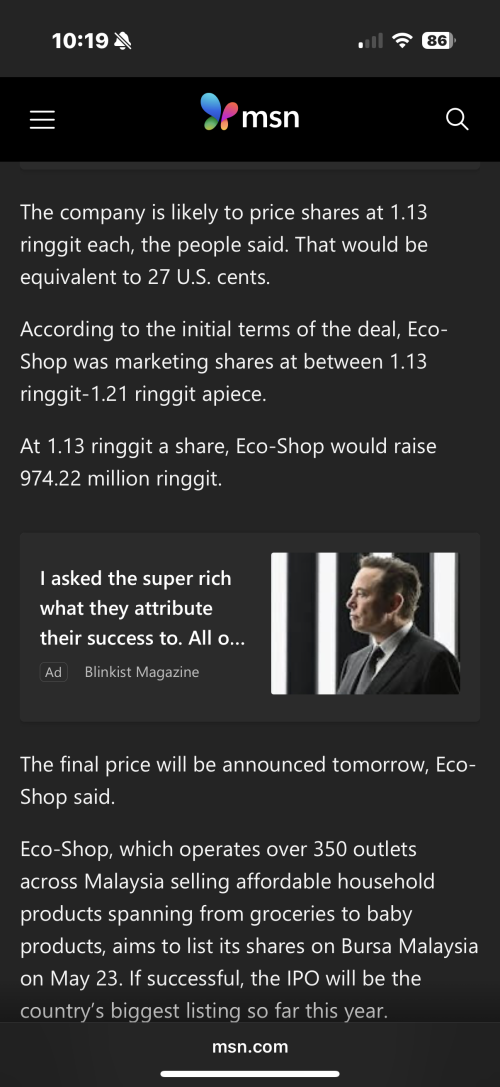

Based on Eco-Shop’s planned debut on the Main Market of Bursa Malaysia at an offer price of RM 1.21 per share (slated for May 23, 2025), here’s a reasoned projection:

1. Comparable IPO first-day “pop.”

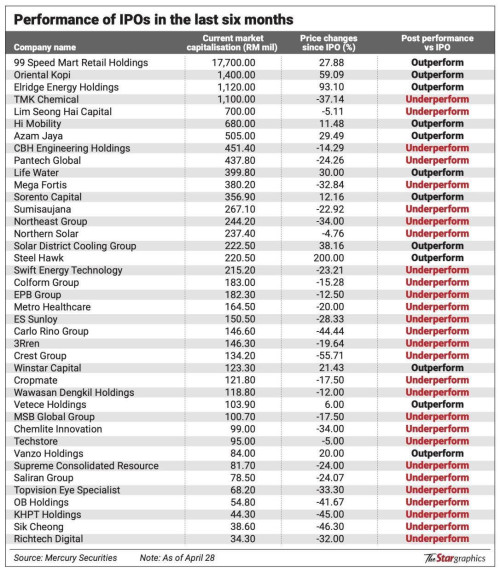

– 99 Speed Mart, a similar discount-retail chain, opened at RM 1.85—about a 12 percent premium over its RM 1.65 IPO price—when it listed in September 2024  .

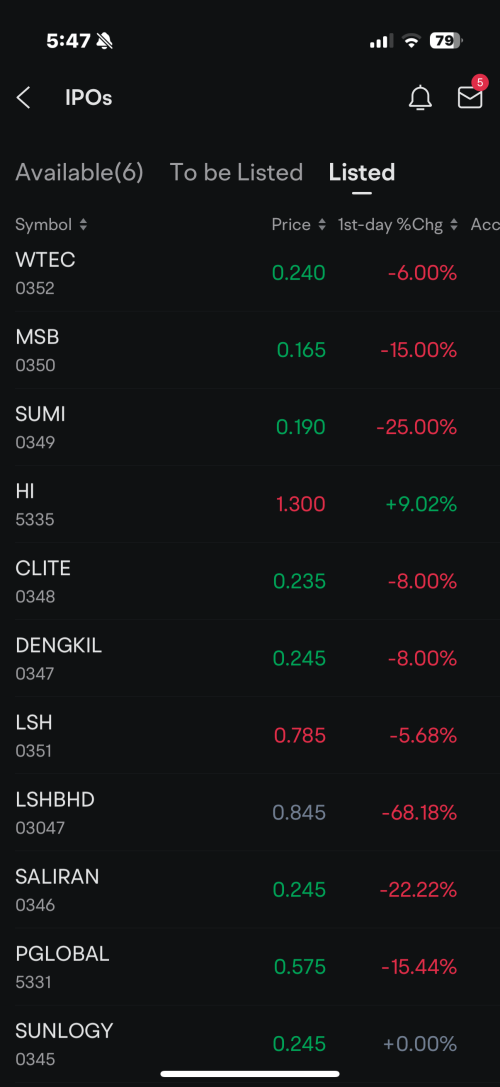

– More broadly, Malaysian IPOs this year have averaged first-day gains of around 7 percent .

2. Predicted opening range.

– 7 percent gain on RM 1.21 → RM 1.30

– 12 percent gain on RM 1.21 → RM 1.36

A midpoint of these (≈9–10 percent) suggests an opening price around RM 1.32–1.34.

3. Is RM 1.21 “reasonable”?

– Eco-Shop’s implied pro-forma price/earnings ratio at RM 1.21 is roughly 39× 2024 earnings .

– By contrast, 99 Speed Mart listed at about 25× 2024 earnings .

– A higher multiple (39× vs. 25×) indicates that Eco-Shop is entering the market at a premium valuation relative to its closest peer—suggesting the IPO price is aggressive, assuming similar growth profiles.

4. Bottom line.

• Opening‐price forecast: RM 1.32–1.34 per share.

• Valuation comment: RM 1.21 is on the high side—Eco-Shop is pricing at a materially richer P/E than 99 Speed Mart. Investors should look for strong execution (store expansion, same-store sales growth) to justify that premium.

Keep an eye on trading momentum in the first hour: if demand mirrors past “dollar-store” listings, you could well see a 10–12 percent opening pop; if sentiment is more muted, gains may be closer to the market average of 7 percent.

IPO: Eco-Shop Marketing Bhd, Main Market

May 1 2025, 10:59 AM

May 1 2025, 10:59 AM

Quote

Quote

0.0141sec

0.0141sec

0.66

0.66

6 queries

6 queries

GZIP Disabled

GZIP Disabled