Hi,

I'm looking for feedbacks (disagreements welcomed) on the idea of saving tax by buying investment-linked insurance.

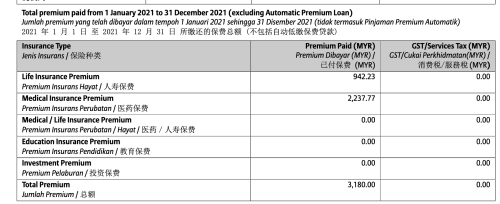

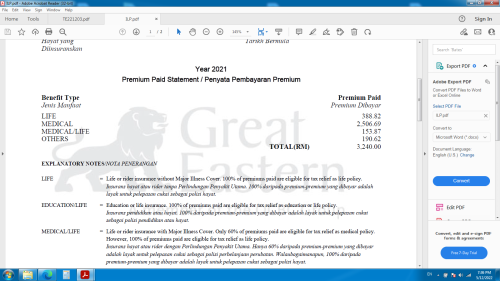

In an annual individual tax assessment for non-public servant, we are eligible for the following tax relief:

- Life insurance premium (Restricted to RM3,000)

- Education and medical insurance (INCLUDING not through salary deduction, restricted to RM3,000)

Let's say I'm in the tax bracket of 21%.

Case A

I max out the life and medical insurance contribution using investment-linked insurance:

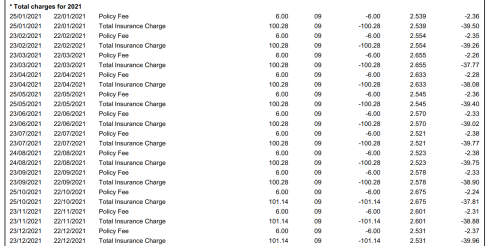

- I pay RM6,000 in cash on insurance annually

- In return, I save a potential of RM6,000 * 0.21 = RM1,260 of tax annually

- Even when the insurance premium is expensive, most of the premium paid will become "cash value" that accumulates into the future (subject to market condition), which can be used to offset the increasing cost of insurance.

Remark: I pay less tax + am able to save for the future.

Case B

I choose to buy cheaper term life and medical insurance (roughly ~RM100 per month in total at my age):

- I pay RM1,200 in cash on insurance annually

- I save RM4,800 compared to Case A, but they are taxed at RM4,800 * 0.21 = RM1,008

- I have spare cash of RM4,800 - RM1,008 = RM3,792

Remark: I have cash in my pocket, but also a sum of tax has to be paid for them.

Thoughts

In Case B, even if I were to invest the spare cash of RM3,792, I presume it will have to do very well to offset the annual tax payment of RM1,008. In contrast to Case A, all the premium payments, less cost of insurance, will be invested (without tax) into the insurer's fund.

What are the pros and cons in each case?

Insurance should only be purchased as a protection, and not for investment/saving/tax reduction, but this scenario really pique my curiosity.

Insurance Saving tax using investment-linked insurance, Reduce tax + saving for the future?

Dec 5 2022, 06:15 PM, updated 4y ago

Dec 5 2022, 06:15 PM, updated 4y ago

Quote

Quote

0.0174sec

0.0174sec

1.02

1.02

5 queries

5 queries

GZIP Disabled

GZIP Disabled