 From: Georgetown,Penang |

QUOTE(plouffle0789 @ Mar 11 2025, 01:46 AM)  ### **Key Insights**

I listed all the past 3 quarters' financial results from the Bursa Malaysia website for Nestlé Berhad. I do not think that the announcement on 25 April 2025 for Nestlé Bhd [4707.KL] will show good results. Just look back at the last three quarters and see how many reductions in profit there were. It's impossible for one quarter to account for all three negative quarter results. U want side bet? Let /k be witness loh. This post has been edited by badmilk: Mar 11 2025, 07:40 AM Skidd Chung liked this post

|

||||||||||||||||||||||||||||||||||||||

|

|

Mar 11 2025, 07:42 AM Mar 11 2025, 07:42 AM

|

Junior Member

479 posts Joined: May 2010 |

|

|

|

Mar 11 2025, 07:45 AM Mar 11 2025, 07:45 AM

Show posts by this member only | IPv6 | Post

#118

|

Junior Member

57 posts Joined: Jun 2009 From: Georgetown,Penang |

|

|

|

Mar 11 2025, 08:28 AM Mar 11 2025, 08:28 AM

Show posts by this member only | IPv6 | Post

#119

|

Junior Member

173 posts Joined: Sep 2021 |

QUOTE(quintesson @ Mar 11 2025, 07:36 AM) Indeed now I don't make milo ice or drink it anymore. 1st I thought maybe is the way I made it then retried it 2nd 3rd time still taste weird from before hard to describe how weird it is but different no matter how many teaspoons I put it in. easy... milo now has palm oil increased, coco reduced, sugar increased |

|

|

Mar 11 2025, 08:30 AM Mar 11 2025, 08:30 AM

Show posts by this member only | IPv6 | Post

#120

|

Junior Member

687 posts Joined: Jul 2010 |

EPF have million of MYR fund. EPF can cut loss just like one click. But we all is cut loss our hard earn money. So be wise. Buy only when the share is uptrend.

|

| Change to: |  0.0227sec 0.0227sec

0.36 0.36

5 queries 5 queries

GZIP Disabled GZIP Disabled

Time is now: 20th December 2025 - 09:01 PM |