i dont think it's so simple like that..

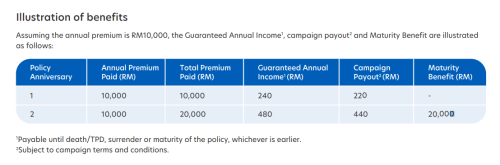

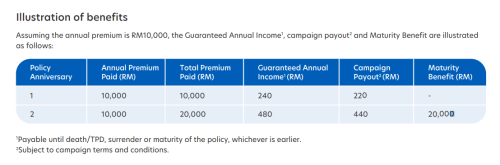

You pay RM10k first year gets 4.8%

You pay RM10k 2nd year gets 4.8%

Then withdraw everything on 3rd year ?

PruEzy Saver

PruEzy Saver

|

|

May 25 2023, 04:09 PM May 25 2023, 04:09 PM

|

All Stars

21,332 posts Joined: Jan 2003 From: Kuala Lumpur |

i dont think it's so simple like that..

You pay RM10k first year gets 4.8% You pay RM10k 2nd year gets 4.8% Then withdraw everything on 3rd year ? |

|

|

|

|

|

May 25 2023, 04:55 PM May 25 2023, 04:55 PM

|

Senior Member

6,249 posts Joined: Jun 2006 |

QUOTE(ronnie @ May 25 2023, 04:09 PM) i dont think it's so simple like that.. 2nd yr 4.8% is for 20k...You pay RM10k first year gets 4.8% You pay RM10k 2nd year gets 4.8% Then withdraw everything on 3rd year ? rate is for total premium paid iirc... but yeah this is what it says This post has been edited by dwRK: May 25 2023, 04:56 PM |

|

|

May 25 2023, 05:18 PM May 25 2023, 05:18 PM

Show posts by this member only | IPv6 | Post

#23

|

Senior Member

4,693 posts Joined: Jan 2003 |

QUOTE(Angelpoli @ May 25 2023, 03:33 PM) No, the plan is 2 years. Policy and payment terms both 2 years. After 2 years matured u take out all the money. No such thing as capital guaranteed in the 1st place as the fund manager or insurer can go bust anytime 🤦♀️Yes. It's saving plan. But the return and capital guarantee is similar like fixed deposit which caught my attention and makes it worth the time to understand it. But it's capital guaranteed. So it's like u put inside fixed deposit. Then they invest in where should be wont affect your guarantee terms unless u void the tnc first or the company or bank bankrupt which then fixed deposit more than 250k also not under insured. Only those with PIDM insured members can claim that their capital is guaranteed for savings and FD however subject to certain minimum level Don’t just be blinded by the words of capital guaranteed and slightly higher than FD rate when things can go south easily if you don’t understand on what you are buying 🤦♀️ as there are no such thing as capital guaranteed in the 1st place other than actual cash in your bank account 🤦♀️ QUOTE(sirius2017 @ May 25 2023, 04:08 PM) It was mentioned in their T&C, point 6 Definitely won’t be in cash and most likely would be payout in form of reinvested units being distributedPAMB shall have the discretion to decide in respect of all matters and disputes concerning this Campaign in accordance with treating you and other Eligible Customers fairly, including substituting the campaign payout with other forms of gifts/payouts of equivalent value. |

|

|

Aug 11 2024, 11:57 PM Aug 11 2024, 11:57 PM

|

Junior Member

31 posts Joined: Apr 2019 |

QUOTE(Angelpoli @ May 24 2023, 10:58 PM) Anyone do any research on this product by Prudential under UOB? I tried reading the tnc and could not find any suspicious part. Capital guaranteed. Annual income of 4.8%. Short term 2 years. Better than any fixed deposit return. Please enlighten me. Thank you. Hey OP, https://www.uob.com.my/personal/insure/digi...uezy-saver.page Not trying to sell this product but more like trying to find out what is the catchy part of this product before making any decision. Seems too good to be true as Prudential themselve also do not offer such good product. Not sure if you signed up for it. I'm interested in signing up also. If you already signed up, can help answer some questions? 1. Overall so far hows the experience? 2. Were you able to claim any tax relief(s) on this product? (not sure if can claim under life). |

|

|

Aug 12 2024, 07:52 AM Aug 12 2024, 07:52 AM

Show posts by this member only | IPv6 | Post

#25

|

Senior Member

4,728 posts Joined: Jul 2013 |

QUOTE(Yayeyiyoyu @ Aug 11 2024, 11:57 PM) Hey OP, 1) sign up process is 100% online. Not sure if you signed up for it. I'm interested in signing up also. If you already signed up, can help answer some questions? 1. Overall so far hows the experience? 2. Were you able to claim any tax relief(s) on this product? (not sure if can claim under life). 2) yes you can park this under life insurance. They issued the statement on this to me |

|

|

Aug 12 2024, 09:07 AM Aug 12 2024, 09:07 AM

Show posts by this member only | IPv6 | Post

#26

|

Junior Member

104 posts Joined: Sep 2009 |

|

|

|

|

|

|

Aug 12 2024, 09:46 AM Aug 12 2024, 09:46 AM

|

Junior Member

820 posts Joined: Aug 2006 |

|

|

|

Aug 12 2024, 10:01 AM Aug 12 2024, 10:01 AM

Show posts by this member only | IPv6 | Post

#28

|

All Stars

24,431 posts Joined: Feb 2011 |

QUOTE(coyouth @ Aug 12 2024, 09:46 AM) Lousy returns Vs EPF. Not to mention possible no payout if you didn't put in money as scheduled or do early withdrawal. Too much hassle of needing to read all the fine prints for lousy returns.Some plans even worse. Ask you to pay for 5 years. Then slowly refund you the amount paid at below promo FD rates!!! People get hooked monthly payment. This post has been edited by Ramjade: Aug 12 2024, 10:03 AM |

|

|

Aug 12 2024, 10:17 AM Aug 12 2024, 10:17 AM

|

Senior Member

5,643 posts Joined: Apr 2011 From: Kuala Lumpur |

QUOTE(Ramjade @ Aug 12 2024, 10:01 AM) Lousy returns Vs EPF. Not to mention possible no payout if you didn't put in money as scheduled or do early withdrawal. Too much hassle of needing to read all the fine prints for lousy returns. This one is 4.8% with two times payment. Some plans even worse. Ask you to pay for 5 years. Then slowly refund you the amount paid at below promo FD rates!!! People get hooked monthly payment. Not all endowment are created the same. |

|

|

Aug 12 2024, 10:52 AM Aug 12 2024, 10:52 AM

|

Junior Member

820 posts Joined: Aug 2006 |

QUOTE(Ramjade @ Aug 12 2024, 10:01 AM) Lousy returns Vs EPF. Not to mention possible no payout if you didn't put in money as scheduled or do early withdrawal. Too much hassle of needing to read all the fine prints for lousy returns. thanks for the enlightenment.Some plans even worse. Ask you to pay for 5 years. Then slowly refund you the amount paid at below promo FD rates!!! People get hooked monthly payment. |

|

|

Aug 12 2024, 01:24 PM Aug 12 2024, 01:24 PM

Show posts by this member only | IPv6 | Post

#31

|

All Stars

24,431 posts Joined: Feb 2011 |

QUOTE(victorian @ Aug 12 2024, 10:17 AM) Yes. Still need to read fine prints. I won't waste money on all these endowment/savings plans.They have no place in my portfolio. This post has been edited by Ramjade: Aug 12 2024, 01:25 PM coyouth liked this post

|

|

|

Aug 12 2024, 02:30 PM Aug 12 2024, 02:30 PM

Show posts by this member only | IPv6 | Post

#32

|

Senior Member

4,728 posts Joined: Jul 2013 |

QUOTE(coyouth @ Aug 12 2024, 09:46 AM) Most of the time, insurance savings endowment plan is really subpar return and / or it's super long term. In those scenario, EPF might be better. This pru ezy saver does work differently. QUOTE(Lazygenes @ Aug 12 2024, 09:07 AM) Do you know if there is a limit to the number of times you can buy this policy? Eg buy another one after a couple of months? 1 person 1 policy. QUOTE(Ramjade @ Aug 12 2024, 10:01 AM) Lousy returns Vs EPF. Not to mention possible no payout if you didn't put in money as scheduled or do early withdrawal. Too much hassle of needing to read all the fine prints for lousy returns. Try to understand the T&C first before you tembak. Some plans even worse. Ask you to pay for 5 years. Then slowly refund you the amount paid at below promo FD rates!!! People get hooked monthly payment. This particular plan pays 4.6% and for 2 years. Yes, it is lower than EPF on average. But it is 4.6% guarantee. And you can take out the money after 2 years. So this is an alternative to those chasing FD. This post has been edited by adele123: Aug 12 2024, 02:31 PM |

|

|

Aug 12 2024, 03:46 PM Aug 12 2024, 03:46 PM

Show posts by this member only | IPv6 | Post

#33

|

All Stars

24,431 posts Joined: Feb 2011 |

QUOTE(adele123 @ Aug 12 2024, 02:30 PM) Most of the time, insurance savings endowment plan is really subpar return and / or it's super long term. In those scenario, EPF might be better. Thanks for the info. Still not interested when I can get 6%p.a easily.This pru ezy saver does work differently. 1 person 1 policy. Try to understand the T&C first before you tembak. This particular plan pays 4.6% and for 2 years. Yes, it is lower than EPF on average. But it is 4.6% guarantee. And you can take out the money after 2 years. So this is an alternative to those chasing FD. |

|

|

|

|

|

Aug 12 2024, 11:13 PM Aug 12 2024, 11:13 PM

Show posts by this member only | IPv6 | Post

#34

|

Senior Member

5,926 posts Joined: Sep 2009 |

QUOTE(adele123 @ Aug 12 2024, 02:30 PM) Most of the time, insurance savings endowment plan is really subpar return and / or it's super long term. In those scenario, EPF might be better. this seems a good alternative to FD now only 4.1%This pru ezy saver does work differently. 1 person 1 policy. Try to understand the T&C first before you tembak. This particular plan pays 4.6% and for 2 years. Yes, it is lower than EPF on average. But it is 4.6% guarantee. And you can take out the money after 2 years. So this is an alternative to those chasing FD. Seem too good to be true if can get 4.6%pa and take all out after 2 years. max can buy only RM20k? any one can share the T&C please. Found out It is not like i thought totally out for those who think can put money in and earn 4.6% pa x 2 years No way! 2years maturity - wrong! after 2nd year you CANNOT get back 100% of premium paid! guaranteed is only 2.4% forget it!! This post has been edited by guy3288: Aug 12 2024, 11:39 PM |

|

|

Aug 13 2024, 12:26 AM Aug 13 2024, 12:26 AM

Show posts by this member only | IPv6 | Post

#35

|

All Stars

24,431 posts Joined: Feb 2011 |

QUOTE(guy3288 @ Aug 12 2024, 11:13 PM) Found out Haha... Thanks. I knew it. Too good to be true.It is not like i thought totally out for those who think can put money in and earn 4.6% pa x 2 years No way! 2years maturity - wrong! after 2nd year you CANNOT get back 100% of premium paid! guaranteed is only 2.4% forget it!! This post has been edited by Ramjade: Aug 13 2024, 12:27 AM |

|

|

Aug 13 2024, 08:35 AM Aug 13 2024, 08:35 AM

Show posts by this member only | IPv6 | Post

#36

|

Senior Member

4,728 posts Joined: Jul 2013 |

read more here

I dont earn sales commission and i dont work for prudential or UOB. Mau, tak mau, i am just explaining the facts. 1) Hold it for 2 years, early termination got penalty. 2) After 2 years, you will get it back in full. There is a 2nd year "payment". 3) base 2.4%. additional 2.2% is under campaign. Read the PDS and the campaign T&C. These 3 points are there. |

|

|

Aug 13 2024, 10:40 AM Aug 13 2024, 10:40 AM

|

Senior Member

5,643 posts Joined: Apr 2011 From: Kuala Lumpur |

QUOTE(guy3288 @ Aug 12 2024, 11:13 PM) this seems a good alternative to FD now only 4.1% aduh learn to read la... Seem too good to be true if can get 4.6%pa and take all out after 2 years. max can buy only RM20k? any one can share the T&C please. Found out It is not like i thought totally out for those who think can put money in and earn 4.6% pa x 2 years No way! 2years maturity - wrong! after 2nd year you CANNOT get back 100% of premium paid! guaranteed is only 2.4% forget it!! and don't bold your words if you are not smart to begin with... 1. Annual guaranteed payout of 4.6% of Total Premium Paid (this consists of Guaranteed Annual Income of 2.4% of Total Premium Paid and campaign payout of 2.2% of Total Premium Paid) will be payable at each Policy Anniversary, provided the policy remains in force 2. 100% capital guarantee at maturity |

|

|

Aug 13 2024, 01:34 PM Aug 13 2024, 01:34 PM

Show posts by this member only | IPv6 | Post

#38

|

Senior Member

5,926 posts Joined: Sep 2009 |

QUOTE(victorian @ Aug 13 2024, 10:40 AM) aduh learn to read la... dont lah try to mislead people saying can put money thereand don't bold your words if you are not smart to begin with... 1. Annual guaranteed payout of 4.6% of Total Premium Paid (this consists of Guaranteed Annual Income of 2.4% of Total Premium Paid and campaign payout of 2.2% of Total Premium Paid) will be payable at each Policy Anniversary, provided the policy remains in force 2. 100% capital guarantee at maturity can earn for 4.6% pa return after 2years take out all as if can earn 4.6% return x 2 years Talk big no use show me in numbers I can put in RM50k today 13.8.24 Next year 13.8.25 i can put in another RM50k Tell me when is the maturity date? you say it is 14.8.2026? If not you are cheating Tell me on 14.8.2026 i surrender the policy Would i get back 1) My premium paid total RM100k 2) Annual income 1st year 4.6% x 50k =RM2300 3) Annual income 2nd year 4.6% x 100k = RM4600 if i can get back RM106900 on 14.8.2026 then you are good to go |

|

|

Aug 13 2024, 02:12 PM Aug 13 2024, 02:12 PM

|

Senior Member

5,643 posts Joined: Apr 2011 From: Kuala Lumpur |

QUOTE(guy3288 @ Aug 13 2024, 01:34 PM) dont lah try to mislead people saying can put money there I have no obligation to convince you but since you are being a smartass, here you go: can earn for 4.6% pa return after 2years take out all as if can earn 4.6% return x 2 years Talk big no use show me in numbers I can put in RM50k today 13.8.24 Next year 13.8.25 i can put in another RM50k Tell me when is the maturity date? you say it is 14.8.2026? If not you are cheating Tell me on 14.8.2026 i surrender the policy Would i get back 1) My premium paid total RM100k 2) Annual income 1st year 4.6% x 50k =RM2300 3) Annual income 2nd year 4.6% x 100k = RM4600 if i can get back RM106900 on 14.8.2026 then you are good to go  I hope this can slap some sense into you. Attached File(s)  PRUEzySaver_Product_Summary.pdf ( 158k )

Number of downloads: 98

PRUEzySaver_Product_Summary.pdf ( 158k )

Number of downloads: 98 |

|

|

Aug 13 2024, 02:38 PM Aug 13 2024, 02:38 PM

Show posts by this member only | IPv6 | Post

#40

|

Senior Member

5,926 posts Joined: Sep 2009 |

QUOTE(victorian @ Aug 13 2024, 02:12 PM) I have no obligation to convince you but since you are being a smartass, here you go: hello bro did you read or not? I hope this can slap some sense into you. dont act like smart ass ok? First you simply hantam can get 4.8% pa for 2 years. QUOTE(victorian @ Aug 12 2024, 10:17 AM) then you tried to mislead others herethe misleading parts you tried to hide is stated there annual income is ONLY payable PROVIDED the policy remains in force i can tell you on 14.8.2026 after 2 years when i want to withdraw I would get much lesser than i have calculated above Are you not cheating there? |

| Change to: |  0.0219sec 0.0219sec

1.15 1.15

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 23rd December 2025 - 10:03 AM |