QUOTE(netflix2019 @ Oct 12 2024, 11:38 AM)

She effectively has one million in a high yield 6% savings account risk free. Where got any other investment offer such a deal?2mil in EPF at 35

2mil in EPF at 35

|

|

Oct 12 2024, 01:47 PM Oct 12 2024, 01:47 PM

Return to original view | IPv6 | Post

#1

|

Junior Member

863 posts Joined: Apr 2019 |

|

|

|

|

|

|

Oct 12 2024, 01:59 PM Oct 12 2024, 01:59 PM

Return to original view | IPv6 | Post

#2

|

Junior Member

863 posts Joined: Apr 2019 |

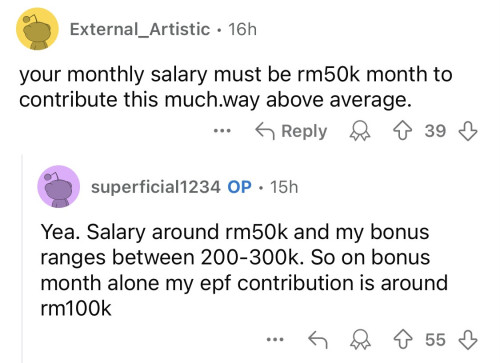

QUOTE(petpenyubobo @ Oct 12 2024, 01:57 PM) Obviously it's mostly self contribution from "external" sources la. 35 years old, say you graduate around 25-26yo within 9 years you start from bottom can contribute millions to EPF? Like she said, maximum self contribution is 100k per year. She took ten years to reach the first million. Compounding interest helps a lot after thatThis post has been edited by diffyhelman2: Oct 12 2024, 02:00 PM |

|

|

Oct 12 2024, 02:06 PM Oct 12 2024, 02:06 PM

Return to original view | IPv6 | Post

#3

|

Junior Member

863 posts Joined: Apr 2019 |

QUOTE(statikinetic @ Oct 12 2024, 01:03 PM) Yes. It's not about trust though, it's about understanding how the structure works. Investment must consider liquidity, risk and returns. Epf amount above one million is like the Best of all three, like a risk free savings account paying six percent. No private bank or mutual fund will give that kind of deal.It's among the most stable of investment avenues. |

|

|

Oct 12 2024, 02:14 PM Oct 12 2024, 02:14 PM

Return to original view | IPv6 | Post

#4

|

Junior Member

863 posts Joined: Apr 2019 |

QUOTE(p4n6 @ Oct 12 2024, 02:11 PM) Actually if work backwards, the amount is debatable… One need to contribute RM10k per mth in epf for 12 years at 5% dividend to hit RM2M. Company will pay 12%, self contribute 11%, so about RM5k per month self contribution. So her average per month salary is RM45k for period of 12 years. If she does not start with RM45k and follow normal incremental path of workers starting RM3k, so roughly her per mth earning RM160k now. So increment per annum is 43%. QUOTE(killdavid @ Oct 12 2024, 02:13 PM) You forgot bonus. Someone said she works in o&g industry This post has been edited by diffyhelman2: Oct 12 2024, 02:15 PM |

|

|

Oct 12 2024, 02:24 PM Oct 12 2024, 02:24 PM

Return to original view | IPv6 | Post

#5

|

Junior Member

863 posts Joined: Apr 2019 |

QUOTE(p4n6 @ Oct 12 2024, 02:20 PM) Bonus is considered in annual compensation, can be averaged out as monthly wage for simple calculation… unless you are in company that pays 36 months bonus every year i think not likely for typical company, i know TSMC and Tencent did pay that high occasionally … but not a typical company in Malaysia. It looks like she also requested the company to deduct the maximum 25% in employee contribution instead of the standard 12%.To add the 45k is for past 12 years not current only. Means from fresh grad onwards 45k per mth to accumulate. p4n6 liked this post

|

|

|

Oct 12 2024, 02:29 PM Oct 12 2024, 02:29 PM

Return to original view | IPv6 | Post

#6

|

Junior Member

863 posts Joined: Apr 2019 |

QUOTE(p4n6 @ Oct 12 2024, 02:27 PM) According to the Reddit thread, yes. And this trick didn’t count into the self contribution limit. And you used five percent dividend which is low. Averaged over ten years the rate is closer to six percent. The last five years hit badly by Covid.This post has been edited by diffyhelman2: Oct 12 2024, 02:33 PM p4n6 liked this post

|

|

|

|

|

|

Oct 12 2024, 03:26 PM Oct 12 2024, 03:26 PM

Return to original view | IPv6 | Post

#7

|

Junior Member

863 posts Joined: Apr 2019 |

QUOTE(silverhawk @ Oct 12 2024, 03:11 PM) In the thread, the one who said that is a different person if I recall. It’s also kinda implied when she said her bonus is 200-300k and her epf contribution from this gross is 100k.I'm somewhat skeptical that can reach 50k/month in the same company. Especially if in O&G, unless you got some tali to pull you up. perhaps she is also in investment banking or private equity. Can partners in law firm here make this much? This post has been edited by diffyhelman2: Oct 12 2024, 03:26 PM |

|

|

Oct 12 2024, 03:28 PM Oct 12 2024, 03:28 PM

Return to original view | IPv6 | Post

#8

|

Junior Member

863 posts Joined: Apr 2019 |

|

|

|

Oct 12 2024, 03:44 PM Oct 12 2024, 03:44 PM

Return to original view | IPv6 | Post

#9

|

Junior Member

863 posts Joined: Apr 2019 |

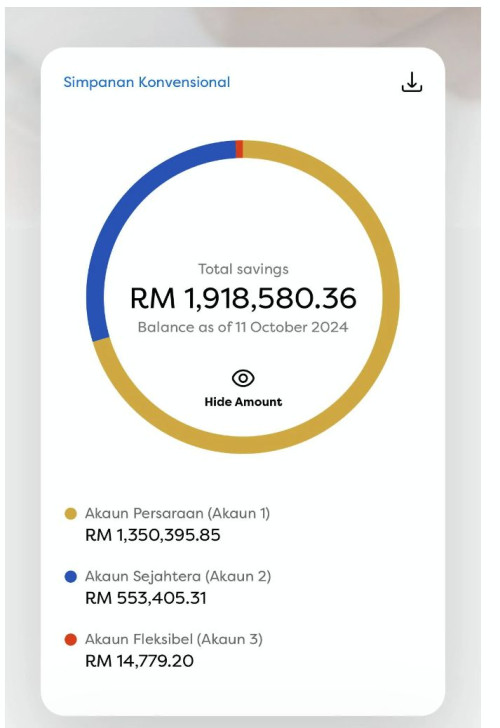

QUOTE(romuluz777 @ Oct 12 2024, 02:15 PM) Did the lady post her acct summary on the portal ? Otherwise BS, anyone can claim that they have millions in EPF at an age when most folks are just sprouting pubic hair LOL QUOTE(mushigen @ Oct 12 2024, 03:33 PM) she posted a screenshothttps://www.reddit.com/media?url=https%3A%2...0aa24a59b367951  This post has been edited by diffyhelman2: Oct 12 2024, 03:44 PM |

|

|

Oct 12 2024, 04:59 PM Oct 12 2024, 04:59 PM

Return to original view | IPv6 | Post

#10

|

Junior Member

863 posts Joined: Apr 2019 |

QUOTE(beLIEve @ Oct 12 2024, 04:58 PM) The problem with this is, 100k self contribution a year only started last year, 2023. Before that, it's 60k. If anyone claims "a few years ago", it's a hoax. This only applies to self contribution on top of your salary deduction. With salary deduction there is no limit. |

|

|

Oct 12 2024, 05:02 PM Oct 12 2024, 05:02 PM

Return to original view | IPv6 | Post

#11

|

Junior Member

863 posts Joined: Apr 2019 |

|

|

|

Oct 12 2024, 08:58 PM Oct 12 2024, 08:58 PM

Return to original view | IPv6 | Post

#12

|

Junior Member

863 posts Joined: Apr 2019 |

|

| Change to: |  0.1407sec 0.1407sec

0.70 0.70

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 17th December 2025 - 02:08 AM |