The group is proposing an initial public offering (IPO) of 862.15 million shares that represent 15% of its enlarged share capital, comprising a public issue of 347 million new shares and an offer for sale of 515.15 million existing shares by its current shareholders, at a price to be fixed.

Bloomberg reported in March last year, citing sources, that the listing of Eco-Shop, which is backed by private equity firm Creador Capital Group, could raise as much as RM800 million. At the time, it was said that a listing could take place as early as September this year.

According to the draft prospectus, the retail offering of Eco-Shop's IPO will involve 186.78 million shares — of which 114.94 million shares will be made available to the Malaysian public via balloting and the remainder reserved for eligible directors, employees and contributors to the group — while its institutional offering will involve up to 675.37 million shares.

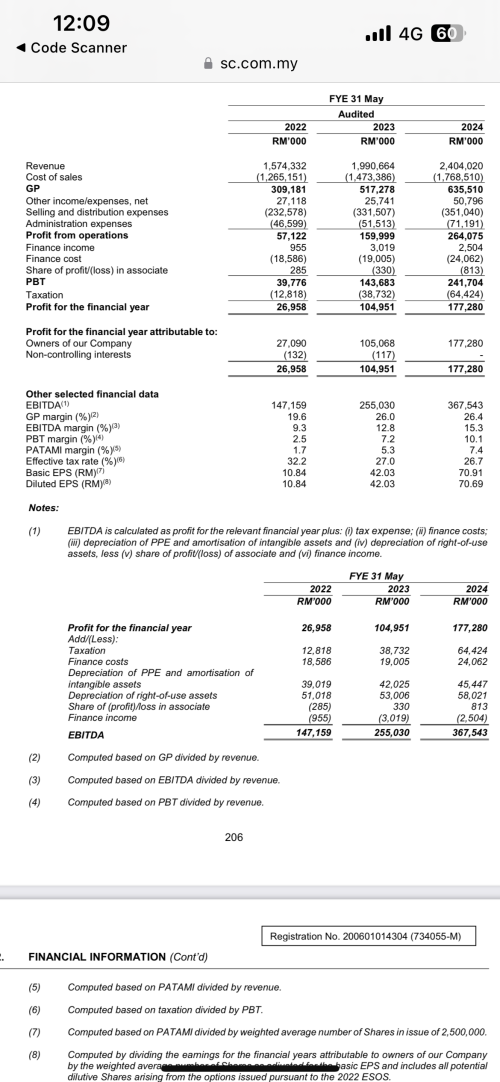

The group, which made a net profit of RM27.09 million on revenue of RM1.57 billion in its financial year ended May 31, 2022 (FY2022), saw its net profit jump to RM105.07 million as revenue expanded to RM1.99 billion in FY2023. In FY2024, its net profit rose further to RM177.28 million as revenue jumped to RM2.4 billion.

Eco-Shop is presently controlled by its founder and managing director Datuk Seri Lee Kar Whatt with a directly owned 80.3% stake and an indirect 2%, while Agathis Montana Sdn Bhd (AMSB), an investment vehicle managed by Creador IV, holds a 10% stake. Both are offering up shares for sale in the IPO. Post-IPO, Lee's direct stake will drop to 73.9%, while AMSB will be left with 1.9%.

The company plans to use its IPO proceeds to expand its store network, particularly in suburban and rural areas, while also investing in logistics and distribution infrastructure. A new distribution centre in Selangor is in the pipeline, along with additional facilities in Sabah and Sarawak to bolster its supply chain. Eco-Shop also intends to upgrade its digital systems and enhance its mobile application.

Incorporated in May 2006 as Eco-Shop Marketing Sdn Bhd and converted into a public limited company in October this year, the group's business is mainly involved in the retailing of groceries and general consumer goods, the wholesaling of rice, oil and sugar, and the provision of transportation business. It is also involved in e-commerce and online selling of a variety of products, besides the manufacturing and sale of plastic products for consumer use.

Maybank Investment Bank Bhd is the principal adviser and sole underwriter for the IPO. It is also the joint global coordinator and joint bookrunner of the IPO, together with UBS Securities Malaysia Sdn Bhd. RHB Investment Bank Bhd is also a joint bookrunner.

This post has been edited by premier239: Dec 5 2024, 01:15 PM

Dec 5 2024, 01:12 PM, updated 2y ago

Dec 5 2024, 01:12 PM, updated 2y ago

Quote

Quote

0.0159sec

0.0159sec

1.01

1.01

5 queries

5 queries

GZIP Disabled

GZIP Disabled