Hi guys, year 2021 was my 1st year my income is taxable. PCB monthly is deducted every month according to payslip but i have not done efiling for that year 2021.

Will I kena denda or chase or anything?

Efiling question

Efiling question

|

|

Feb 25 2023, 10:55 AM, updated 3y ago Feb 25 2023, 10:55 AM, updated 3y ago

Show posts by this member only | Post

#1

|

Junior Member

262 posts Joined: Aug 2010 |

Hi guys, year 2021 was my 1st year my income is taxable. PCB monthly is deducted every month according to payslip but i have not done efiling for that year 2021.

Will I kena denda or chase or anything? |

|

|

|

|

|

Feb 25 2023, 11:12 AM Feb 25 2023, 11:12 AM

Show posts by this member only | IPv6 | Post

#2

|

Senior Member

1,154 posts Joined: Oct 2021 |

|

|

|

Feb 25 2023, 11:13 AM Feb 25 2023, 11:13 AM

Show posts by this member only | IPv6 | Post

#3

|

|

Elite

2,553 posts Joined: Jan 2003 |

|

|

|

Feb 25 2023, 11:20 AM Feb 25 2023, 11:20 AM

Show posts by this member only | IPv6 | Post

#4

|

All Stars

24,339 posts Joined: Feb 2011 |

QUOTE(cipollll @ Feb 25 2023, 10:55 AM) Hi guys, year 2021 was my 1st year my income is taxable. PCB monthly is deducted every month according to payslip but i have not done efiling for that year 2021. Yes eventually if you continue never file your tax. Keep in mind you won't get anything back from govt already is you are late to file your tax. You might be needed to pay more if amount tax is supposed to be more than what's taxable.Will I kena denda or chase or anything? |

|

|

Feb 25 2023, 11:58 AM Feb 25 2023, 11:58 AM

Show posts by this member only | IPv6 | Post

#5

|

Junior Member

262 posts Joined: Aug 2010 |

QUOTE(teslaman @ Feb 25 2023, 11:12 AM) Oh really? I think will do that later next monthQUOTE(haturaya @ Feb 25 2023, 11:13 AM) Sure, will ask them.QUOTE(Ramjade @ Feb 25 2023, 11:20 AM) Yes eventually if you continue never file your tax. Keep in mind you won't get anything back from govt already is you are late to file your tax. You might be needed to pay more if amount tax is supposed to be more than what's taxable. Got it. I wonder what is the circumstances that you might actually need to pay more? I see that most of thr time people do efiling and get back some money. |

|

|

Feb 25 2023, 12:07 PM Feb 25 2023, 12:07 PM

Show posts by this member only | IPv6 | Post

#6

|

All Stars

24,339 posts Joined: Feb 2011 |

QUOTE(cipollll @ Feb 25 2023, 11:58 AM) Oh really? I think will do that later next month If you are doing extra part time or own business.Sure, will ask them. Got it. I wonder what is the circumstances that you might actually need to pay more? I see that most of thr time people do efiling and get back some money. This post has been edited by Ramjade: Feb 25 2023, 12:07 PM |

|

|

|

|

|

Feb 25 2023, 12:41 PM Feb 25 2023, 12:41 PM

Show posts by this member only | Post

#7

|

Senior Member

1,520 posts Joined: May 2008 |

Don’t delay the missed filing year. There would be a small fine if any. But not that significant in early stage. There was one year I was 6 months late in filing, and still get refund.

I think for people with PCB, the fine would not be as harsh as people who pay tax after filing. |

|

|

Feb 25 2023, 06:28 PM Feb 25 2023, 06:28 PM

Show posts by this member only | IPv6 | Post

#8

|

Senior Member

5,542 posts Joined: Aug 2011 |

QUOTE(cipollll @ Feb 25 2023, 10:55 AM) Hi guys, year 2021 was my 1st year my income is taxable. PCB monthly is deducted every month according to payslip but i have not done efiling for that year 2021. No denda if you have not underpaid via PCB. I also have pcb deduction since 2017 but only filed first time ever in 2020. I filed for the previous years in 2020, I got tax refunds in fact! LHDN gave me back money as the pcb deduction was more than what I was required to pay.Will I kena denda or chase or anything? However, if your pcb deduction is below your actual tax payable, you will kena denda. Example pcb deduction RM1k but actual payable is rm1.1k. You will have to pay back the rm100 difference together with some penalties (not sure of the specific of the penalty, but it’s only on the amount of difference). Edit: Also, if you same employer during the year annd no other source of income, and pay via pcb, you DO NOT need to file your taxes. You can, but not required. You should anyway since you will get refund. https://phl.hasil.gov.my/pdf/pdfam/PCB_CUKAI_MUKTAMAD.pdf This post has been edited by contestchris: Feb 25 2023, 06:30 PM |

|

|

Feb 25 2023, 07:25 PM Feb 25 2023, 07:25 PM

Show posts by this member only | Post

#9

|

Junior Member

174 posts Joined: Feb 2019 |

Next month open just isi jer last year punya.

Ayam think can isi up to 3-4 years ago punya, as long as u got form detail and whatsoever proof for refund. This post has been edited by marukopi: Feb 25 2023, 07:26 PM |

|

|

Feb 26 2023, 08:10 AM Feb 26 2023, 08:10 AM

|

Junior Member

540 posts Joined: Mar 2016 |

U need to call lhdn or go to their office .

Will probably get fined |

|

|

Feb 26 2023, 09:34 PM Feb 26 2023, 09:34 PM

Show posts by this member only | IPv6 | Post

#11

|

Senior Member

1,154 posts Joined: Oct 2021 |

QUOTE(cipollll @ Feb 25 2023, 11:58 AM) Oh really? I think will do that later next month Yes u can declare undeclared income from previous years, small issue.Sure, will ask them. Got it. I wonder what is the circumstances that you might actually need to pay more? I see that most of thr time people do efiling and get back some money. |

|

|

Feb 26 2023, 10:39 PM Feb 26 2023, 10:39 PM

|

Junior Member

262 posts Joined: Aug 2010 |

A bit of mixed opinion from the comments, similar mixed answers from people I know that I asked in real life.

but I suppose I trust reply #8 the most as the guy includes a very legit reference. Thanks everyone. This post has been edited by cipollll: Feb 26 2023, 10:40 PM |

|

|

Feb 27 2023, 01:12 AM Feb 27 2023, 01:12 AM

Show posts by this member only | IPv6 | Post

#13

|

Senior Member

1,389 posts Joined: Apr 2009 |

|

|

|

|

|

|

Mar 2 2023, 02:09 PM Mar 2 2023, 02:09 PM

|

Senior Member

1,154 posts Joined: Oct 2021 |

|

|

|

Mar 11 2025, 07:32 PM Mar 11 2025, 07:32 PM

|

Newbie

28 posts Joined: Mar 2014 |

|

|

|

Mar 11 2025, 09:26 PM Mar 11 2025, 09:26 PM

Show posts by this member only | IPv6 | Post

#16

|

Junior Member

267 posts Joined: Jul 2012 |

(deleted) replying to an old thread... sigh

This post has been edited by mr_geforce: Mar 11 2025, 09:27 PM |

|

|

Mar 12 2025, 07:07 AM Mar 12 2025, 07:07 AM

|

Senior Member

3,832 posts Joined: Oct 2011 |

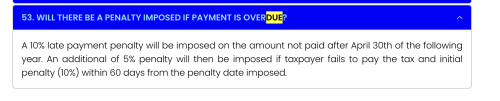

QUOTE(pkh93 @ Mar 11 2025, 07:32 PM)  Hey guys, does this mean as long as I pay my tax before April next year, I won't be charge any penalty for late payment? pkh93 liked this post

|

|

|

Mar 12 2025, 08:41 AM Mar 12 2025, 08:41 AM

Show posts by this member only | IPv6 | Post

#18

|

Junior Member

318 posts Joined: Nov 2011 |

QUOTE(cipollll @ Feb 25 2023, 10:55 AM) Hi guys, year 2021 was my 1st year my income is taxable. PCB monthly is deducted every month according to payslip but i have not done efiling for that year 2021. Well, it is your duty to report your tax, and you may lose refund or you may need to pay more, depending on your contributions and deduction. Start to submit now and be prepared to be fined. A fine and or a call to provide more information might happen.Will I kena denda or chase or anything? |

| Change to: |  0.0179sec 0.0179sec

0.50 0.50

5 queries 5 queries

GZIP Disabled GZIP Disabled

Time is now: 5th December 2025 - 06:03 AM |