| Date | Implementation Details |

| 1 August 2024 | Implemented for taxpayers with an annual turnover of RM 100 million and above. |

| 1 January 2025 | Implementation for taxpayers with an annual turnover between RM 25 million and RM 100 million. |

| 1 July 2025 | Full and comprehensive implementation for all remaining taxpayers with an annual turnover between RM 500,001 and RM 24.99 million. |

| 1 January 2026 | Full and comprehensive implementation for all remaining taxpayers with an annual turnover between (RM 150k – RM 500k) |

/------------------/------------------------------------/-----------------------------/

| Scenario | Condition | e-Invoice Start Date |

| Scenario A | YA2022 revenue < RM1,000,000 | Exempted (if qualifies) |

| (Qualifies for | + Individual shareholders only | |

| Exemption) | + No holding/subsidiary company | |

| + No related company > RM1,000,000 |

| Scenario A | Any of YA2023 / YA2024 / YA2025 | 1 July 2026 |

| revenue > RM1,000,000 |

| Scenario A | YA2026 or later | 1 Jan of the following year |

| revenue > RM1,000,000 |

| Scenario B | Does NOT qualify for exemption | 1 July 2026 (Mandatory) |

| (Not Exempted) | (corporate shareholder / subsidiary | |

| / related company > RM1,000,000) |

https://bukku.my/

https://mytax.hasil.gov.my/

Lotus's , Econsave, AEON, AEON BIG,

Giant, Jaya Grocer ,

Village Grocer,

Cold Storage,

MASLEE,

MYDIN,

THE STORE,

KK MART,

99 SPEEDMART,

TF VALUE MART,

and NSK

You need to ensure that all e-invoices are submitted to LHDN Malaysia and accounted for by the 7th day of the following month..

QUOTE

Annual Sales between RM150k to RM500k, the implementation date will be postponed to 1st January 2026.

The Malaysian government has announced a significant extension of the e-Invoicing implementation deadline for small and medium enterprises (SMEs), pushing the requirement to January 1, 2026.

This crucial decision affects businesses with annual revenue between RM150,000 and RM500,000, providing essential breathing room for digital transformation.

Key Highlights of the e-Invoicing Extension:

Implementation deadline extended to 1st January 2026

In addition, six-month transition period will also be provided

Over 240,000 SMEs to benefit from the extension

Businesses earning below RM150,000 annually fully exempted

Free access to MyInvois portal and mobile app

The Malaysian government has announced a significant extension of the e-Invoicing implementation deadline for small and medium enterprises (SMEs), pushing the requirement to January 1, 2026.

This crucial decision affects businesses with annual revenue between RM150,000 and RM500,000, providing essential breathing room for digital transformation.

Key Highlights of the e-Invoicing Extension:

Implementation deadline extended to 1st January 2026

In addition, six-month transition period will also be provided

Over 240,000 SMEs to benefit from the extension

Businesses earning below RM150,000 annually fully exempted

Free access to MyInvois portal and mobile app

RM 150,000 divided by 365 days equals approximately around RM 411 per day.

RM 500,000 divided by 365 days equals approximately around RM 1,370 per day.

***** 2 July 2024 News *****

KUALA LUMPUR: Micro, small and medium enterprises (MSMEs) that are earning less than RM 150,000 annually are not required to issue e-invoices, says Finance Minister II Datuk Seri Amir Hamzah Azizan (pic).

“For now, traders with annual sales below RM150,000 are not required to issue e-invoices.

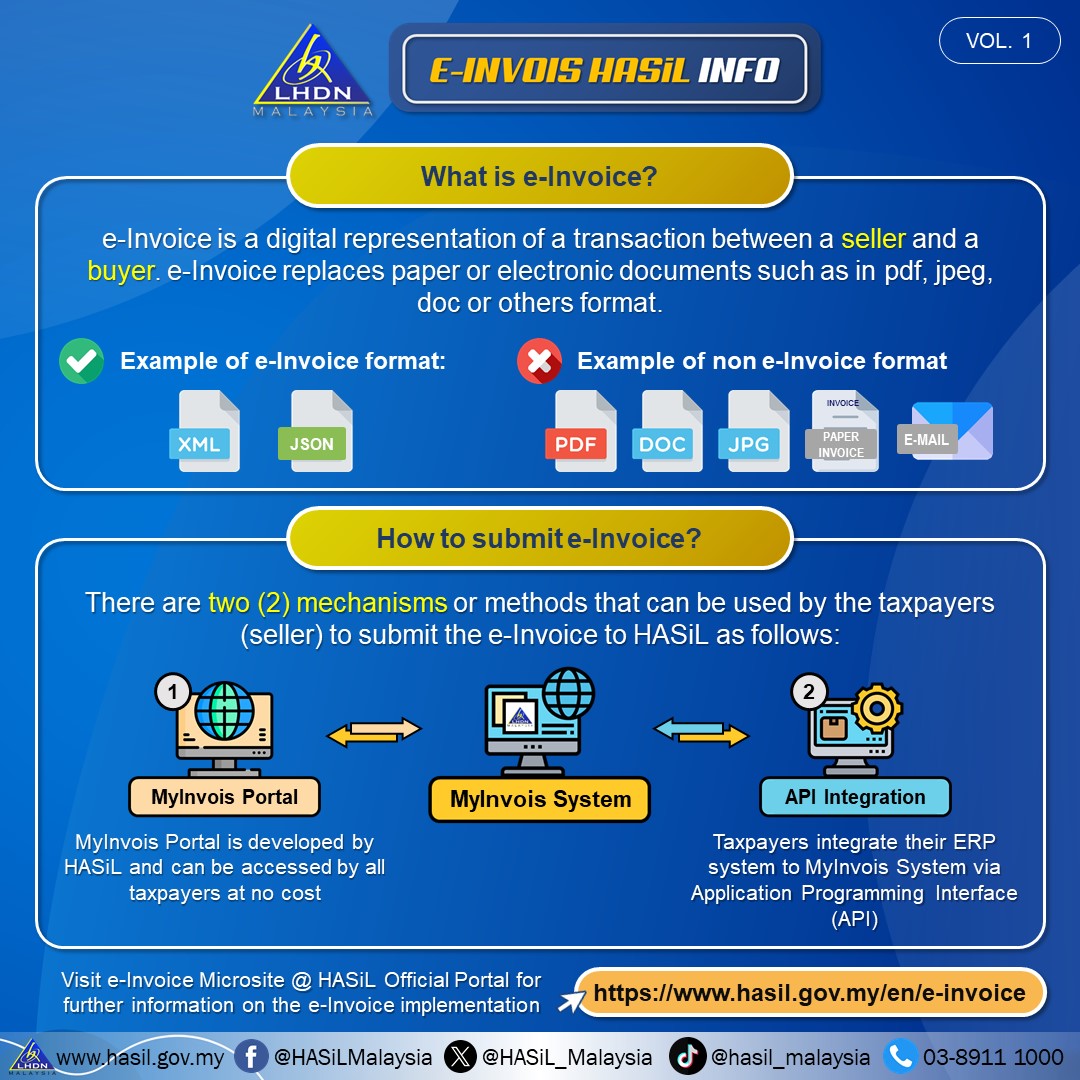

The e-Invoice, introduced by the Inland Revenue Board of Malaysia (IRB) or LHDN Malaysia, encourages businesses in the nation to adopt digitalization and transact efficiently and accurately.

The Malaysian government has announced that on April 1, 2015, it will implement a Goods and Services Tax (GST) of 6 percent.

What is Sales and Service Tax?

SST, or Sales and Service Tax, is the major consumption tax that is charged on the sale of goods and services.

Since SST is a consumption tax in Malaysia, tax burden is ultimately borne by consumers. This means that businesses are responsible for collecting the tax from consumers as part of the purchase price and remitting it to the government.

SST comprises two separate taxes: Sales Tax and Service Tax. Sales Tax is applicable to taxable goods either manufactured in or imported into Malaysia, while Service Tax is levied on specific services provided by businesses in Malaysia.

SST is applied at a single stage, either during the manufacturing process or at the point of consumption of goods and services.

14th Malaysia General elections were held in Malaysia on Wednesday, 9 May 2018.

The Ministry of Finance ("MOF") has announced that the Goods and Services Tax ("GST") standard rate will be changed from six percent (6%) to zero percent (0%) *****effective 1st June 2018.*********

Just 22 days after 14th General Election...........

Sales and Services Tax in Malaysia was officially reintroduced on

****1 September 2018*****, replacing the former Goods and Services Tax (GST) system.

The Goods and Services Tax Act 2014 was repealed with effect from 1 September 2018. Notwithstanding, any liability arising under the GST Act will remain.

------------------------------------------

------------------------------------

So Genting Highlands Malaysian Food Street and Medan Selera ,skyway should start this e-invoice at 1 August 2024?

TNB and RANHILL SAJ SDN. BHD.

Should start also ????

| How is e-Invoice different from traditional invoice? |

| The main purpose of e-invoice is for buyers to claim tax relief. Buyers must request e-invoice from sellers if the transaction is eligible for tax relief. Hence, the details required on e-invoice are more detailed than a normal invoice, which include buyers’ TIN number, IC number and others. |

| If the expenses is not for tax relief (e.g. daily expenses), then the buyer is not required to request e-invoice |

Besides, another purpose of the initiative of implementing e-Invoice by the government is that it enables a better administration of taxes by the government and enhances tax compliance, as the proposal of utilizing Tax Identification Number (TIN) and e-Invoicing can also reduce fraud, shadow economy and revenue leakage in the nation.

It also serves as the approach to substitute GST

for the moment as a method of efficient administration, as shared by Datuk Seri Ahmad Maslan, Deputy Minister of Finance Malaysia.

With the taxpayers are urged to prepare early to ensure full compliance with the requirements and to get through the acclimation period smoothly and, at the same time, transact easily among suppliers and buyers.

| Prohibition on the Use of Consolidated E-Invoices in Seven Key Industries |

| June 19, 2024 |

| Recently, many companies have faced the challenge of the Inland Revenue Board (LHDN) mandating the implementation of the e-Invoice system. |

| When "e-Invoice" is mentioned, most business owners break into a cold sweat. Fear often arises from the unknown; because e-Invoices are a new concept, many do not know where to start, which causes anxiety. |

| **Is the e-Invoice system a good solution for standardizing all business transaction records?** |

| Yes! The e-Invoice system standardizes all business transaction records, effectively improving business efficiency, preventing financial confusion, making illegal businesses visible, preventing tax evasion, and enhancing tax compliance and transparency. However, this system is much more complex than you might imagine. |

| **Types of e-Invoices** |

| 1. **Invoice:** A commercial document detailing the transaction between the seller and the buyer. This includes self-billed e-Invoices by the buyer to record their expenses. |

| 2. **Credit Note:** Issued by the seller to correct errors, generally used to provide discounts or adjustments to a previous e-Invoice without refunding the buyer. |

| 3. **Debit Note:** Used to adjust a previous e-Invoice due to additional charges incurred. |

| 4. **Refund Note:** An e-Invoice issued by the seller to the buyer confirming a refund. |

| **Key Steps in Issuing an e-Invoice** |

| The article details six major steps in the process of issuing e-Invoices. |

| **What about retailers?** |

| Retail businesses operate in a B2C (Business to Consumer) model. Issuing an e-Invoice for every transaction would be cumbersome. This is where the Consolidated e-Invoice comes in handy. |

| **What is a Consolidated e-Invoice?** |

| A Consolidated e-Invoice is an e-Invoice issued by the seller that avoids the need for a separate e-Invoice for each transaction. If the buyer does not request an e-Invoice, the seller can issue a regular invoice and consolidate these into one e-Invoice at the end of the month, submitting it to the LHDN within seven days after the month's end. |

| **Example:** |

| - **01.01.2025 – 31.1.2025:** End of January business/sales. |

| - **1.2.2025 – 7.2.2025:** Consolidate and issue a consolidated e-Invoice based on the previous month’s sales invoices and submit it to the LHDN within seven days. |

| **Seven Industries Prohibited from Using Consolidated e-Invoices** |

| The tax authorities have specified that the following industries must issue an e-Invoice for each transaction: |

| 1. Automotive industry |

| 2. Aviation industry |

| 3. Luxury goods and jewelry (taxpayers may issue consolidated e-Invoices until further notice from the LHDN if the buyer does not request an e-Invoice) |

| 4. Construction industry |

| 5. Wholesalers and retailers of construction materials |

| 6. Licensed betting and gaming |

| 7. Payments to agents, dealers, and distributors |

| **e-Invoice Two-Day Intensive Workshop ** |

| Feeling uneasy about the e-Invoice policy or have many questions about e-Invoices? Don’t worry, you're not alone! |

| Many entrepreneurs are confused and anxious about the e-Invoice policy and unsure how to start converting their transactions to the e-Invoice system. |

| **By participating in the e-Invoice Two-Day Intensive Workshop, you will learn:** |

| - Key points of e-Invoices |

| - Overview of e-Invoice workflow |

| - Proof of income |

| - Proof of expenditure |

| - Transition period for e-Invoice implementation |

| - Required data fields for e-Invoices and SDK code |

| - Who can be exempted from implementing e-Invoices |

| - Internal group transactions |

| - API introductory guide |

| - Laws and regulations regarding e-Invoices |

I need to enter items like motor, gear oil, engine oil, oil filter, spark plug, water tank, brake pad, air filter, engine overhaul, tuning, lights, windshield wiper, and battery (with many models) ......... into the e-invoice billing system.

Car workshop.

Otherwise customer will get blank receipt.

The software can?

https://mdec.my/national-einvoicing

Malaysia’s Peppol Solution and Service Providers:

List of Peppol-Ready Solution Providers (Published on 12/07/2024)

List of Service Providers (Published on 12/07/2024)

| # | Company Name | URL | Status |

| 1 | Advintek Consulting Services Sdn. Bhd | [Advintek](https://einvoice.advintek.com.my/) | |

| 2 | Avalara Europe Limited | [Avalara](https://www.avalara.com/) | |

| 3 | B2BROUTER GLOBAL SL | [B2BROUTER](https://www.b2brouter.net) | Accredited |

| 4 | Basware Corporation | [Basware](https://www.basware.com/en/) | Accredited |

| 5 | Beacon Systems Sdn Bhd | [Beacon Systems](https://beaconx.com.my/) | Accredited |

| 6 | B-Global Sdn. Bhd | [B-Global](https://b-globaltechnology.net/) | Accredited |

| 7 | Bigledger Sdn Bhd | [Bigledger](https://bigledger.com/) | Accredited |

| 8 | Billit BV | [Billit](https://www.billit.eu/en-int/) | Accredited |

| 9 | Century Software (M) Sdn Bhd | [Century Software](https://centurysoftware.com.my) | Accredited |

| 10 | Cleartax (Defmacro Software) | [Cleartax](https://cleartax.com/my/en) | Accredited |

| 11 | Comarch S.A. | [Comarch](https://www.comarch.com) | Accredited |

| 12 | Complyance, Inc. |

5195

CENSOF HOLDINGS BERHAD

Pagero AB

Many also....

Undergoing Accreditation for Peppol Access Point/ Service Providers (SP)

Accenture Sdn Bhd

Level 30 ,

Menara Exchange ,

106 Lingkaran TRX,

Tun Razak Exchange ,

KUALA LUMPUR 55188 ,

Malaysia

---------------------------------------------------

| No. | Company Name | Address | Phone Number |

| 1 | Ernst & Young Tax Consultants Sdn Bhd | B-15, Medini 9, Persiaran Medini Sentral 1, Bandar Medini Iskandar, Johor Darul Ta’zim, Iskandar Puteri 79250 | N/A |

| 2 | KPMG Tax Services Sdn. Bhd. | Level 3, CIMB Leadership Academy, 3, Jalan Medini Utara 1, Medini Iskandar, 79200 Iskandar Puteri, Johor | +60(7) 266 2213 |

| 3 | PWC ************* | Menara Ansar, Level 16, Jalan Trus, 80000 Johor Bahru, Johor | +60 (7) 218 6000 |

| 4 | Deloitte ************ | Suite 27-01, Level 27, Menara JLAND, Johor Bahru City Centre, Jalan Tun Abdul Razak, Johor Bahru 80000 | +607 268 0888 |

| Rank | Top 10 Accounting Firm | Revenue (USD billion) |

| 1 | Deloitte | 64.9 |

| 2 | PwC | 53 |

| 3 | EY | 49.4 |

| 4 | KPMG | 36.4 |

| 5 | BDO | 14 |

| 6 | RSM | 8 |

| 7 | Grant Thornton | 6.6 |

| 8 | Nexia International | 5 |

| 9 | Crowe Horwath | 4.3 |

| 10 | Baker Tilly | 4.3 |

| No. | Company Name | Address | Phone Number |

| 1 | RSM *********** | Suite 16-02, Level 16, Menara Landmark, No. 12, Jalan Ngee Heng, 80000 Johor Bahru, Johor, Malaysia | +6 (07) 276 2828 |

| 2 | BDO Technology Solutions Sdn Bhd (same building as Grant Thornton ) | Suite 18-04, Level 18, Menara Zurich, 15, Jalan Dato' Abdullah Tahir, Johor Bahru 80300, Malaysia | +607 331 9815 |

| 3 | Grant Thornton Malaysia PLT (201906003682 & AF 0737) | Suite 28.01, 28th Floor, Menara Zurich, No.15, Jalan Dato’ Abdullah Tahir, 80300 Johor Bahru, Johor | +607 332 8335 |

| 4 | CROWE HORWATH JB TAX SDN. BHD. | Pusat Komersial Bayu Tasek, Unit E-2-3, Persiaran Southkey 1, Kota Southkey, Johor Bahru, 80150, Johor | +607 288 6627 |

| 5 | BAKER TILLY MONTEIRO HENG TAX SERVICES SDN. BHD. | 38-02, Jalan Sri Pelangi 4, Taman Pelangi, 80400 Johor Bahru, Johor | +60 7 - 332 6925 / 7332 6926 / 7289 2925 |

**Note:** There are no Nexia accounting firms in Johor.

Surprisingly, Accenture , BDO and Ernst & Young Tax Consultants Sdn Bhd are still undergoing accreditation.

Nasi Lemak

Pisang Goreng

Ramly Burger Stall

Cendol

Ayam Goreng

Mee Goreng Pasar Malam

Laksa

Mee Rebus

Mee Soto

ROJAK

KARIPAP

Air Tebu

Air kelapa

Popiah

Tau Fu Fa

Cincao

Air Sirap Bandung

| Aspect | Details |

| **Annual Sales Threshold** | RM 150,000 |

| **Monthly Sales Threshold** | RM 12,500 (RM 150,000 divided by 12 months) |

| **E-Invoicing Requirement** | Required if annual sales exceed RM 150,000. |

This post has been edited by plouffle0789: Dec 17 2025, 10:54 AM

Jun 20 2024, 09:36 PM, updated 6d ago

Jun 20 2024, 09:36 PM, updated 6d ago

Quote

Quote

0.0349sec

0.0349sec

0.63

0.63

6 queries

6 queries

GZIP Disabled

GZIP Disabled