HE Group Bhd aims to raise RM24.33mil in proceeds from its upcoming initial public offering (IPO) for business expansion purposes.

The electrical engineering service provider, slated for a listing on the ACE Market of Bursa Malaysia on Jan 30, 2024, said RM15.13mil or 62.19% of the gross proceeds will be used to supplement the working capital requirements in tandem with the expected growth in the group’s business.

Meanwhile, RM3.65mil or 15% of the gross proceeds is earmarked for business expansion, including the growth of the group’s workforce, strengthening of its internal capabilities, and the establishment of two new offices in Kedah and Johor.

The group is also allocating RM1.75mil, representing 7.19% of the gross proceeds, for capital expenditure while the remaining proceeds will cover listing-related expenses.

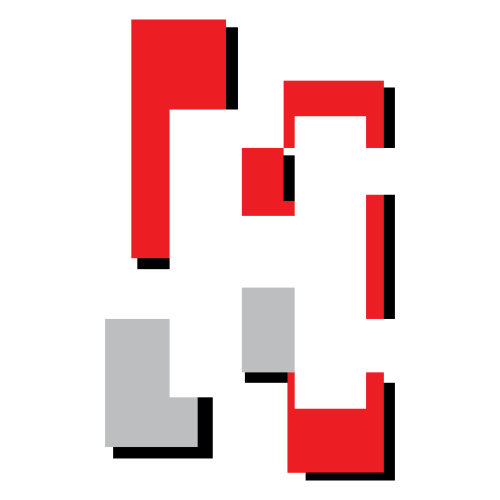

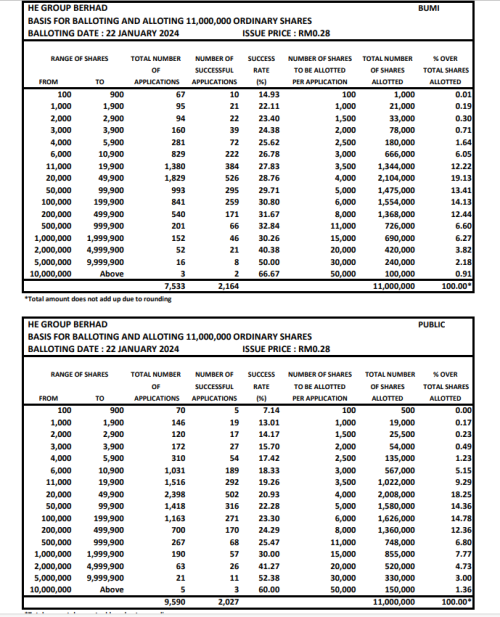

With an enlarged share capital of 440 million and an IPO price of 28 sen per share, the group will have a market capitalisation of RM123.2mil upon listing.

HE Group managing director Haw Chee Seng said the group's order book amounted to RM211.91mil as at Dec 15, 2023, which would keep the group busy until end-2024.

“Our track record in serving critical and high-value industries such as semiconductors, medical devices, and electronic product industries demonstrates our strengths and capabilities.

https://www.thestar.com.my/business/busines...mil-in-from-ipo

IPO: HE GROUP BERHAD, ACE listing on 30 Jan 2024

Jan 16 2024, 10:27 PM

Jan 16 2024, 10:27 PM

Quote

Quote

0.0466sec

0.0466sec

0.69

0.69

5 queries

5 queries

GZIP Disabled

GZIP Disabled