I'm not a CIMB personnel so I suggest you call them to really clarify but from my understanding.

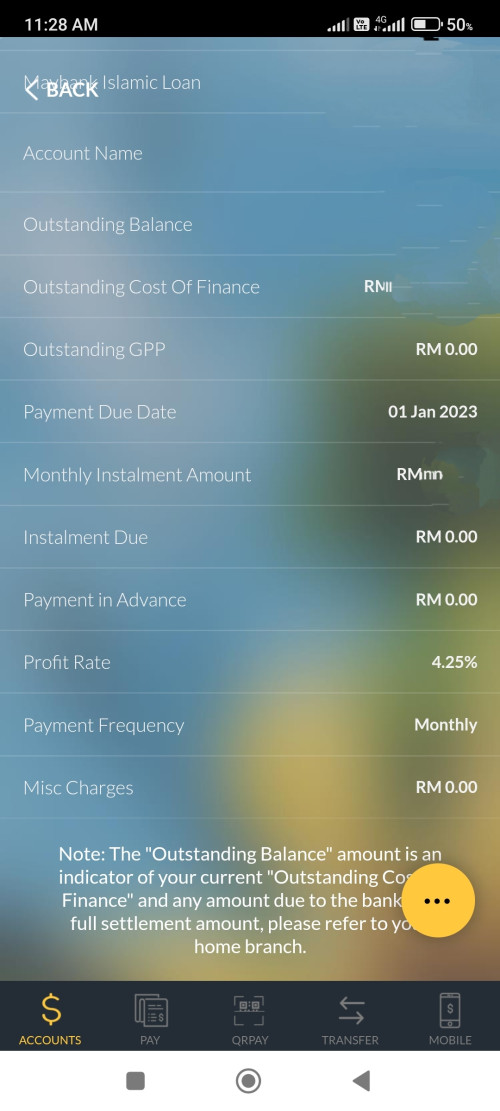

Current Balance is what you still owe which is RM40k+

Available Balance presumably is the extra cash you've parked inside which you can withdraw if you choose to which is RM123k+

New Limit is the overall loan, I assume to be Current Balance + Available Balance = RM164k+. Meaning to say if you withdraw all your Available Balance, this sum is how much you owe the Bank.

Limit Reduction Amount is how much your principal has reduced for that month. Means for that month after considering the interest saved from the extra cash that you've parked inside + the monthly loan payment, the overall principle reduced by RM2k+.

If they want to make full settlement, call the bank for the amount to be paid but it should be the RM40k+ amount assuming that you don't want to withdraw the Available Balance.

Call the bank to be sure, but I think that's what the terms mean.

If my parent already has extra cash like the amount in Available Balance, she still unable to use this amount to full deduct the loan principal & interest because of the Limit Reduction? Or she has to request the bank to increase the Limit Reduction Amount in order to fully include the Available Balance & the monthly payment to deduct the loan principal & interest?

Nov 13 2022, 02:44 PM, updated 4y ago

Nov 13 2022, 02:44 PM, updated 4y ago

Quote

Quote

0.0228sec

0.0228sec

0.18

0.18

5 queries

5 queries

GZIP Disabled

GZIP Disabled