IPO: Cosmos Technology International Berhad

|

|

Sep 15 2022, 07:09 PM Sep 15 2022, 07:09 PM

Return to original view | IPv6 | Post

#1

|

Junior Member

88 posts Joined: Apr 2012 |

|

|

|

Sep 24 2022, 10:45 AM Sep 24 2022, 10:45 AM

Return to original view | IPv6 | Post

#2

|

Junior Member

88 posts Joined: Apr 2012 |

|

|

|

Oct 4 2022, 01:49 PM Oct 4 2022, 01:49 PM

Return to original view | IPv6 | Post

#3

|

Junior Member

88 posts Joined: Apr 2012 |

*Comments from Affin:-*

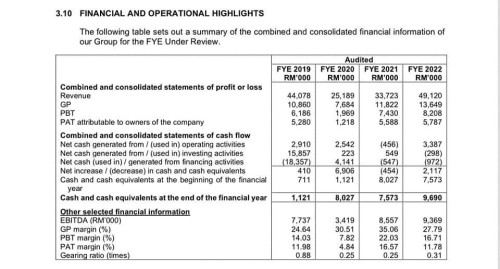

Cosmos is an integrated water technology solutions provider for fluid control products and manufacturer of fabricated metal products for the water, wastewater and oil and gas (O&G) industries. · It is the certified partner and solutions partner of Siemens Malaysia for electronic and ultrasonic flowmeters and official partner of LACROIX Sofrel for dataloggers and centralised monitoring systems. · Under the 12th Malaysia Plan, a total of RM26bn has been allocated for water infrastructure projects to improve water supply coverage and services as well as reducing the national NRW level. · Good prospects for Cosmos to secure contracts to upgrade flowmeters for existing water treatment plants (WTPs) and supply to new WTPs to be built such as the RM4bn Rasau Water Supply Scheme. · At the IPO price of RM0.35, Cosmos is valued at a FY22 core PER of 12x, below the 2021 PER range of 13-24x for other Bursa Malaysia-listed contractors for water-related projects, ie, Salcon and Taliworks. · *At FY22 PER of 20x (close to the average of historical peer PER range), Cosmos share price is valued at RM0.58.* Regards, Loong Chee Wei Senior Associate Director, Equity Research Affin Hwang Investment Bank Bhd | Research |

| Change to: |  0.0351sec 0.0351sec

1.22 1.22

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 24th December 2025 - 01:20 PM |