Here to understand a bit about your broker, how much is their commission per round trip and what is the charges for the platform to trade FCPO in Malaysia. I've been trading CME and CBOT products for a while an interested to look into FCPO.

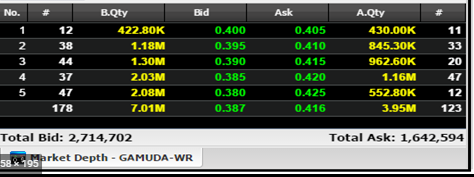

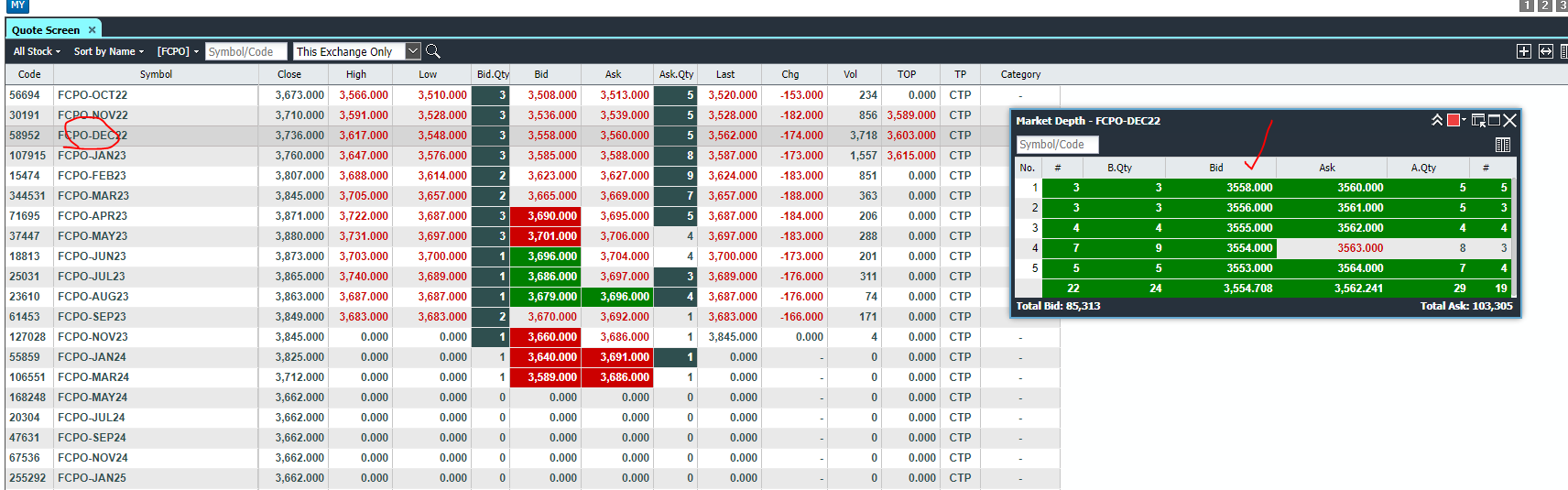

Also, if anyone who is using ladder/DOM to trade FCPO, could you guys share a screenshot of your DOM with FCPO on its active hours. I'm interested to see how thick or thin the volume is.

Thanks in advance.

What broker/platform are you using to trade FCPO?

Sep 24 2022, 10:39 AM, updated 4y ago

Sep 24 2022, 10:39 AM, updated 4y ago

Quote

Quote

0.0212sec

0.0212sec

0.21

0.21

5 queries

5 queries

GZIP Disabled

GZIP Disabled