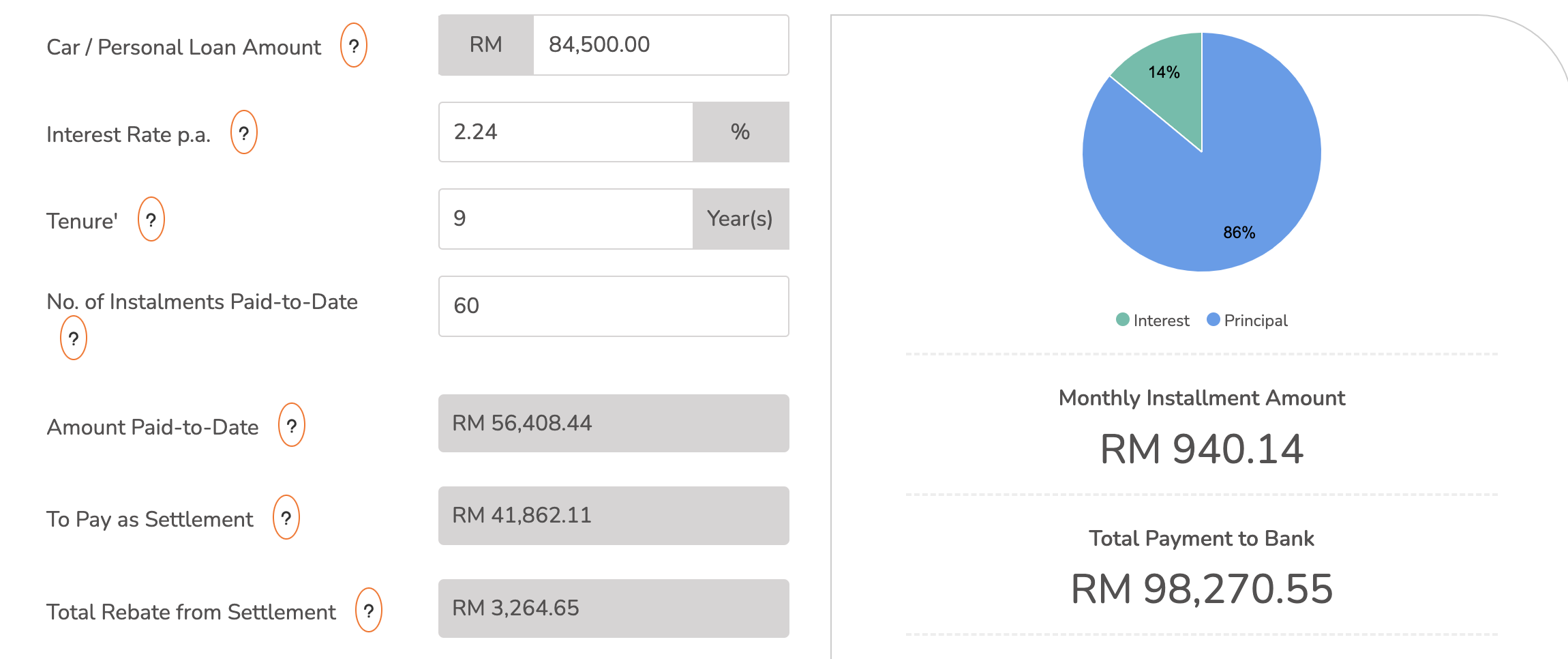

I have a "normal" fixed rate car loan with Affin, 2.24% for 9 years. Paying RM941/month.

> [((2.24% * 9 years) * RM84.5k) + RM84.5k] / 108 months = RM941/month

The principal component is RM84.5k, while the interest component is RM1.89k a year (or RM17.03k over 9 years).

Let's say I settle at the end of year 5.

Total principal paid: 5/9 * RM84.5k = RM46.94k

Total interest paid: RM1.89k * 5 years = RM9.45k

Balance principal remaining = RM84.5k - RM46.94k = RM37.56k

Balance interest remaining = RM1.89k * 4 years = RM7.56k

Some questions:

1) Are there any penalty for early settlement under a normal, conventional fixed-rate hire purchase?

2) Is my calculation above accurate? Is it accurate to say both the principal and interest components are divided equally over the 108 months?

3) Assuming my calculation is accurate, how much do I need to settle at the end of year 5, assuming I sell the car at the end of year 5? Is it RM37.56k (balance principal remaining), or RM37.56k + RM7.56k (balance principal + interest)....or something else? Any penalty? Any "discount" for the interest already paid in the previous years?

Thanks!

Early settlement car loan - how it works?

Feb 19 2023, 12:56 PM, updated 3y ago

Feb 19 2023, 12:56 PM, updated 3y ago

Quote

Quote

0.0175sec

0.0175sec

0.54

0.54

5 queries

5 queries

GZIP Disabled

GZIP Disabled