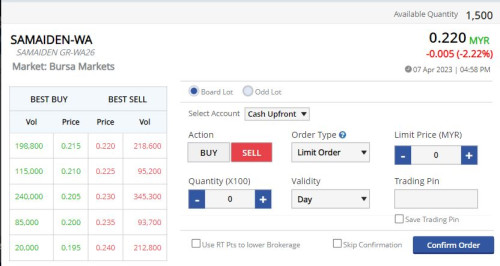

So I've bought 1,500 Samaiden GR-WA26 warrants on Rakuten with price RM0.225 and I invested RM330

The exercise/strike price is RM0.72

The stock price as of 7/4/2023 is RM0.97

Now, lets say, next week the stock goes up by 10 sen to RM1.07. My first questions are:

1. The exercise price still remains same right?

2. If I want to exercise these warrants, I sell them in Rakuten?

3a. If yes, what is the price I should be selling at? Will it be RM0.225 + RM0.10? Because when I click on "Sell" and the pop up appears, I dont see any involvement of the strike price, which gets me confused.

3b. If no, how do I exercise the warrants?

4. What is the RM0.225 price called? Is that the intrinsic/underlying price?

Apr 7 2023, 11:42 PM, updated 3y ago

Apr 7 2023, 11:42 PM, updated 3y ago

Quote

Quote

0.0196sec

0.0196sec

0.30

0.30

6 queries

6 queries

GZIP Disabled

GZIP Disabled