🕘 Bank Every Day? Check Malaysia 7-Day Branches! 💳🏧💰💵🌟

QUOTE

OCBC Bank is first in Southeast Asia to enable instant encashment of cash cheques at ATMs

12 Mar 2020

OCBC Bank's digital push at branches, now enhanced by next-generation ATMs, enables customers to perform close to 80 per cent of all frequently performed transactions without having to queue for a teller

OCBC Bank customers can encash cash cheques immediately at next-generation ATMs located at 23 branches

Singapore, 12 March 2020 –

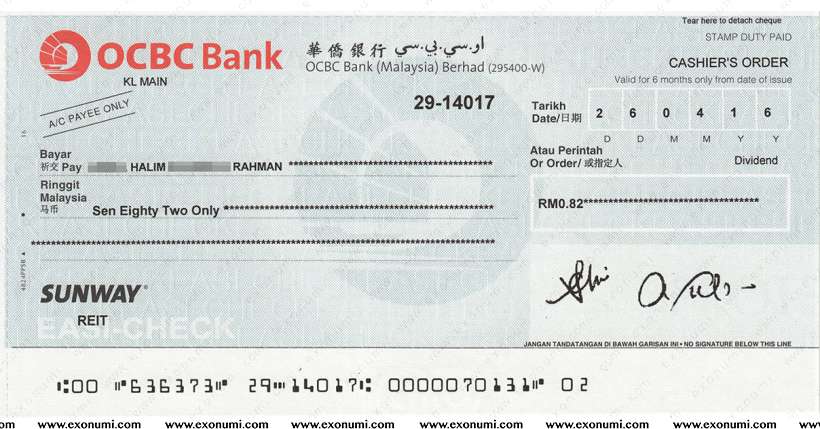

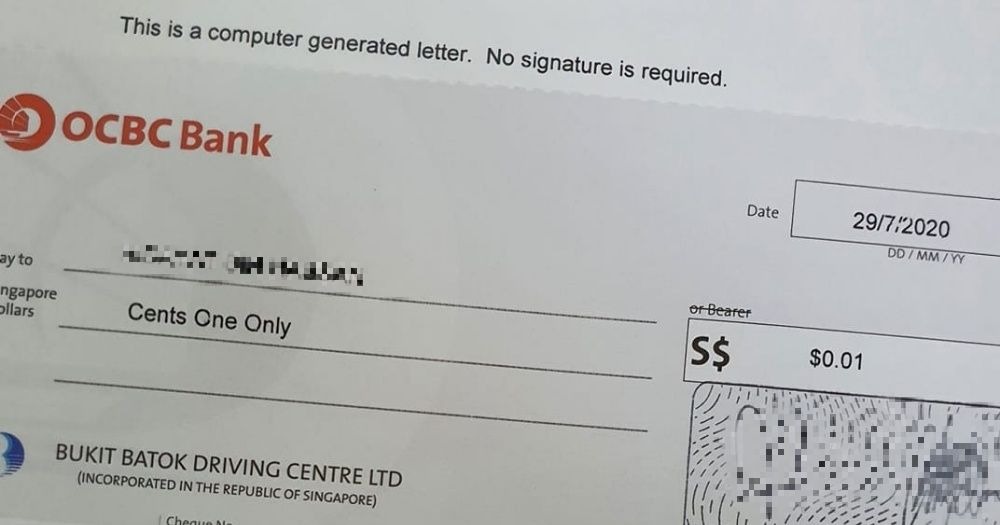

Even as Singapore pushes to become cheque-free by 2025, cash cheques continue to be used by small and medium-sized enterprises (SMEs), typically to pay staff salaries, get cash for daily business operations or pay vendors for services rendered.

While cheque usage by OCBC Bank’s retail banking customers has fallen 40 per cent since 2018, one in six cash transactions performed by OCBC Bank tellers over the counter are still cash cheque encashments; 95 per cent of these cheques are issued by SMEs.

Until cheques are fully phased out, and to drive digital literacy and adoption, OCBC Bank has rolled out a cheque encashment service across all its next-generation ATMs at 23 branches.

Since February 2020, customers have been able to encash cheques – for up to a maximum of $30,000 in a single cheque – by depositing them into the ATM to instantly get cash.

This capability enables the next-generation ATMs to process 90 per cent of all the cheques usually encashed at OCBC Bank branch teller counters.

The average cheque encashment transaction time has been reduced to under three minutes at the ATM, as customers can save about 60 per cent of their time compared to waiting to be served at a branch. All the necessary security checks and verifications are performed by Digital Ambassadors on mobile tablets in real time, so security is not compromised.

The next-generation ATMs have already processed cheque encashments totalling close to S$17 million.

12 Mar 2020

OCBC Bank's digital push at branches, now enhanced by next-generation ATMs, enables customers to perform close to 80 per cent of all frequently performed transactions without having to queue for a teller

OCBC Bank customers can encash cash cheques immediately at next-generation ATMs located at 23 branches

Singapore, 12 March 2020 –

Even as Singapore pushes to become cheque-free by 2025, cash cheques continue to be used by small and medium-sized enterprises (SMEs), typically to pay staff salaries, get cash for daily business operations or pay vendors for services rendered.

While cheque usage by OCBC Bank’s retail banking customers has fallen 40 per cent since 2018, one in six cash transactions performed by OCBC Bank tellers over the counter are still cash cheque encashments; 95 per cent of these cheques are issued by SMEs.

Until cheques are fully phased out, and to drive digital literacy and adoption, OCBC Bank has rolled out a cheque encashment service across all its next-generation ATMs at 23 branches.

Since February 2020, customers have been able to encash cheques – for up to a maximum of $30,000 in a single cheque – by depositing them into the ATM to instantly get cash.

This capability enables the next-generation ATMs to process 90 per cent of all the cheques usually encashed at OCBC Bank branch teller counters.

The average cheque encashment transaction time has been reduced to under three minutes at the ATM, as customers can save about 60 per cent of their time compared to waiting to be served at a branch. All the necessary security checks and verifications are performed by Digital Ambassadors on mobile tablets in real time, so security is not compromised.

The next-generation ATMs have already processed cheque encashments totalling close to S$17 million.

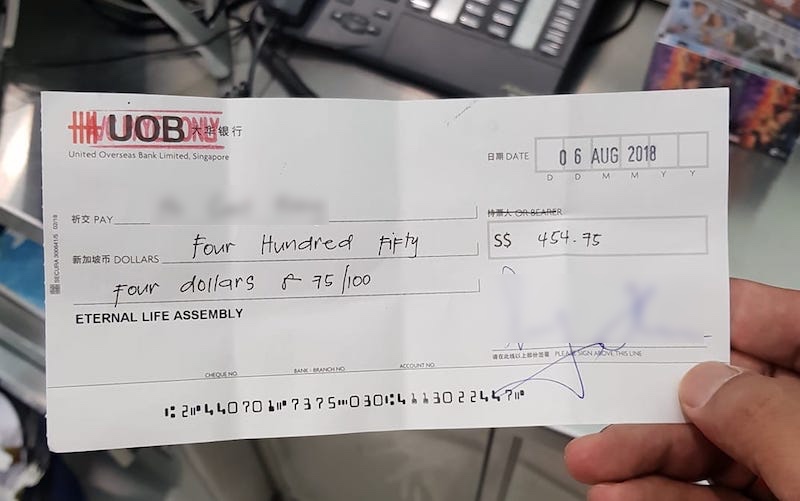

Penang UOB bank at bungalow

(Privilege banking)

9, Jalan Kelawai,

10250 George Town,

Pulau Pinang

| Bank | Branch / Location | Mon – Fri | Saturday | Sunday | Public Holiday | Notes |

| ------ | ------------------ | ----------- | ---------- | -------- | ---------------- | ------- |

| **Maybank** | Suria KLCC (Lot C-21-C, Concourse Ext) | 10:00am – 6:00pm | 10:00am – 6:00pm | 10:00am – 6:00pm | 10:00am – 6:00pm | ✅ Full banking services (including Public Holidays) |

| **CIMB** | Suria KLCC (Lot C04-C05, Concourse Level) | 9:30am – 5:00pm (5:00pm–5:30pm Non-Cash only) | 9:30am – 5:00pm (5:00pm–5:30pm Non-Cash only) | 9:30am – 4:30pm | 9:30am – 4:30pm | ✅ Open on Sunday & Public Holidays |

| **OCBC** | Selangor (7 branches: Cheras, Kajang, Kepong, Klang, Petaling Jaya, Puchong, Subang Jaya) | 10:00am – 2:30pm | 10:00am – 2:30pm | ❌ Closed | ❌ Closed | 🚪 Saturday half-day service only |

| **OCBC** | Melaka | 9:30am – 4:00pm | 10:00am – 4:00pm | 10:00am – 4:00pm | ❌ Closed | ✅ Weekend service |

| **OCBC** | Johor (Taman Molek) | 9:30am – 5:00pm | 10:00am – 4:00pm | 10:00am – 4:00pm | ❌ Closed | ✅ Weekend service |

This post has been edited by plouffle0789: Sep 5 2025, 08:13 PM

Apr 13 2023, 10:40 AM, updated 3 months ago

Apr 13 2023, 10:40 AM, updated 3 months ago

Quote

Quote

0.0180sec

0.0180sec

0.43

0.43

5 queries

5 queries

GZIP Disabled

GZIP Disabled