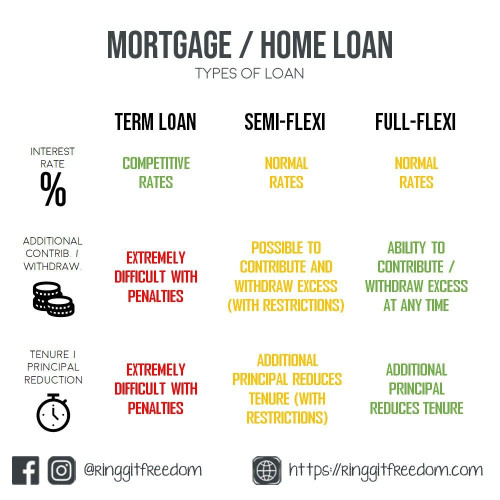

Hi all, wondering if anyone is having the public bank semi flexi account? I wanted to be putting in extra cash into the loan account every month so that it can reduce my principal amount, as well as when I wanted to withdraw I can do so.

My scenario as such:

Monthly installment: RM3000

Monthly additional payment: RM2000

So in this case, I will be topping up additional RM2000 each month for the sake of reducing the principal amount, how can I do so?

Also say 1 year later I am in need of money so I can withdraw the RM24000 extra that I already put in (12 x RM2000) as this is a semi flexi account.

I tried putting in some money but it shows transaction type 914, which is advanced payment, so in this case I'm not even sure if this will reduce the principal amount (so that I pay less interest every month)

Hope anyone with this experience can help!

Public Bank Semi Flexi Loan Account

Jan 21 2024, 03:57 PM, updated 2y ago

Jan 21 2024, 03:57 PM, updated 2y ago

Quote

Quote

0.0163sec

0.0163sec

0.88

0.88

5 queries

5 queries

GZIP Disabled

GZIP Disabled