Dear All,

Some time back, PM announced 50% stamp duty exemption for houses >RM500k, <RM1m.

https://www.edgeprop.my/content/1903062/sta...00-%E2%80%94-pm

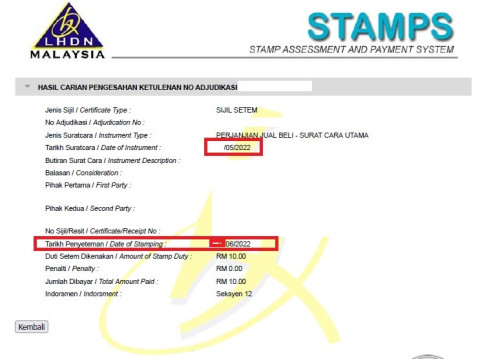

“The exemption is for sale and purchase agreements completed from June 1, 2022 to December 2023,” he said.

What does "completed" in the above context mean? Date of SPA signing or date of stamping at LHDN?

If someone's SPA is dated 31/5 but is stamped in June, is it still possible to get a refund for the stamp duty paid?

TIA.

WTA stamp duty exemption (>500k) criteria

Oct 12 2022, 10:48 AM, updated 3y ago

Oct 12 2022, 10:48 AM, updated 3y ago

Quote

Quote

0.0164sec

0.0164sec

0.48

0.48

5 queries

5 queries

GZIP Disabled

GZIP Disabled