Also important if intending to use it as a high yield "parking" account - what are the online withdrawal limits, and is it as fast as normal bank Duitnow (instant)/IBG (same day)?

Digital bank Rize, By Al Rajhi Bank

Digital bank Rize, By Al Rajhi Bank

|

|

Apr 12 2023, 12:09 PM Apr 12 2023, 12:09 PM

Return to original view | IPv6 | Post

#1

|

Junior Member

836 posts Joined: Sep 2022 |

Also important if intending to use it as a high yield "parking" account - what are the online withdrawal limits, and is it as fast as normal bank Duitnow (instant)/IBG (same day)?

|

|

|

|

|

|

Apr 12 2023, 06:37 PM Apr 12 2023, 06:37 PM

Return to original view | IPv6 | Post

#2

|

Junior Member

836 posts Joined: Sep 2022 |

QUOTE(Mr. Najib Razak @ Apr 12 2023, 03:33 PM) I'.m at account opening on the app. First step - sign up & ID verification not moving already 5 minutes! 25 minutes still not moving. Anyone else having this problem? This post has been edited by BWassup: Apr 12 2023, 06:56 PM |

|

|

Apr 12 2023, 09:07 PM Apr 12 2023, 09:07 PM

Return to original view | IPv6 | Post

#3

|

Junior Member

836 posts Joined: Sep 2022 |

QUOTE(xander2k8 @ Apr 12 2023, 08:19 PM) Android. Same problem as me?I uninstalled and reinstalled the app, still stuck at this screen, whether using wireless or 4G  It's "rize my" app right? Having this problem in account opening does makes one wonder whether their app is properly secured and trouble-free to use in future. |

|

|

Apr 12 2023, 10:49 PM Apr 12 2023, 10:49 PM

Return to original view | IPv6 | Post

#4

|

Junior Member

836 posts Joined: Sep 2022 |

QUOTE(Mr. Najib Razak @ Apr 12 2023, 09:59 PM) Xander2k8 reported same problem with some IOS users.Maybe too many applicants made it koyak. Will try again tomorrow. Hope they resolve the issue quickly. This post has been edited by BWassup: Apr 12 2023, 10:50 PM Mr. Najib Razak liked this post

|

|

|

Apr 13 2023, 10:16 AM Apr 13 2023, 10:16 AM

Return to original view | IPv6 | Post

#5

|

Junior Member

836 posts Joined: Sep 2022 |

QUOTE(BWassup @ Apr 12 2023, 09:07 PM) Android. Same problem as me? The call centre requested for screenshots, and their technical team will look into it.I uninstalled and reinstalled the app, still stuck at this screen, whether using wireless or 4G  It's "rize my" app right? Having this problem in account opening does makes one wonder whether their app is properly secured and trouble-free to use in future. |

|

|

Apr 13 2023, 12:07 PM Apr 13 2023, 12:07 PM

Return to original view | IPv6 | Post

#6

|

Junior Member

836 posts Joined: Sep 2022 |

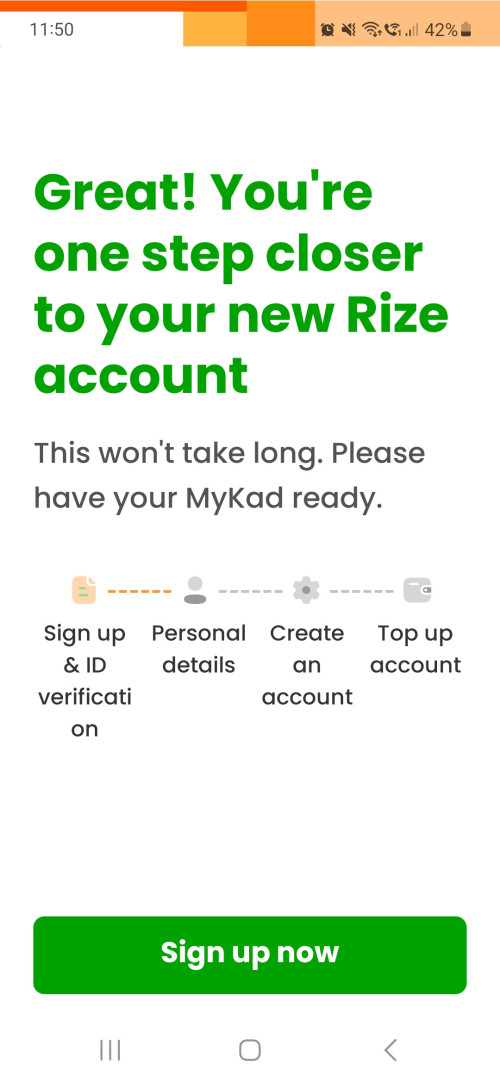

QUOTE(BWassup @ Apr 13 2023, 10:16 AM) It seems the problem is my font size was too big.If you are having the same problem as me, this can be adjusted in Phone. Settings => Display => Font Size. After adjustment, you should be able to see the "Sign Up Now" box as in the image below:  I managed to submit my account opening, and awaiting approval |

|

|

|

|

|

Apr 13 2023, 03:53 PM Apr 13 2023, 03:53 PM

Return to original view | IPv6 | Post

#7

|

Junior Member

836 posts Joined: Sep 2022 |

The Duitnow transfer limit is RM50k.

Is there any way to withdraw funds in excess of RM50k, e.g. via Banker's Cheque or RENTAS OTC? There does not seem to be any information on this in the website. |

|

|

Apr 13 2023, 05:29 PM Apr 13 2023, 05:29 PM

Return to original view | IPv6 | Post

#8

|

Junior Member

836 posts Joined: Sep 2022 |

QUOTE(cklimm @ Apr 13 2023, 05:03 PM) I doubt Al Rajhi physical bank will entertain Rize, so either do it in multiple days of 50k or, just dont put too much loh. Yeah. Anyway, hesitate to put too much into digital banking. But it would be nice to put say 100k in it as a parking account to earn FD-like rates, pending redeployment of funds when opportunity arises, instead of locking it up directly in FD. Great flexibility |

|

|

Apr 14 2023, 10:36 AM Apr 14 2023, 10:36 AM

Return to original view | IPv6 | Post

#9

|

Junior Member

836 posts Joined: Sep 2022 |

QUOTE(raptor_cZn @ Apr 14 2023, 12:24 AM) Do I need to wait before I can make transfers out after activation and depositing the RM20? Worth to check your font size setting. It might work if you reduce it. The transfer button seems grayed out on my app Yesterday my account number in app was incomplete, displayed on 2 lines, and ending with ... last 3 digits not shown. After reducing the font by one size, the full number reappeared, on one line! It appears that the design of the app is not canggih enough to adapt to suit larger font size, leading to information on the screen being cut off. I don't have this problem with other bank apps, using the bigger font size. Their apps just reduce the font automatically to suit the screen display |

|

|

Apr 14 2023, 10:38 AM Apr 14 2023, 10:38 AM

Return to original view | IPv6 | Post

#10

|

Junior Member

836 posts Joined: Sep 2022 |

QUOTE(robt1013 @ Apr 14 2023, 09:59 AM) Try logging in see if it works.They also didnt advise me of account approved, but I went ahead to log in. After that funded RM20 successfully, and also could apply for debit card. robt1013 liked this post

|

|

|

Apr 14 2023, 04:51 PM Apr 14 2023, 04:51 PM

Return to original view | IPv6 | Post

#11

|

Junior Member

836 posts Joined: Sep 2022 |

QUOTE(xander2k8 @ Apr 14 2023, 12:48 PM) Read the TnC it stated there monthly 🤦♀️ As I'm exploring Rize app, there are several functions which I could not perform due to the click button at the bottom being cut off when I use a larger font size.Possible the app doesn’t have dynamic fonts sizing embedded with it 🤦♀️ Even KDIs is having the same problems with fixed font sizing being programmed in the app So it will always be a bit more mah fun to use the app, as it is easier for me to read with a larger font size e.g. Whatsapp, email, etc. Will have to change the font size each time before and after using Rize |

|

|

Apr 14 2023, 07:08 PM Apr 14 2023, 07:08 PM

Return to original view | IPv6 | Post

#12

|

Junior Member

836 posts Joined: Sep 2022 |

|

|

|

Apr 17 2023, 10:12 AM Apr 17 2023, 10:12 AM

Return to original view | IPv6 | Post

#13

|

Junior Member

836 posts Joined: Sep 2022 |

|

|

|

|

|

|

Apr 19 2023, 11:39 AM Apr 19 2023, 11:39 AM

Return to original view | IPv6 | Post

#14

|

Junior Member

836 posts Joined: Sep 2022 |

QUOTE(joice11 @ Apr 19 2023, 11:18 AM) 1. CAMPAIGN PERIODThis Campaign is valid from 20 March 2023 until 31 August 2023, both dates inclusive ("Campaign Period"). 2. ELIGIBILITY This Campaign is open to all individuals who fulfil the following criteria during the Campaign Period:- a) Individual who does not have any existing products with the Bank; b) Successfully registered with and opened a Commodity Murabahah Savings Account-i (“CMSA”) via rize Application which is available for download in the official Apple App Store, Google Play Store and Huawei App Gallery; c) Activated the CMSA-i by depositing a minimum of RM20 in CMSA-i within 30 days after the CMSA is successfully opened; and d) Applied for and activated the rize Debit Card-i on the rize Application according to the cover letter accompanying the debit card. (henceforth referred to as “Eligible Customer(s)”) Looks like cannot, as per 2d This post has been edited by BWassup: Apr 19 2023, 11:47 AM |

|

|

Apr 19 2023, 03:19 PM Apr 19 2023, 03:19 PM

Return to original view | IPv6 | Post

#15

|

Junior Member

836 posts Joined: Sep 2022 |

|

|

|

Apr 19 2023, 03:47 PM Apr 19 2023, 03:47 PM

Return to original view | IPv6 | Post

#16

|

Junior Member

836 posts Joined: Sep 2022 |

QUOTE(virulence @ Apr 19 2023, 03:38 PM) Under promotions on their website has a link to tnc: This link was posted by someone a bit earlier:https://www.rize.com.my/index.php/promotions# No mention that debit card is compulsory under tnc: https://www.rize.com.my/application/themes/...OTICE_Final.pdf https://www.rize.com.my/application/themes/..._Rize_Final.pdf Maybe the conditions were revised, I don't know, that's why I suggested to check with the call centre. |

|

|

Apr 20 2023, 12:06 PM Apr 20 2023, 12:06 PM

Return to original view | IPv6 | Post

#17

|

Junior Member

836 posts Joined: Sep 2022 |

|

|

|

Apr 20 2023, 02:45 PM Apr 20 2023, 02:45 PM

Return to original view | IPv6 | Post

#18

|

Junior Member

836 posts Joined: Sep 2022 |

|

|

|

Apr 20 2023, 03:27 PM Apr 20 2023, 03:27 PM

Return to original view | IPv6 | Post

#19

|

Junior Member

836 posts Joined: Sep 2022 |

QUOTE(xander2k8 @ Apr 20 2023, 02:53 PM) https://www.uob.com.my/personal/save/saving...ount/index.htmlMaximum Effective Interest Rate on the UOB One Account is 4.00% p.a. at RM100,000 deposit balance, provided customers complete any of the 2 actions per month. Effective Interest Rate of 3.60% p.a. for balance tier above RM100,000 is calculated based on RM125,000 deposit, provided customers complete any of the 2 actions per month. Actions - salary credit, debit card usage, bill payment, fund transfer, direct debit. |

|

|

Apr 20 2023, 04:09 PM Apr 20 2023, 04:09 PM

Return to original view | IPv6 | Post

#20

|

Junior Member

836 posts Joined: Sep 2022 |

QUOTE(xander2k8 @ Apr 20 2023, 03:57 PM) You calculate yourself 🤦♀️ but with 200k I suggest to put the max 100k for it and then 100k in another banks that gives similar interests Most physical banks (i.e. excluding digital banks like Rize) have a limit of 100k to earn high interest rates. Above that, rates drop. And all require you to do some actions too! These features are not unique to UOB.Think UOB 4% on 100k is the highest amongst physical banks currently. RHB Smart Account maximum rate is 3.35% on 100k; OCBC 3.1% on 100k. Super2047 liked this post

|

|

Topic ClosedOptions

|

| Change to: |  0.0835sec 0.0835sec

0.55 0.55

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 2nd December 2025 - 12:55 PM |