QUOTE(yungkit14 @ May 10 2024, 08:22 AM)

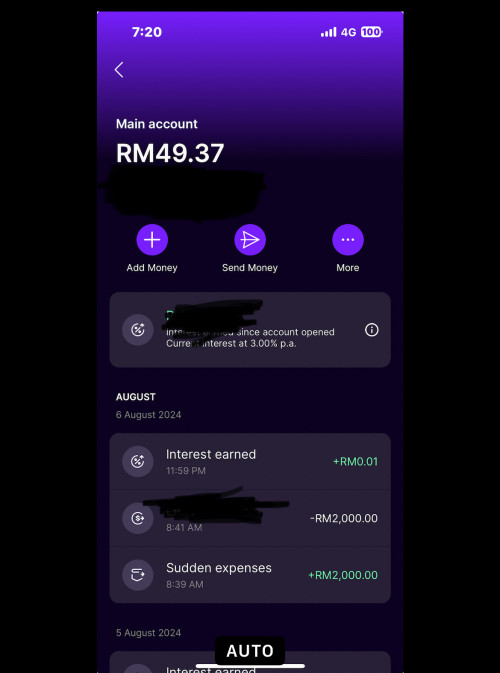

No, he means 61+122 = 183 per pocket, which is what I posted earlier. That gives you 4% p.a. effective interest for the first 183*11 = 2013 MYR that you have. QUOTE(TOS @ May 10 2024, 07:43 AM)

I am thinking of maximizing the total absolute value instead of just looking at the percentage.

So, if I want 0.02 instead of 0.01, I should be looking at 0.015 right (prior to round up)? Each pocket saving should now be (0.015*366)/0.03 = 183 MYR instead of 61 MYR.

Effective rate will be (0.02*366)/183 = 4% p.a., still higher than many other FD and also consider the liquidity... (no penalty for withdrawal)

If I push further, looking at 0.03, then it will be 0.025. Each pocket saving = (0.025*366)/0.03 = 305 MYR

Effective rate will now be (0.03*366)/305 = 3.6% p.a., comparable to many FD out there, but with added liquidity... (no penalty for withdrawal)

Judging from opportunity cost, the 4% "floating deposit" option looks enticing.

This post has been edited by TOS: May 10 2024, 08:35 AMSo, if I want 0.02 instead of 0.01, I should be looking at 0.015 right (prior to round up)? Each pocket saving should now be (0.015*366)/0.03 = 183 MYR instead of 61 MYR.

Effective rate will be (0.02*366)/183 = 4% p.a., still higher than many other FD and also consider the liquidity... (no penalty for withdrawal)

If I push further, looking at 0.03, then it will be 0.025. Each pocket saving = (0.025*366)/0.03 = 305 MYR

Effective rate will now be (0.03*366)/305 = 3.6% p.a., comparable to many FD out there, but with added liquidity... (no penalty for withdrawal)

Judging from opportunity cost, the 4% "floating deposit" option looks enticing.

May 10 2024, 08:35 AM

May 10 2024, 08:35 AM

Quote

Quote

0.0238sec

0.0238sec

0.30

0.30

7 queries

7 queries

GZIP Disabled

GZIP Disabled