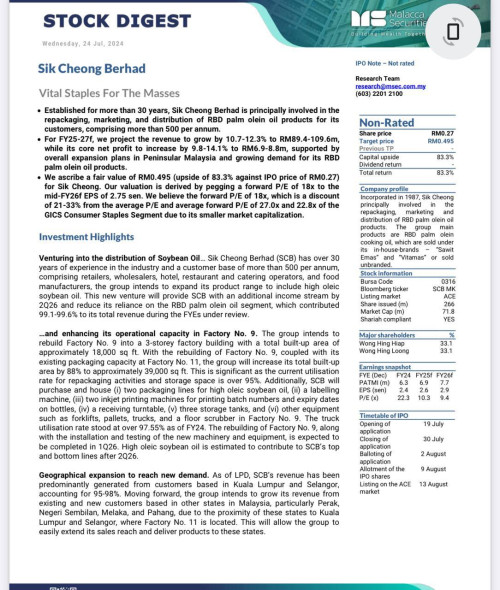

Sik Cheong Bhd is offering up to 66 million new shares in an initial public offering (IPO), as it seeks to list on the ACE Market of Bursa Malaysia.

The group said the 66 million new shares comprise a public offering of 13.3 million shares via balloting, four million shares for eligible directors and employees of the group, while the remaining 48.7 million shares are for private placement to selected investors.

Meanwhile, Sik Cheong is also planning an offer-for-sale of 20 million existing shares by way of private placement to selected investors.

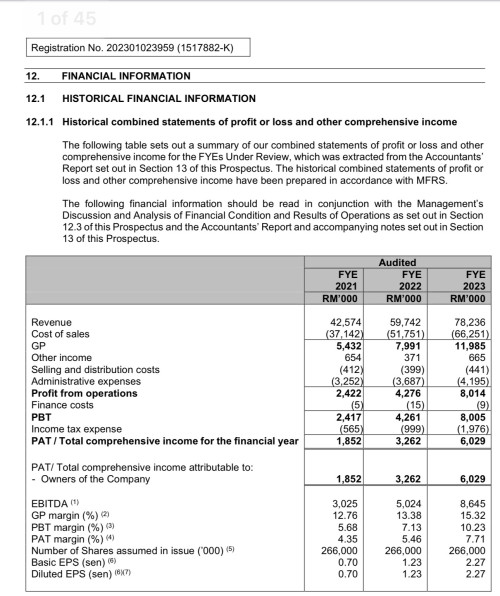

The group intends to utilise the IPO proceeds to finance its packaging facility expansion plan and as working capital.

Sik Cheong said it has more than 500 customers, mainly retailers, wholesalers, hotel, restaurant and catering operators, and food manufacturers, which enables it to continue securing new orders, while cross-selling other types of edible oil products such as high oleic soybean oil products, which it intends to distribute in the future.

Sik Cheong is principally involved in the repackaging, marketing and distribution of edible oil and other food products, and the distribution of lamp oil and other trading products.

TA Securities Holdings Bhd is the principal adviser, sponsor, underwriter and placement agent for the IPO.

https://theedgemalaysia.com/node/697154

This post has been edited by nexona88: Jul 30 2024, 04:36 PM

IPO: Sik Cheong Bhd, IPO - Ace Market

Jan 25 2024, 03:15 PM, updated 2y ago

Jan 25 2024, 03:15 PM, updated 2y ago

Quote

Quote

0.0283sec

0.0283sec

0.60

0.60

5 queries

5 queries

GZIP Disabled

GZIP Disabled