QUOTE(Chastain @ Apr 19 2023, 10:15 PM)

I do online shopping

Since the items are not available via retail.

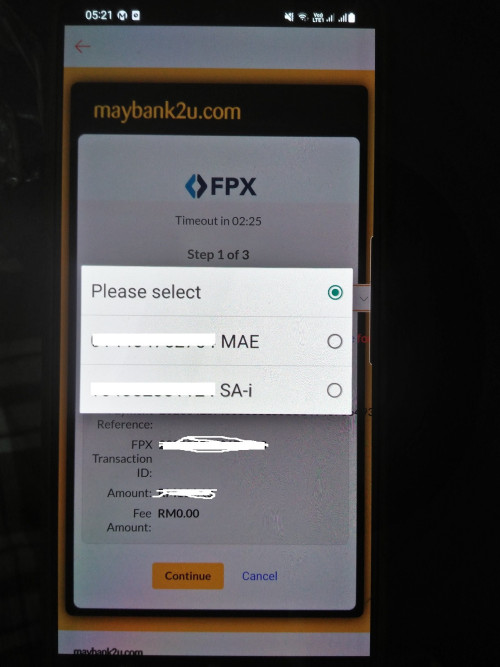

This Secure2u are making it things difficult.

Even DuitNow requires Secure2u

If not, at least can shopping via Touch N Go app.

Fucking scammers

They are the reason why no more TAC

Silly victims giving out TAC are a nuisance, but not the main problem.

Banks are loaded financially can gang up, hire white hat hackers, to track down scammers and hackers, then hand them over to the authoritise.

Keep in mind, online banking has been around over decades, but MY banks refuse to this.

Instead banks blame depositors. While education is vital but then they don't educate depositors at time of a/c opening?

Recently, a bar council member is waging a lawsuit against a bank for funds suddenly gone missing. Point being, banks are not all innocent.

If banks really value depositors, they could have track down scammers and hackers.

I suspect banks want as many people to use their app to curb against crypto and other forms of currency.

Possibly even roll out their own digital currency, which I hear in China's social system, who knows if its true that they can switch off digital currency. Then cannot buy food, people will have to beg gov't.

Other methods for online shopping is credit card and preload a/c with debit card.

Debit card usually have RM8 fee per annum.

Anyway for now, I hope Secure2u works out.

With quantum computer and 5G rolling out, hackers will find a way, fast.

Do becareful as new technology often do not have mass trials, like mRNA vax.

Apr 19 2023, 11:10 PM

Apr 19 2023, 11:10 PM

Quote

Quote

0.0213sec

0.0213sec

0.57

0.57

5 queries

5 queries

GZIP Disabled

GZIP Disabled