Minox International Group Bhd executive director Looi Poo Poo, Minox managing director (MD) Cheong Chee Son, M&A Securities Sdn Bhd MD Datuk Bill Tan, and M&A Securities head of corporate finance Gary Ting at the signing of the underwriting agreement on Wednesday, Aug 23, 2023, in conjunction with Minox's upcoming listing on the ACE Market of Bursa Malaysia in October 2023.

KUALA LUMPUR (Aug 23): ACE Market-bound Minox International Group Bhd (Minox) has inked an underwriting agreement with M&A Securities Sdn Bhd.

In a statement on Wednesday (Aug 23), Minox said the initial public offer (IPO) exercise entails a public issuance of 90.0 million new ordinary shares, representing 25.0% of their enlarged share capital of 360.0 million shares, as well as an offer for sale of 18.0 million existing shares, or 5.0% of the enlarged share capital, through private placement to selected investors.

Of the 90.0 million new shares to be issued, 18.0 million new shares, representing 5.0% of the enlarged share capital, will be made available to the Malaysian public through balloting; 10.8 million new shares representing 3.0% of the enlarged share capital for eligible directors, employees and persons who have contributed to the success of Minox; 16.2 million shares representing 4.5% of the enlarged share capital to selected investors through private placement; while the balance 45.0 million shares or 12.5% of the enlarged share capital to Bumiputera investors approved by the Ministry of Investment, Trade and Industry (“Miti”) through private placement.

M&A Securities will underwrite 28.8 million new shares made available to the Malaysian public and Pink Form Allocations.

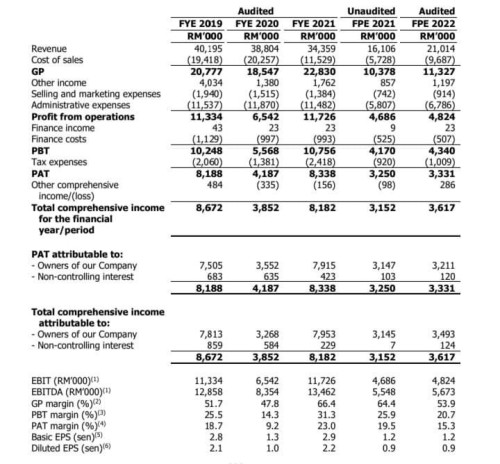

Minox is principally involved in the distribution of stainless steel sanitary valves, tubes & fittings, installation components & equipment, rubber hoses under its “MINOX” brand and other related products.

It has 25 years of track record in supplying various stainless steel sanitary products to customers in the food and beverage (“F&B”), pharmaceutical, as well as semiconductor industries.

Beyond the domestic market, the group has built a strong presence in Asean, deriving two-thirds of revenue from this region, with Indonesia, Singapore and Thailand being its key export markets.

Minox managing director Cheong Chee Son said with imminent access to the broader equity capital market, the company will have greater resources and flexibility to accelerate its expansion plans to increase market share, and capitalise on the opportunities in the growing sanitary valves and fittings industry.

He said Minox products are used throughout the hygienic and high purity production lines of its customers in the F&B, pharmaceutical and semiconductor industries.

“We currently serve approximately 1,700 active customers from well-known brand names of dairy products, juices & beverages, and mineral water, to bio-pharma and healthcare products.

“In addition, Minox also distributes its products to project consultants which are multinational system providers for F&B, pharmaceutical and semiconductor industries.

“Moving forward, we have charted a clear growth path. Our IPO proceeds are primarily earmarked towards expanding our business — product development and deployment to further tap into semiconductor clientele via our specialised products, construction of a new warehouse in Puchong to support higher business volume, and setting up of a new warehouse in Singapore to enhance export sales.

“Other utilisation of proceeds include paring down of borrowings, working capital use and defrayment of listing expenses,” he said.

Minox is scheduled to be listed on the ACE Market by October 2023, with M&A Securities as the principal adviser, sponsor, underwriter and placement agent for the IPO exercise.

This post has been edited by Halibut: Sep 18 2023, 10:39 AM

Attached File(s)

Registrable_Prospectus_for_exposure_draft.pdf ( 12.67mb )

Number of downloads: 84

Registrable_Prospectus_for_exposure_draft.pdf ( 12.67mb )

Number of downloads: 84

Sep 18 2023, 10:35 AM, updated 3y ago

Sep 18 2023, 10:35 AM, updated 3y ago

Quote

Quote

0.0280sec

0.0280sec

0.73

0.73

6 queries

6 queries

GZIP Disabled

GZIP Disabled