firstly, please bear with me as I'm new to property investments. thank you in advance also for your selfless sharing and teachings. looking forward to learn from the sifus here : )

I would like to know if there are any existing EXSIM KLCC Projects owners here.

since they are straight cut investment projects, would like to ask how much can such projects generate monthly, enough to cover instalments + maintenance + sinking fund? and can generate passive income? expressionz, ceylonz, scarletz.

are they well maintained? building quality of their products?

considering upcoming hugoz hence asking for info

also, feel free to share also your views on such projects

here are few of my thoughts and opinions, as far as I know,

1. Hugoz is last few piece development (maybe max another 2 projects?) in the stretch of Jalan Yap Kwan Seng road which supplies to KLCC (popular by demand on Airbnb)

2. Hugoz Airbnb is going to be managed by Mana-Mana operator and profit will be pooled and shared.

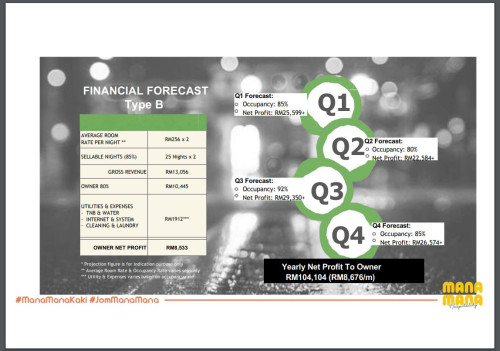

3. Hugoz and Mana-Mana (EXSIM's own Airbnb operator) forecasts high returns which of course is super inflated (refer to image below).

4. From researching at Airbnb, I can see that Scarletz some of them are so occupied whereas listings in the last few pages are empty. So then I am skeptical whether or not can they even cover monthly commitments. Also, how they pool units into groups and distribute the profits among owners. As we do not know how the pooling system works and how the units prioritization works, some owners may get more returns than others.

5. I quite understand that since this is cookie cutter investment project, capital appreciation may be hard to be realized. People wouldn't opt for these for own stay.

6. My thought process is for a dual key unit in Hugoz, I would need to fork out a total of around RM 50k including down payment, MOT, renovation, furnishing, etc. to start operating Airbnb and start generating income. Referring to the image below, I will deduct 30% from the net profit and normalize it from its over inflation by developers / agents / operators hence around RM 6k net profit from the Airbnb operations. Monthly commitments including instalments, maintenance, sinking fund, insurance, wear and tear sit around RM 5k. That means I can generate RM 1k every month. This investment would then need around 50 months to breakeven my initial cost of RM 50k. And after that 50 months, the rest are clean net profits. If I am so very lucky, and the unit actually appreciate in price, that's another bonus.

are there any flaws in my thought process? my only concern is 30% deduction from the operator's forecast is not enough to justify and normalize it.

Jul 26 2023, 02:56 AM, updated 3y ago

Jul 26 2023, 02:56 AM, updated 3y ago

Quote

Quote

0.0212sec

0.0212sec

0.67

0.67

5 queries

5 queries

GZIP Disabled

GZIP Disabled