QUOTE(cnks @ Mar 14 2024, 01:08 PM)

I don't think the 4 withdrawals have any major impact in ability to retire. If the withdrawals of (I forgot how much cumulatively, say RM40k?) makes you not able to retire, you are not able to retire anyway with or without the withdrawals.

Government should look at other factors, instead of just conveniently blaming the withdrawals, like salary is not keeping up with the living costs, brain drain, lagging in many opportunities, etc.

This. All the figures are talking about the figure depositors have NOW, meaning it's 40k post-compounding interest (for the ones soon to retire anyway).Government should look at other factors, instead of just conveniently blaming the withdrawals, like salary is not keeping up with the living costs, brain drain, lagging in many opportunities, etc.

The younger ones who joined the 40k withdrawals for stupid reasons may be dumb, but atleast they still have time to build it all back up.

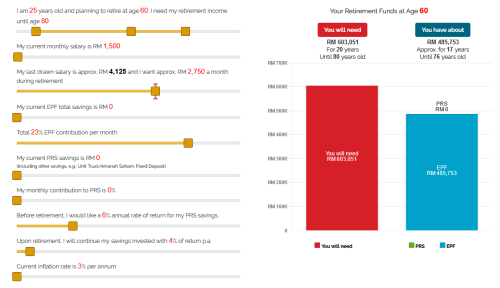

From the calculator:

https://www.ppa.my/retirement-calculator/

Assuming 25 years old, income starting at RM1.5k, increment matching inflation at 3%. Your EPF would be atleast 480k by the time you retire.

Not saying the withdrawals didn't do anything to worsen the situation, but it's just a small part of the equation.

Mar 14 2024, 01:38 PM

Mar 14 2024, 01:38 PM

Quote

Quote 0.0203sec

0.0203sec

0.30

0.30

6 queries

6 queries

GZIP Disabled

GZIP Disabled