2000 time,

JOHOR LAND BHD

KLSE (MYR): JLAND (6564) want to but this mall

And end up cancel deal

SKS Group (aka MB World / fka Mahabuilders)

2009 johor land berhad delisted from bursa malaysia bhd.

https://m.malaysiastock.biz/Company-Announc....aspx?id=358610

Lot 04-53, 4th Floor,

Skudai Parade Shopping Complex,

Batu 10, Jalan Skudai,

81300 Skudai,

Johor

https://www.facebook.com/skudai.parade.shop...mibextid=ZbWKwL

There are a big fish pond at level G

2022 May still active on facebook...

The Rise of Large Shopping Malls and the Challenges Faced by Traditional Malls

In the face of intense competition in a saturated market, traditional malls are struggling to survive as large shopping malls continue to rise. One such case is the Skudai Parade Shopping Complex , located in Skudai.

Established in 1999, the plaza faced financial difficulties and was taken over by RHB Bank in 2011, just after 12 years after it opened.

After undergoing several unsuccessful auctions, it is now headed for its fourth auction.

Ye Qingxiang (34 years old), a real estate broker responsible for the auction of Skudai Parade Shopping Complex , revealed that the previous auction prices were relatively close to market prices.

However, the challenge lies in the fact that buyers need to purchase all management units within the plaza, which has deterred potential buyers.

For the upcoming auction on May 15th, the starting price will be 42.28 million Malaysian Ringgit.

This includes 231 shop units and 25 apartment units within the plaza.

Competition with Modern Shopping Malls

The emergence of modern, large shopping malls in recent years has shifted consumer preferences towards more contemporary options, which is one of the reasons behind Skudai Parade Shopping Complex 's auction.

The design and branding of these large malls have successfully attracted consumers' attention, compelling older malls like Skudai Parade Shopping Complex to adapt and compete.

Liu Daosen, the chairman of the Johor branch of the Malaysian Institute of Estate Agents, explained that the previous auctions failed because the plaza is not being sold as land, but as a fully constructed building with existing tenants.

This creates complexities in the transition of ownership and management, making it difficult to attract buyers.

Misconceptions and Hopes for Revival

Despite the auctions and challenges, 20% of the businesses within Skudai Parade Shopping Complex are still operational. Some local residents mistakenly believe that the plaza has shut down, prompting existing tenants to promote the plaza on social media to attract customers.

Existing business owners are willing to cooperate with new management to improve the plaza's prospects.

Fu Cai Cheng (52 years old), a tenant operating a clothing store, expressed his satisfaction with the plaza's rent and business policies. He hopes that the plaza can regain its past glory and success. Another business owner, Chen Jiajun (44 years old), who runs a mobile phone store, emphasized that even though some people believe the plaza has closed, 20% of businesses are still operational and he is determined to help the plaza continue operating.

Challenges for Apartment Owners

The fate of the two apartment buildings located above Skudai Parade Shopping Complex is also uncertain due to the impending auction. Apartment owners are concerned about the issue of unpaid electricity bills by the management, which could lead to power cuts. They hope that a change in management would lead to improvements in the situation.

Wang Jinyi (62 years old), an apartment unit owner, expressed concerns about potential power cuts and the impact it would have on the elderly residents. The lack of individual ownership also complicates matters, as the units are tied to the overall management of the plaza.

Formation of a United Management Committee

To secure their interests, plaza unit owners are banding together to form the Skudai Parade Shopping Complex United Management Committee. This committee aims to take over the management of the plaza and address the concerns of the unit owners.

Yang Yuheng (58 years old), a unit owner running a watch store, highlighted the need for the committee due to concerns about power cuts and the management's outstanding electricity bills. Unit owners are seeking assistance from local authorities to ensure the smooth operation of their businesses and living arrangements.

In Conclusion

The story of Skudai Parade Shopping Complex illustrates the challenges traditional malls face in the era of modern, large shopping malls. As competition intensifies, established malls must adapt to changing consumer preferences and economic realities to remain relevant and competitive.

About Skudai Parade

Shopping Complex

Incorporation Date: September 15, 1995

Located along the busy Jalan Skudai and just about 1km from the Skudai Interchange, Skudai Parade is a multi-million ringgit retail centre and has been an evergreen attraction for the last 10 years. It is managed by Sineo Management Sdn. Bhd.

The retail complex has the benefit of a high traffic exposure ( 150,000 vehicles passing by daily ) from the main road and is opposite the JB Central Municipal Council ( MBJBT ), the Skudai Police Station and the busy township of Taman Ungku Tun Aminah & taman Sri Putri.

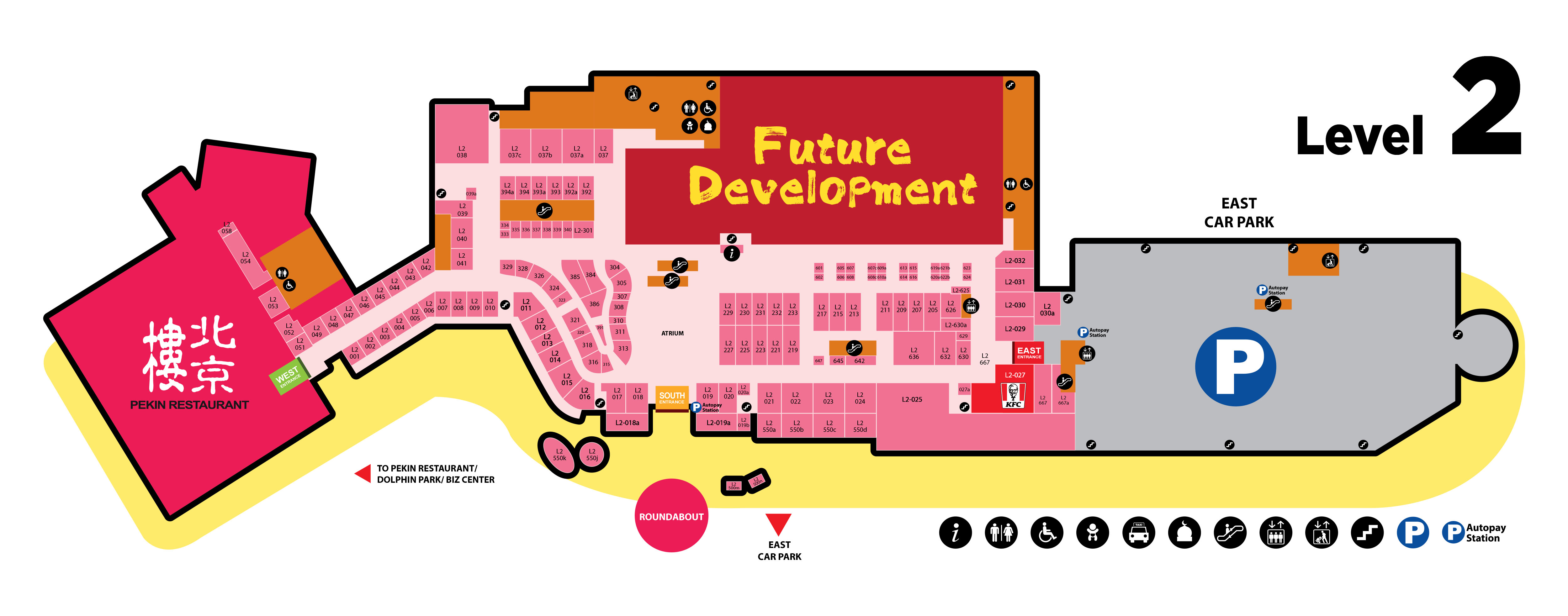

Spreading over 9 acres of prime land with more than 300 retail shops on a multi-level shopping podium, two residential apartment blocks and parking bays of more than 1,400 cars.

Syarikat menandatangani Perjanjian Belian pada 2 Disember 1997 dengan Sineo Enterprise Sdn. Bhd. dan Bagan Ratna Sdn. Bhd. untuk membeli bahagian yang belum dijual dalam projek pembangunan campuran bersepadu. Projek ini merangkumi:

Kompleks membeli-belah 6 tingkat

Tempat letak kereta 4 tingkat

Dua blok pangsapuri 13 tingkat

Sebuah blok hotel 20 tingkat

Harga belian bagi blok hotel 20 tingkat ialah RM280,000,000.

Pembayaran akan dilakukan seperti berikut:

RM28,000,000 melalui bayaran tunai

Baki RM252,000,000 melalui terbitan 210,000,000 syer biasa baru yang bernilai RM1.00 setiap satu. Syer ini akan dikreditkan sebagai bayaran penuh pada harga terbitan RM1.20 se-syer.

Cadangan ini telah dibatalkan pada 25 Jun, 1999 dan cadangan skim penyelesaian sedang dibincangkan dengan penjual-penjual.

http://cdn1.i3investor.com/my/files/dfgs88...-1736761126.pdf

Twenty Largest Shareholders

No. of

Name Shares %

1. Perbadanan Johor 169,729,000 21.71

2. Employees Provident Fund Board 31,556,000 4.04

3. Kulim (Malaysia) Berhad 10,000,000 1.28

4. Bank Simpanan Nasional Malaysia – 2 a/cs 9,663,000 1.22

5. Johor Ventures Sdn Bhd 7,143,000 0.91

6. Sindora Berhad 5,500,000 0.70

7. Cartaban Noms (A) Sdn Bhd – A/C SSBT Fund ZV3M

For IFC Emerging Markets Fund – Malaysia 2,642,100 0.34

8. UOBM Noms (A) Sdn Bhd – A/C United Overseas Bank Noms

(Pte) Ltd for Hung Yook Thong 2,600,000 0.33

9. Lim Khueng Ngi 2,059,000 0.26

10. Tan Sei Han 1,981,000 0.25

11. Sim Yaw Hang 1,861,000 0.24

12. UOBM Noms (A) Sdn Bhd – A/C United Overseas Bank Noms

(Pte) Ltd for

House of Hung Pte 1,376,000 0.18

13. Lim Seng Chee 1,337,000 0.17

14. Amanah Raya Noms (T) Sdn Bhd – A/C Amanah Saham Selangor 1,128,000 0.14

15. Hock Hua Finance Noms (T) Sdn Bhd – A/C Wong Lai Cheng 1,094,000 0.14

16. Johor Capital Holdings Sdn Bhd 1,000,000 0.13

17. Manohran a/l Vellappan 1,000,000 0.13

18. Chia Hooi Liang 1,000,000 0.13

19. Tan Han Seng – 2 a/cs 1,000,000 0.13

20. Tay Teck Ho 910,000 0.12

The condo also vacant edi?

This post has been edited by plouffle0789: May 23 2024, 12:45 PM

Aug 12 2023, 11:38 PM, updated 2y ago

Aug 12 2023, 11:38 PM, updated 2y ago

Quote

Quote

0.0176sec

0.0176sec

0.65

0.65

6 queries

6 queries

GZIP Disabled

GZIP Disabled