Outline ·

[ Standard ] ·

Linear+

IPO: MKH Oil Palm Bhd, Potential IPO - Main Market

|

TSnexona88

|

Apr 21 2023, 06:20 PM, updated 2y ago Apr 21 2023, 06:20 PM, updated 2y ago

|

|

MKH’s plantation arm MKH Oil Palm to offer up to 250.7 mil shares in Main Market IPOThe 250.7 million shares — 24.5% of its enlarged issued share capital of 1.023 billion — comprise 220 million new shares and an offer for sale of 30.7 million existing shares, its draft prospectus published on the Securities Commission Malaysia website showed. A total of 51.21 million shares out of the 220 million new shares are allocated to the Malaysian public, of which 25.6 million issue shares will be set aside for Bumiputera public investors. Another 168.79 million shares out of the 220 million new shares are for private placement to selected investors. The offer shares of 30.7 million will be allocated by way of private placement to selected investors. MKHOP is principally involved in investment holding and management services. Through its subsidiaries, the group is involved in cultivation of oil palm and production and sale of crude palm oil (CPO) and palm kernel. On Aug 11, 2022, MKHOP was converted into a public company limited by shares. For the financial year ended Sept 30, 2022 (FY2022), MKHOP posted a profit after tax of RM60.14 million, versus RM77.45 million in FY2021 and RM18.69 million in FY2020. As for revenue, the company logged RM315.82 million in FY2022, RM306.61 million in FY2021 and RM282.324 in FY2020. https://www.theedgemarkets.com/node/664122

|

|

|

|

|

|

Halibut

|

Mar 29 2024, 02:45 PM Mar 29 2024, 02:45 PM

|

|

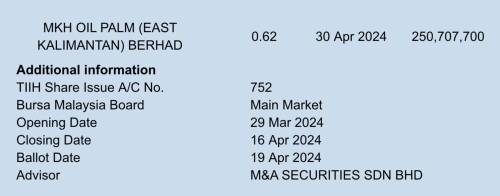

Ipo will be priced at RM0.62

KUALA LUMPUR (March 29): Oil palm plantation player MKH Oil Palm (East Kalimantan) Bhd began taking orders from investors on Friday for its initial public offering (IPO) on the Main Market that would raise up to RM155.43 million.

The IPO, which is priced at 62 sen apiece, comprises a public issuance of 220 million new ordinary shares, which represents 21.5% of the enlarged share capital, as well as an offer for sale of 30.7 million existing shares, which represents 3% of the enlarged share capital, by way of private placement to selected investors.

Out of the 220 million new shares, the company allocated 51.21 million shares to the public, while 168.79 million shares are reserved for private placement to select investors.

Applications for the IPO will be closed on April 16, while the listing is set for April 30. With an enlarged share capital of 1.02 billion shares, the group will have a market capitalisation of RM634.6 million upon listing.

The company sees a price-earnings ratio of 20.3 times, based on its net profit of RM30.4 million for the financial year ended Sept 30, 2023 (FY2023).

This represents a decline of 45.2% from the net profit of RM55.5 million in FY2022, due to the rising operating costs amid an increase in operational activities, driven by more favourable weather conditions.

According to its statement on Friday, the company plans to use RM42 million or 30.8% of the proceeds to acquire lands for oil palm plantations within the East Kalimantan province, while RM9 million or 6.6% would be used to set up a palm kernel crushing facility to provide the group with an additional income stream.

Meanwhile, another RM42 million or 30.8% of the total proceeds will be used for capital expenditures for existing plantation lands, the upkeep of the existing palm oil mill, the refurbishment of staff housing quarters, and the expansion of the electricity supply.

The group will also allocate RM33 million or 22% of the proceeds for loan repayments, and the remaining RM13.4 million or 9.8% for working capital and listing expenses.

M&A Securities is the adviser, underwriter and placement agent for the IPO. Kenanga Investment Bank is the joint writer and joint placement agent, while AmInvestment Bank is also the joint placement agent.

|

|

|

|

|

|

ronnie

|

Mar 29 2024, 10:07 PM Mar 29 2024, 10:07 PM

|

|

|

|

|

|

|

|

Halibut

|

Mar 29 2024, 11:53 PM Mar 29 2024, 11:53 PM

|

|

This one not available under miti right? If not, for sure will fly

|

|

|

|

|

|

IPO ADDICT

|

Apr 1 2024, 06:24 AM Apr 1 2024, 06:24 AM

|

|

QUOTE(Halibut @ Mar 29 2024, 11:53 PM) This one not available under miti right? If not, for sure will fly  This post has been edited by IPO ADDICT: Apr 7 2024, 07:22 AM This post has been edited by IPO ADDICT: Apr 7 2024, 07:22 AM |

|

|

|

|

|

theevilman1909

|

Apr 1 2024, 03:22 PM Apr 1 2024, 03:22 PM

|

|

plantation stock okay???  got many others currently listed... |

|

|

|

|

|

Baik

|

Apr 1 2024, 03:24 PM Apr 1 2024, 03:24 PM

|

|

QUOTE(theevilman1909 @ Apr 1 2024, 04:22 PM) plantation stock okay???  got many others currently listed... plantation all ringgit2 stock coming MKHOP RM0.62 and Johor Plantation Berhad RMX.XX. #tayor |

|

|

|

|

|

lordwood

|

Apr 8 2024, 12:18 PM Apr 8 2024, 12:18 PM

|

Getting Started

|

got TP bor

|

|

|

|

|

|

nikazwa

|

Apr 8 2024, 10:21 PM Apr 8 2024, 10:21 PM

|

|

Is there any previous plantation company went for IPO ? How was its performance?

|

|

|

|

|

|

lim47

|

Apr 10 2024, 12:51 AM Apr 10 2024, 12:51 AM

|

|

Anyone can share some tp ?

No rating yet ?

|

|

|

|

|

|

SUSsafety2022

|

Apr 10 2024, 01:08 AM Apr 10 2024, 01:08 AM

|

New Member

|

It's a smart move to ensure broader participation and support. Those profit after tax and revenue numbers really paint a picture of where they stand and where they might be headed.

|

|

|

|

|

|

froz3nnoob

|

Apr 10 2024, 07:26 AM Apr 10 2024, 07:26 AM

|

|

Its seem that’s because their company is based on indonesia they doesn't need to go under miti

|

|

|

|

|

|

TSnexona88

|

Apr 10 2024, 08:59 AM Apr 10 2024, 08:59 AM

|

|

QUOTE(froz3nnoob @ Apr 10 2024, 07:26 AM) Its seem that’s because their company is based on indonesia they doesn't need to go under miti If I remember correctly.. Any companies intended to list in Bursa... If their income revenue is 60% above from foreign countries / non Malaysia based... You don't need to have to offer MITI allocation or even can skip the bumi equity requirements... |

|

|

|

|

|

froz3nnoob

|

Apr 10 2024, 04:47 PM Apr 10 2024, 04:47 PM

|

|

QUOTE(nexona88 @ Apr 10 2024, 09:59 AM) If I remember correctly.. Any companies intended to list in Bursa... If their income revenue is 60% above from foreign countries / non Malaysia based... You don't need to have to offer MITI allocation or even can skip the bumi equity requirements... ya their ipo prospectus did mention oso |

|

|

|

|

|

tnang

|

Apr 10 2024, 07:39 PM Apr 10 2024, 07:39 PM

|

|

Any tp so far?

|

|

|

|

|

|

lordwood

|

Apr 11 2024, 12:53 AM Apr 11 2024, 12:53 AM

|

Getting Started

|

11/4 IPO ref 1279

|

|

|

|

|

|

IPO ADDICT

|

Apr 11 2024, 06:56 AM Apr 11 2024, 06:56 AM

|

|

QUOTE(tnang @ Apr 10 2024, 07:39 PM)  |

|

|

|

|

|

nikazwa

|

Apr 11 2024, 05:22 PM Apr 11 2024, 05:22 PM

|

|

Please share any TP pls....

|

|

|

|

|

|

lordwood

|

Apr 12 2024, 08:12 AM Apr 12 2024, 08:12 AM

|

Getting Started

|

https://theedgemalaysia.com/node/707673Mecury Sec TP / Fair value: 80 sen abt 29% upside No MITI Still considering ar? Good la, less man more "shares". This post has been edited by lordwood: Apr 12 2024, 08:19 AM

|

|

|

|

|

|

nikazwa

|

Apr 12 2024, 10:15 AM Apr 12 2024, 10:15 AM

|

|

Hopefully we can hv other TP ...tq

|

|

|

|

|

Apr 21 2023, 06:20 PM, updated 2y ago

Apr 21 2023, 06:20 PM, updated 2y ago

Quote

Quote

0.0144sec

0.0144sec

0.69

0.69

5 queries

5 queries

GZIP Disabled

GZIP Disabled