for own stay, still ok,

for investment, new launches are 9 die 1 live.

its targeted at new gen who has limited saving, therefore leveraging their future 30 years for a 'home'.

I myself, bought a landed 3 years ago, costs 960

and to date, i am looking at the price, its still the same price.

and these past 3 years, i have spent more than 20k on changing roof, fixing leakage...

not to mention monthly houseloan (double the money of rent).

+ the initial down payment.

if rent:

- the initial down payment can be invested for other return (20%)

- monthly extra cash flow, 2~3k

- extra cash from fixing etc...

if purchase:

- only + point is, i get to furnish it however i like, and its for me and my family.

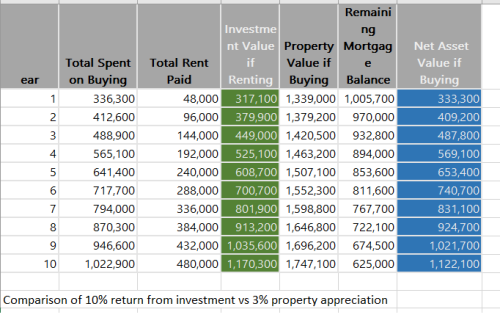

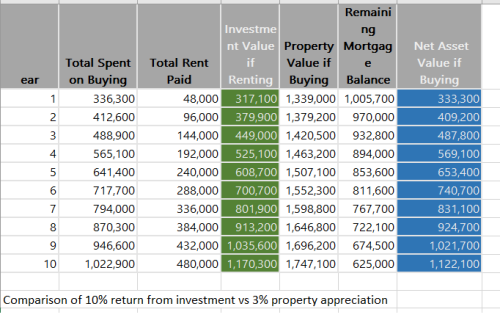

i have done a detailed calculation, if

from the cash flow i can generate about 8% annually = the property has to appreciate at least 3% annually to break even.

If the property do not appreciate, the winner is the bank who loan you the money.

however, it is not the case, its 4years already, and the price is stagnant, and its a very good location.

if its an investment it will be a lost for me, but since its own stay, so there is this unquantifiable factor.

the only jewel in property investment which gives better chance of return are those who fish at lelong... otherwise, you are on a negative edge game.

This post has been edited by DirectorLee: Mar 30 2024, 12:01 PM

This post has been edited by DirectorLee: Mar 30 2024, 12:01 PM

Sep 19 2023, 10:44 AM, updated 3y ago

Sep 19 2023, 10:44 AM, updated 3y ago

Quote

Quote

0.0895sec

0.0895sec

0.46

0.46

5 queries

5 queries

GZIP Disabled

GZIP Disabled