KUALA LUMPUR (Jan 5): ACE-Market bound building support services provider KJTS Group Bhd has set its initial public offering (IPO) price at 27 sen per share, aiming to raise about RM58.9 million under the listing exercise.

Based on the IPO price of 27 sen per share, KJTS is expected to have a market capitalisation of RM185.76 million upon listing, implying a valuation of 26 times its profit after tax (PAT) attributed to owners of the company of approximately RM6.87 million and earnings per share of one sen for the financial year ended Dec 31, 2022 (FYE2022).

At its prospectus launch on Friday, KJTS said the IPO will involve the issuance of 218.03 million new ordinary shares, representing 31.69% of the enlarged share capital.

Out of these, 168.63 million shares or 24.51% are allocated to institutional and selected investors, while the remaining 49.4 million shares or 7.18% are for retail offering.

The retail offering, meanwhile, consists of 34.4 million new shares or 5% for the Malaysian public via balloting, and 15 million new shares or 2.18% for the eligible directors, key senior management, employees and persons who have contributed to the success of KJTS and its subsidiaries.

KJTS and its subsidiaries are principally a provider of building support services focusing on providing cooling energy, cleaning and facilities management (FM) services.

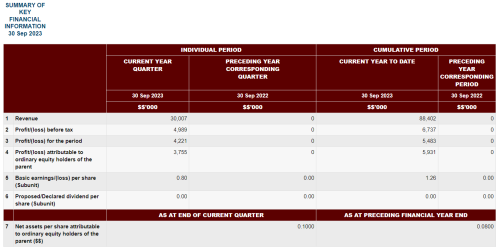

For FYE2022, KJTS registered RM7.16 million PAT, up 19.73% from RM5.98 million PAT recorded in FYE2021, as revenue rose 10.78% to RM94.44 million from RM85.25 million.

KJTS intends to distribute an annual dividend of 20% of its PAT attributable to its shareholders.

Applications for the IPO are open and will close at 5pm on Jan 11. Hong Leong Investment Bank Bhd is the principal adviser, sponsor, sole underwriter and sole bookrunner for the IPO exercise.

This post has been edited by ronnie: Jan 5 2024, 02:38 PM

Jan 5 2024, 02:29 PM, updated 2y ago

Jan 5 2024, 02:29 PM, updated 2y ago

Quote

Quote

0.0195sec

0.0195sec

0.56

0.56

6 queries

6 queries

GZIP Disabled

GZIP Disabled