QUOTE(zhou.xingxing @ Apr 15 2024, 11:09 AM)

i think also need to consider whether the 53k savings include after owning house? or its wholly just savings and the person doesnt owns a house and have yet to paid any house instalment/deposits..

Lets say its savings la

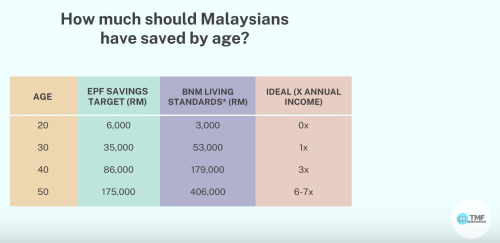

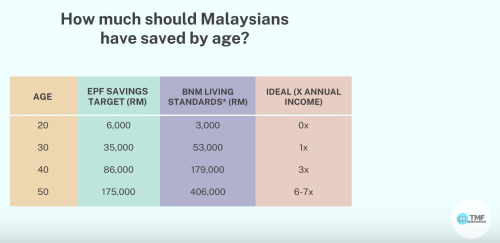

53k in 10 years (realistically, 8 cause you probably only get your first job around 22yo). Means you need to save ~6k a year for 8 years. Doesn't seem a lot, but if you're earning 4k, your nett is around 3.5k, and RM500 is close to 20% of your salary. With price of everything today, unless you stay home with parents and mummy still cook for you, unlikely can save that amount.

Also in the same row, it says EPF saving by 30 should be 35k. Using 8 years as benchmark, that's only 4k/year of EPF contribution. If your salary is 4k, per month about ~RM900 already goes into epf. One year already 11k. Can hit your EPF target in 3 years.

Quite impossible for salary to be so low that you only have 35k in your EPF by age 30. Even if your salary is only 2k, your EPF would be at 46k, not counting dividends and compound interest

Apr 15 2024, 11:07 AM

Apr 15 2024, 11:07 AM

Quote

Quote 0.0203sec

0.0203sec

0.29

0.29

6 queries

6 queries

GZIP Disabled

GZIP Disabled