1. Corporate Tax reduced from 25% to 24% for that year.

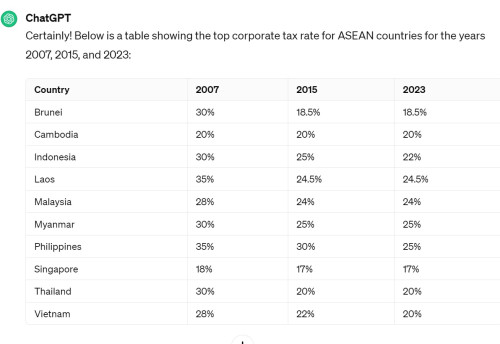

Since then corporate tax has never been reduced anymore causing us to fall behind the rest of ASEAN which reduced their taxes in subsequent years to attract investments.

2. Personal income tax highest band reduced from 26% to 25%.

Since then, the top band has been increased after GE14 to 30%

3. Households with RM4,000 per month income and below are no longer required to pay any income tax.

4. BR1M was increased almost 50% from RM650 to RM950.

In year 2024 when we now have CUKAI SST 10% + 8%, CUKAI LVGT 10%, CUKAI CGT 10%, CUKAI DST 8%, CUKAI HVGT 10% and increase in water, electricity, Indah Water bills as well as airport tax increase...

WHAT DO THE PEOPLE GET IN RETURN?

Mar 17 2024, 09:15 AM, updated 2y ago

Mar 17 2024, 09:15 AM, updated 2y ago

Quote

Quote

0.0153sec

0.0153sec

0.71

0.71

6 queries

6 queries

GZIP Disabled

GZIP Disabled