https://theedgemalaysia.com/node/738131ACE Market-bound Northern Solar seeks to raise up to RM65m in IPO

KUALA LUMPUR (Dec 18): Solar renewable energy specialist Northern Solar Holdings Bhd, en route to list on the ACE Market of Bursa Malaysia on Feb 6, is looking to raise up to RM64.8 million from the public market to part-finance its business expansion and for working capital.

The proposed initial public offering (IPO) involves the issuance of 67.25 million new shares and an offer for sale of 35.6 million existing shares at a price of 63 sen per share. All in all, the listing would offer investors up to a 26% stake in the company.

"Gross proceeds from the public issue amounting to RM42.37 million will be used mainly for the expansion and working capital purposes," Northern Solar said at its prospectus launch on Wednesday.

The offer for sale, which amounts to RM22.43 million, will go to its selling shareholders, including co-founders Lew Shoong Kai and Chew Win Hoe, who currently hold a 42.5% stake in Northern Solar each.

The IPO application closes on Jan 20.

Northern Solar mainly provides engineering, procurement, construction and commissioning of solar photovoltaic (PV) systems, generation of renewable energy as well as operation and maintenance of solar PV equipment and systems. It also owns and operates 10 solar PV systems and another four solar PV systems under its 20%-owned Engtex Energy Sdn Bhd. Pipe and valve maker Engtex Group Bhd (KL:ENGTEX) owns 80% of Engtex Energy.

Real estate developer Lagenda Properties Bhd (KL:LAGENDA) has a 15% stake in Northern Solar.

At the IPO price of 63 sen per share, Northern Solar would have a market capitalisation of RM249.23 million upon listing based on its enlarged share capital of 395.6 million shares. This values the company at a price-to-earnings (P/E) ratio of 24 times its financial year ended March 31, 2024 (FY2024) earnings.

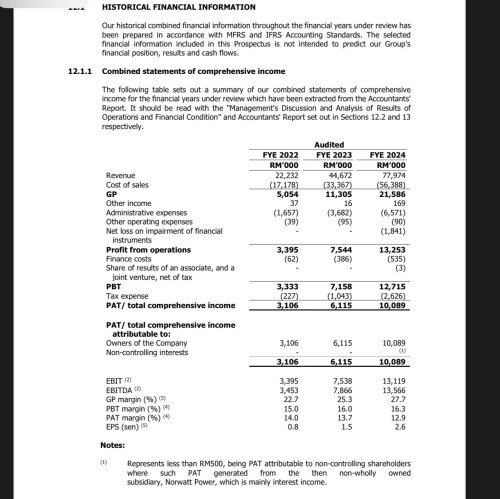

For FY2024, Northern Solar reported a net profit of RM10.09 million on revenue of RM77.97 million.

Under the IPO, Northern Solar will make 19.78 million shares available to the public and 7.91 million shares to eligible persons. The company will also set aside 39.56 million shares to select investors through private placement.

The offer for sale of 35.6 million existing shares, meanwhile, will be done through private placement to select investors. Proceeds from the sale of existing shares will accrue entirely to the selling shareholders Lew and Chew, whose holdings will be reduced to 30.8% each.

More than half of the proceeds, RM29.17 million, has been earmarked for working capital purposes to expand its solar PV systems business. Another RM3.2 million of the proceeds will be used to establish a new corporate office with an engineering command centre in Petaling Jaya, Selangor and to fund the establishment of an expanded office in Johor and an additional office in Penang.

Another RM5.5 million will be used to repay bank borrowings and the remaining RM4.55 million for listing-related expenses.

M&A Securities is the IPO’s adviser, sponsor, underwriter and placement agent.

This post has been edited by coyouth: Dec 18 2024, 02:21 PM

Oct 30 2024, 11:58 AM, updated 2y ago

Oct 30 2024, 11:58 AM, updated 2y ago

Quote

Quote

0.0275sec

0.0275sec

0.67

0.67

5 queries

5 queries

GZIP Disabled

GZIP Disabled