Yes. You can look into this 2 way

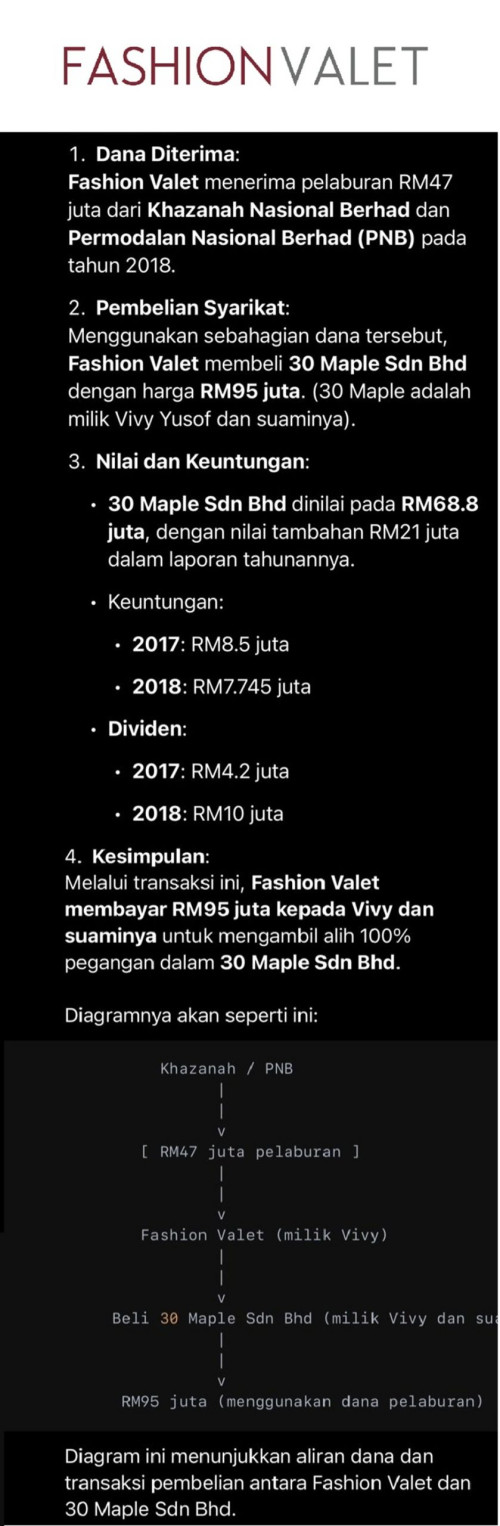

A. It a straight forward cash out. Blind also can see thru it. But if really do it all above board with 3rd independent valuation plus lower than valuation report purchasing it, maybe it all good cos enhancing the core company future profits and position.

Or

B. The founder need to do this because need to fulfill the promise or KPI to Khazanah/PNB short term projections. But at the price paid for it, it just too ridiculous. Normally the founders buy over the said company first, then only presented a stronger case for funding. It will look nicer this way.

If the said company are theirs wholly, they want to buy their company at 1B also nobody care. Just remember pay the stamp duty.

But if got 3rd minority shareholders especially involved Khazanah. Khazanah need to at least know about this and get approval for it.

Imagine all those listed companies bosses do this without proper procedures and check and balance, you and me as minority shareholders will be screwed

Nov 9 2024, 09:38 AM

Nov 9 2024, 09:38 AM

Quote

Quote

0.0827sec

0.0827sec

0.68

0.68

6 queries

6 queries

GZIP Disabled

GZIP Disabled