Outline ·

[ Standard ] ·

Linear+

Capital Gain Tax for oversea shares

|

TSGoodMorningMY

|

Feb 20 2025, 10:38 AM, updated 10 months ago Feb 20 2025, 10:38 AM, updated 10 months ago

|

New Member

|

Do we have to pay capital gain tax for oversea shares trading in US stock exchange via foreign brokers like eToro, IB, etc?

My brother-in-law asked me, he thought I know since I trade Malaysian stock market. As far as I know, for malaysian listed stock, there is no capital gain tax (yet?), if I m right.

But for overseas shares say Tesla, Meta etc, he bought in 2022, then he sold all in 2024. So he has to pay the capital gain? I think no right?

But I do not dare to advise him. So anyone here knows?

What about Maybank etc that allow us to buy US stock?

|

|

|

|

|

|

darkhunter16

|

Feb 20 2025, 11:39 AM Feb 20 2025, 11:39 AM

|

Getting Started

|

Follow

|

|

|

|

|

|

T.Alvin

|

Feb 20 2025, 11:43 AM Feb 20 2025, 11:43 AM

|

Getting Started

|

i also want to know. (Parking)

|

|

|

|

|

|

kens88`

|

Feb 20 2025, 11:44 AM Feb 20 2025, 11:44 AM

|

|

https://www.pwc.com/my/en/issues/capital-ga...ject%20to%20CGT. Well, the first sentence already say individuals are NOT subject to capital gains tax la

|

|

|

|

|

|

TSGoodMorningMY

|

Feb 20 2025, 12:57 PM Feb 20 2025, 12:57 PM

|

New Member

|

QUOTE(kens88` @ Feb 20 2025, 11:44 AM) https://www.pwc.com/my/en/issues/capital-ga...ject%20to%20CGT. Well, the first sentence already say individuals are NOT subject to capital gains tax la Nice! Thanks! Hope PMX dont change this next year! |

|

|

|

|

|

MrBaba

|

Feb 20 2025, 01:51 PM Feb 20 2025, 01:51 PM

|

|

Idk how can he miss the 30% tax part

|

|

|

|

|

|

TSGoodMorningMY

|

Feb 20 2025, 02:19 PM Feb 20 2025, 02:19 PM

|

New Member

|

QUOTE(MrBaba @ Feb 20 2025, 01:51 PM) Idk how can he miss the 30% tax part What do you mean? Where? Can you please clarify? |

|

|

|

|

|

cempedaklife

|

Feb 20 2025, 03:15 PM Feb 20 2025, 03:15 PM

|

|

QUOTE(MrBaba @ Feb 20 2025, 01:51 PM) Idk how can he miss the 30% tax part 30% tax is dividend, bang. |

|

|

|

|

|

talexeh

|

Feb 20 2025, 03:18 PM Feb 20 2025, 03:18 PM

|

|

QUOTE(GoodMorningMY @ Feb 20 2025, 02:19 PM) What do you mean? Where? Can you please clarify? He most likely refers to the 30% dividend withholding tax. |

|

|

|

|

|

TSGoodMorningMY

|

Feb 20 2025, 04:42 PM Feb 20 2025, 04:42 PM

|

New Member

|

https://www.hasil.gov.my/media/nbwloyo2/kom...gt-09022024.pdfThis document clearly shows the answer: Question 10 Is this CGT applicable to companies only? what about individual (Malaysian tax resident/foreigner)? From 1.1.2024, CGT will apply to companies, limited liability partnerships, trusts and cooperatives only. Everyone concerns please read the document and share your findings here!

|

|

|

|

|

|

kswee

|

Feb 20 2025, 06:50 PM Feb 20 2025, 06:50 PM

|

|

|

|

|

|

|

|

4102Lahces

|

Feb 21 2025, 03:52 PM Feb 21 2025, 03:52 PM

|

Getting Started

|

I understand theres a plan to put tax on foreign income and dividend by 2026? Theres many countries that will charge up to 40% on that income.

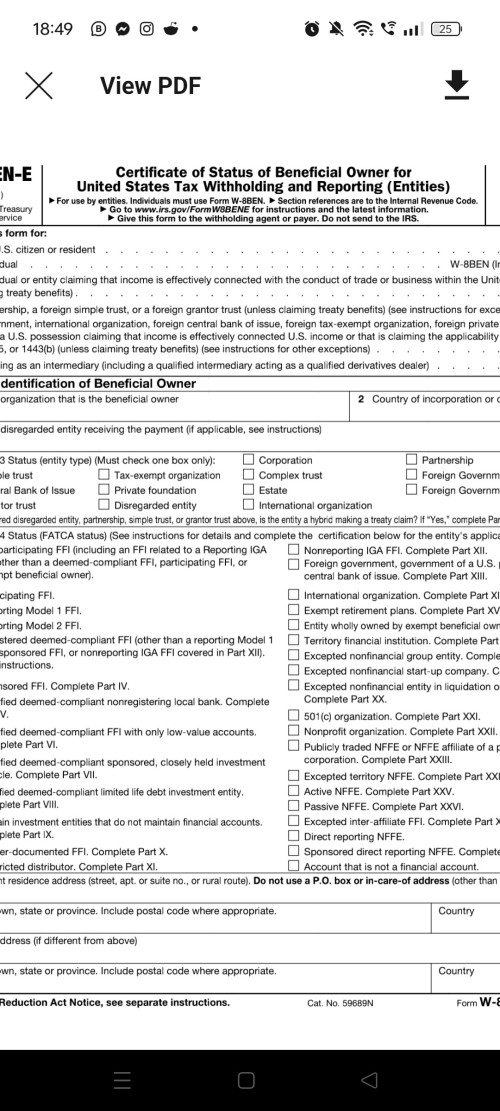

I recall W8-BEN is really only for declarations of tax residence - specifically targeting US residents and US citizens - which you should have already done before purchasing the shares in the first place?

|

|

|

|

|

Feb 20 2025, 10:38 AM, updated 10 months ago

Feb 20 2025, 10:38 AM, updated 10 months ago

Quote

Quote

0.0261sec

0.0261sec

0.26

0.26

5 queries

5 queries

GZIP Disabled

GZIP Disabled