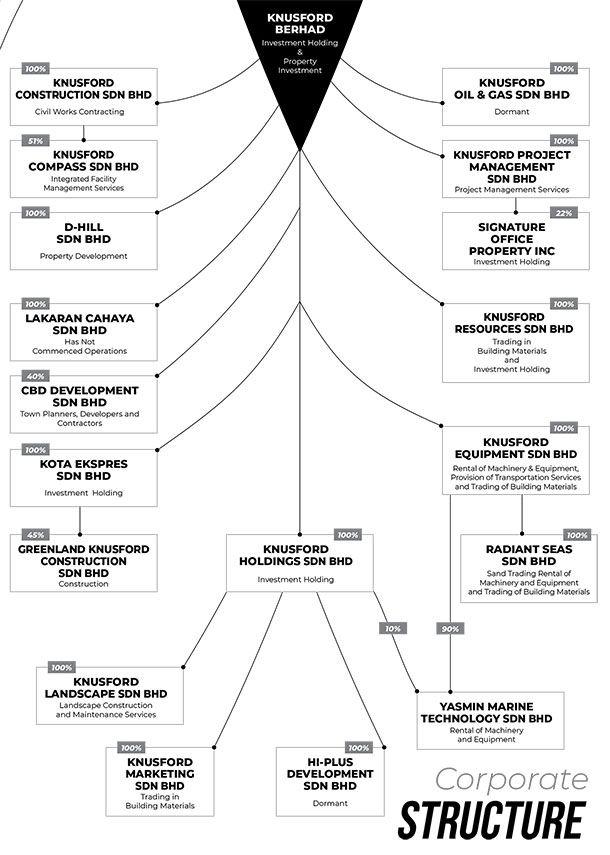

Trading and services include reconditioning, sales and rental of light and heavy machinery, trading and building materials, provision of transportation services and project management services. Property development includes the development of residential and commercial properties.

Investment property consists of leasing of property. Construction includes civil works contracting and landscape construction/maintenance. The revenues of the group are derived from its operations in Malaysia.

# Notice Of Person Ceasing (29C) - DYMM Sultan Ibrahim Ibni Almarhum Sultan Iskandar

**BackOct 19, 2015**

## Particulars of Substantial Securities Holder

| **No.** | **Field** | **Details** |

| --- | --- | --- |

| 1 | **Name** | DYMM SULTAN IBRAHIM IBNI ALMARHUM SULTAN ISKANDAR |

| 2 | **Address** | Istana Pasir Pelangi, Pasir Pelangi, Johor Bahru, 80500 Johor, Malaysia. |

| 3 | **NRIC/Passport No/Company No.** | - |

| 4 | **Nationality/Country of incorporation** | Malaysia |

| 5 | **Descriptions (Class & nominal value)** | Ordinary Shares of RM1.00 each |

| 6 | **Date of cessation** | 13 Oct 2015 |

| 7 | **Name & address of registered holder** | Aman Setegap Sdn Bhd, Ground Floor, Wisma Ekovest, No. 118, Jalan Gombak, 53000 Kuala Lumpur |

| 8 | **Currency** | Malaysian Ringgit (MYR) |

| 9 | **No of securities disposed** | 30,000,000 |

| 10 | **Price Transacted ($$)** | |

| 11 | **Circumstances by reason of which Securities Holder has interest** | Private Arrangement |

| 12 | **Nature of interest** | Indirect |

| 13 | **Date of notice** | 19 Oct 2015 |

### Remarks:

Disposal of shares in Aman Setegap Sdn Bhd, which in turn holds 30,000,000 ordinary shares in Knusford Berhad.

### Announcement Info:

| **No.** | **Field** | **Details** |

| --- | --- | --- |

| 14 | **Company Name** | KNUSFORD BERHAD |

| 15 | **Stock Name** | KNUSFOR |

| 16 | **Date Announced** | 19 Oct 2015 |

| 17 | **Category** | Notice of Person Ceasing Substantial Shareholders Pursuant to Form 29C |

| 18 | **Reference Number** | CS3-15102015-00001 |

QUOTE

Reference is made to the Company’s announcement dated 27 October 2023 in relation to the execution of a binding heads of merger agreement in relation to the proposed merger of the construction and construction-related businesses of EKOVEST BHD (8877) and Knusford via

the proposed acquisition by Knusford of the entire equity interest in Ekovest Construction Sdn Bhd from Ekovest (“Proposed Knusford-ECSB Merger”) (“Announcement”).

Unless otherwise stated, all terms used herein shall have the same meaning as defined in the Announcement.

The Company wishes to announce that the Parties have mutually agreed for an extension of 2 months commencing from 28 May 2024 to 27 July 2024, to grant more time for the Parties to assess, evaluate and deliberate the Proposed Knusford-ECSB Merger in detail and to discuss and negotiate on the terms of the Definitive Agreement between the Parties.

This announcement is dated 27 May 2024.

the proposed acquisition by Knusford of the entire equity interest in Ekovest Construction Sdn Bhd from Ekovest (“Proposed Knusford-ECSB Merger”) (“Announcement”).

Unless otherwise stated, all terms used herein shall have the same meaning as defined in the Announcement.

The Company wishes to announce that the Parties have mutually agreed for an extension of 2 months commencing from 28 May 2024 to 27 July 2024, to grant more time for the Parties to assess, evaluate and deliberate the Proposed Knusford-ECSB Merger in detail and to discuss and negotiate on the terms of the Definitive Agreement between the Parties.

This announcement is dated 27 May 2024.

Company Name EKOVEST CONSTRUCTION SDN. BHD.

Company Registration No. 0251734T / 199201020230

Nature of Business CIVIL ENGINEERING AND BUILDING WORKS

Date of Registration 1992-10-29

State WILAYAH PERSEKUTUAN

DYAM Tunku Ismail Ibni Sultan Ibrahim, a 39-year-old Malaysian male, was appointed as Chairman and Non-Independent Non-Executive Director of Knusford Berhad on 21 August 2013. DYAM Tunku Ismail completed his studies at Hale School in Australia. After completing his studies, he was enrolled in the Indian Military Academy. He was appointed as Tunku Mahkota Johor in 2010.

# Company Information - D-HILL SDN. BHD. (MALAYSIA)

| **No.** | **Field** | **Details** |

| --- | --- | --- |

| 1 | **Company Name** | D-HILL SDN. BHD. |

| 2 | **Company Registration No.** | 0353024U / 199501023820 |

| 3 | **Nature of Business** | PROPERTY DEVELOPMENT |

| 4 | **Date of Registration** | 1995-07-27 |

| 5 | **State** | WILAYAH PERSEKUTUAN |

https://theedgemalaysia.com/article/tunku-i...usford-chairman

This post has been edited by plouffle0789: Jun 16 2024, 09:37 PM

Jun 16 2024, 09:33 PM, updated 5 months ago

Jun 16 2024, 09:33 PM, updated 5 months ago

Quote

Quote

0.0170sec

0.0170sec

0.22

0.22

5 queries

5 queries

GZIP Disabled

GZIP Disabled