Outline ·

[ Standard ] ·

Linear+

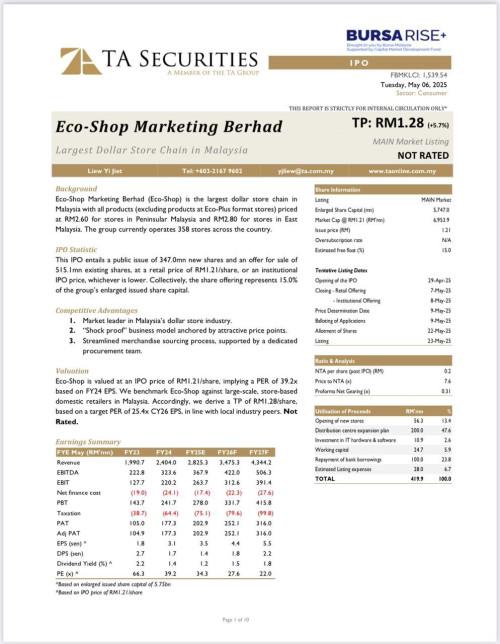

IPO: Eco-Shop Marketing Bhd, Main Market

|

Baik

|

Apr 29 2025, 03:55 PM Apr 29 2025, 03:55 PM

|

|

“Eco-Shop has secured commitments from ten cornerstone investors, collectively subscribing for 90.91 million shares, representing 90.31% of the institutional offering (excluding the Bumiputera portion under Miti).

The cornerstone investors include AHAM Asset Management, Albizia Capital Pte Ltd, Areca Capital Sdn Bhd, Eastspring Investments Bhd, Kairous Equity Sdn Bhd, Kenanga Investors Bhd, Kenanga Islamic Investors Bhd, Lion Global Investors Ltd, RHB Asset Management Sdn Bhd and RHB Islamic International Asset Management Bhd.”

If we refer to MrDiy and 99Speedmart cases, the biggest winner are institutions and non-bumi because Bumi dont have fund for main market IPO. Public allocation goes to non-bumi while MITI allocation goes to institutions.

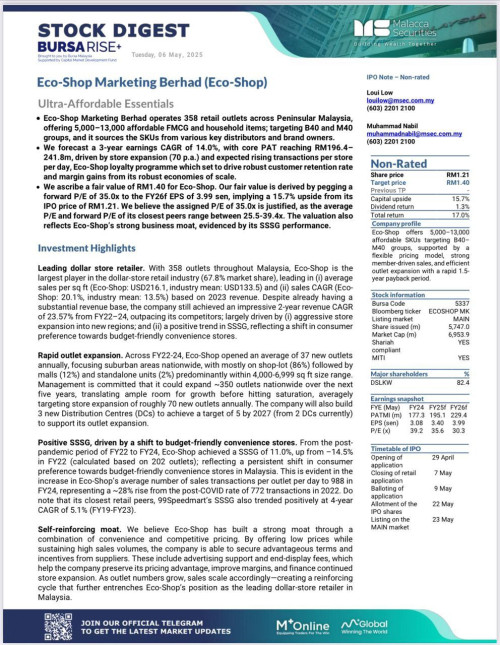

70 more shops to open annually within 5 years.

Smaller shares compared to MrDiy and 99s.

Similar biz like MrDiy and 99s.

RM2.60 products everyone can afford.

Well known/established shop in Malaysia.

Increased inflation will drive people to dollar shop.

Not related to US trade tariff issue.

#tayor

|

|

|

|

|

|

Baik

|

May 2 2025, 02:52 PM May 2 2025, 02:52 PM

|

|

QUOTE(lim47 @ May 2 2025, 09:15 AM) Got any TP out ? Share some This can buy? Not yet, you can check for amoi review of ECO SHOP IPO (Click here)High likely EPF to join like previous ipo - 99speedmart, MrDiy, CTOS. #tayor |

|

|

|

|

|

Baik

|

May 6 2025, 05:05 PM May 6 2025, 05:05 PM

|

|

QUOTE(lim47 @ May 6 2025, 11:44 AM)   Ok can buy, taruh all in Redemption time. MrDiy current rating = BuyBuyBuy. Even EPF chip in more shares. RM1.21 is cheaper than MrDiy & 99speedmarts with more upside possibilities. RM0.20 more income per product from April 2025. Last time they increase in RM0.20 in June 2022 profit rocketed. #tayor |

|

|

|

|

|

Baik

|

May 7 2025, 10:01 AM May 7 2025, 10:01 AM

|

|

MBB 4,500 at 930am from other group.

#tayor

|

|

|

|

|

|

Baik

|

May 9 2025, 07:11 PM May 9 2025, 07:11 PM

|

|

Ballot out.

Congrats to non-bumi & institutions shareholders.

675.368m for institutions fully subscribed

114.94m for public fully subscribed.

#tayor

|

|

|

|

|

|

Baik

|

May 9 2025, 07:12 PM May 9 2025, 07:12 PM

|

|

QUOTE(coyouth @ May 9 2025, 11:18 AM) what do you mean from the other group? other than lowyat forum. |

|

|

|

|

|

Baik

|

May 13 2025, 03:15 PM May 13 2025, 03:15 PM

|

|

PETALING JAYA: Eco-Shop Marketing Bhd has lowered the final retail price for its initial public offering (IPO) to “put more money on the table” for investors, amid soft market conditions.

A source with knowledge of the deal also told StarBiz that private equity firm Creador had to sell its Eco-Shop shares more than it wanted to, in order to meet Bursa Malaysia’s public float requirement of 15%.

Creador, which was previously behind prominent IPOs such as CTOS Digital Bhd and MR DIY Group (M) Bhd, also backs Eco-Shop with a 10% pre-IPO stake.

“Creador wanted to keep a 5% equity interest, but had to sell down 80% of its original stake to make available enough shares for the free float. Post-IPO, it will have a 1.9% stake in Eco-Shop,” according to the source.

Scheduled to be listed on the Main Market on May 23, Eco-Shop saw the shares allocated for the public being subscribed by 1.96 times the amount available.

This represents an overall oversubscription rate of 0.96 times, as reported by Eco-Shop on May 9.

For a highly anticipated IPO that is also the largest listing in over eight months, some market observers said the oversubscription rate could have been bigger.

To put it into perspective, the three companies listed on the Main Market so far this year had seen a better response from retail investors.

The public portion of Sarawak-based telecommunications company Reach Ten Holdings Bhd’s IPO was oversubscribed by 1.85 times, bus operator HI Mobility Bhd (6.57 times) and pipemaker Pantech Global Bhd (44.93 times).

Last year’s largest IPO – 99 Speed Mart Retail Holdings Bhd – was oversubscribed by 3.04 times.

However, to be fair, the stock market was in a better shape then. The current IPO market – to Eco-Shop’s disadvantage – has been soft amid global market volatility.

All nine listings on the ACE Market since March this year had declined on the first trading day.

The global tariff war has affected investor sentiment.

Nonetheless, Eco-Shop received a total of 18,308 applications for 225.2 million shares from the public.

This was despite only 114.94 million shares offered to the public.

At the same time, the response from cornerstone institutional investors including Permodalan Nasional Bhd remained robust, according to the source.

“In fact, the institutional investors wanted more Eco-Shop issue shares. But, the company only offered 15% of the share base as there was no necessity to raise more cash.

“When Eco-Shop went out to institutions, it had a demand of over 1.2 billion shares. But it only had 430 million shares to give out, so it had to cut many investors,” said the source.

When asked about the undersubscription for the retail bumiputra portion, the source said the initial response for Eco-Shop’s IPO was strong.

However, as the US tariff war worsened and weakened the overall market sentiment, the final demand from retail bumiputra investors was only for 38.4 million shares.

This was lower than the 57.47 million shares offered to retail bumiputra investors.

It is noteworthy that companies seeking listing on Bursa Malaysia are required to allocate 12.5% of the enlarged number of issued shares upon listing to bumiputra investors to be approved or recognised by the Investment, Trade and Industry Ministry (Miti).

In the case of Eco-Shop, it obtained a waiver to reduce the requirement to 10%.

“However, in the end, the Miti retail demand was low at only 2.5%, so 7.5% flowed back to the pool,” the source explained.

The unsubscribed bumiputra shares have been clawed back and re-allocated to institutional investors, who have taken up all the shares.

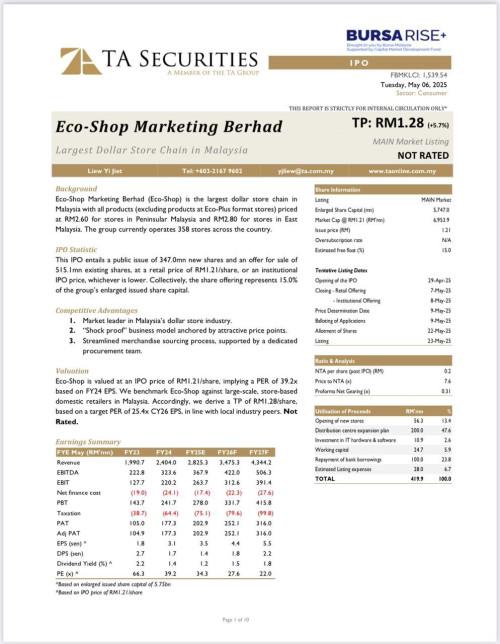

In view of the soft market conditions, Eco-Shop has fixed the final retail price at RM1.13, down by 6.6% from the earlier indicative issue price of RM1.21.

“The original price range was RM1.10 to RM1.21, so the final retail price was fixed at RM1.13.

“It was fixed closer to the lower end of the range to put more money on the table and to make the IPO attractive.”

The source pointed out that Eco-Shop’s IPO was priced 10% below 99 Speedmart’s valuation at IPO.

“The forward price-to-earnings ratio (post-money) for Eco-Shop is estimated at 26 times, compared with 99 Speedmart’s 28 times.”

The more prudent valuation does not signal weak prospects for Eco-Shop going forward, the source said.

“Internal earnings projections showed that the profit after tax in the financial year of 2026 (FY26) will reach RM250mil as compared to RM177.3mil in FY24,” said the source.

“Perhaps, this explains why the company owners do not want to sell too much of the shares,” the source added.

|

|

|

|

|

|

Baik

|

May 20 2025, 06:31 PM May 20 2025, 06:31 PM

|

|

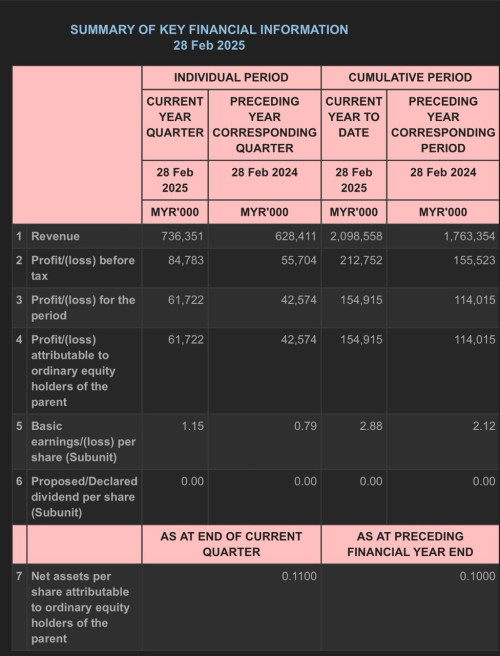

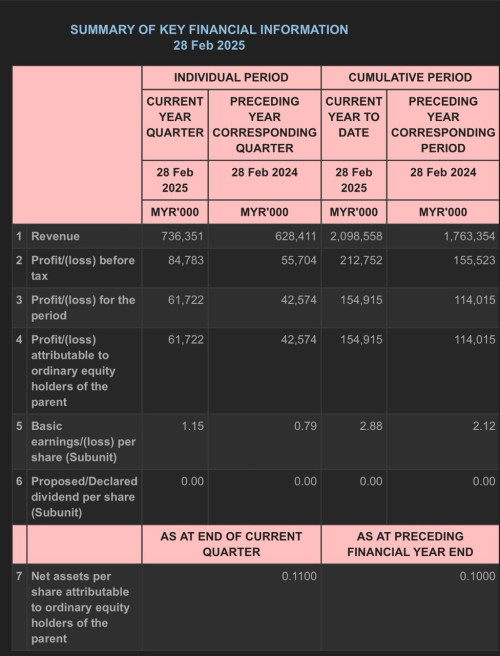

QUOTE(pileepalah @ May 19 2025, 10:55 PM) why? see latest QR.  even peoplelogy today +ve. #tayor |

|

|

|

|

Apr 29 2025, 03:55 PM

Apr 29 2025, 03:55 PM

Quote

Quote

0.0248sec

0.0248sec

0.85

0.85

6 queries

6 queries

GZIP Disabled

GZIP Disabled