Outline ·

[ Standard ] ·

Linear+

USD/MYR and SGD/MYR

|

prophetjul

|

Jul 11 2023, 09:54 AM Jul 11 2023, 09:54 AM

|

|

QUOTE(umboy @ Sep 7 2022, 11:19 PM) Can anyone enlighten me what happened for the past few minutes According to the graph from google, in the past few minutes, ringgit suddenly appreciate against SGD and USD 1 SGD = 2.97 MYR 1 USD = 4.19 MYR Then it return to normal now It seems I can’t convert at that rate Wonder what was going in  Throw back!  |

|

|

|

|

|

prophetjul

|

Jul 11 2023, 09:55 AM Jul 11 2023, 09:55 AM

|

|

QUOTE(TOS @ Jul 11 2023, 09:43 AM) You sound like a broken record! (pun intended)  |

|

|

|

|

|

prophetjul

|

Oct 7 2023, 08:00 AM Oct 7 2023, 08:00 AM

|

|

QUOTE(gashout @ Oct 7 2023, 03:34 AM) Our reserve is paltry as compared to Singapores reserve. This shows how much money the country has been squandered by certain individuals. Especially the vast natural resources And misuse and squandering of natural resources is irreversible. Light in Msia is diminishing by the day. |

|

|

|

|

|

prophetjul

|

Feb 21 2024, 09:57 AM Feb 21 2024, 09:57 AM

|

|

QUOTE(AVFAN @ Feb 21 2024, 09:40 AM) RM breaking new lows every day. congrats to USD, SGD, gold holders. even viet dong is gaining big time against RM. the trend will continue as nobody seems interested to explain the real reasons, let alone how to deal with it! Thank you. Thank you.  |

|

|

|

|

|

prophetjul

|

Feb 22 2024, 10:16 AM Feb 22 2024, 10:16 AM

|

|

QUOTE(ericlaiys @ Feb 22 2024, 09:42 AM) That is what they said LAST YEAR!  |

|

|

|

|

|

prophetjul

|

Feb 22 2024, 04:03 PM Feb 22 2024, 04:03 PM

|

|

QUOTE(CommodoreAmiga @ Feb 22 2024, 03:20 PM) BNM unlikely cut rates. Unless US drop till very low. BNM OPR will likely remain unchanged until next year. I think US drop won't be as fast as it rise. i agree that BNM is unlikely to cut rates so soon. The disparity between US interest rate and MY OPR is 2 to 2.5%. Before that MY was much higher than U.S. It has some way to go. |

|

|

|

|

|

prophetjul

|

Feb 23 2024, 10:43 AM Feb 23 2024, 10:43 AM

|

|

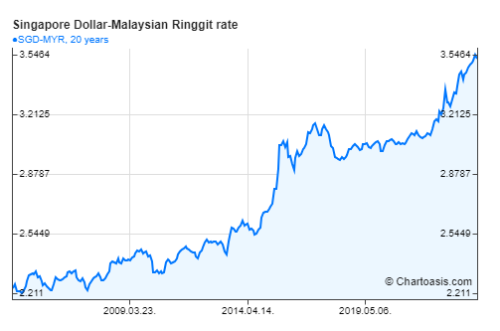

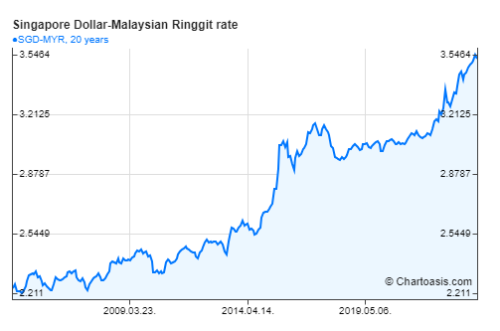

QUOTE(BboyDora @ Feb 23 2024, 10:37 AM) first time see currency movement? of course it will up and down up and down . down abit no need to scare. it will go up to RM 4 or RM 4.5 by year end 2024. SGD never wrong for the past 20 years. (uptrend)Well said.  But actually last 50 years.  This post has been edited by prophetjul: Feb 23 2024, 10:44 AM This post has been edited by prophetjul: Feb 23 2024, 10:44 AM |

|

|

|

|

|

prophetjul

|

Feb 23 2024, 10:59 AM Feb 23 2024, 10:59 AM

|

|

QUOTE(BboyDora @ Feb 23 2024, 10:50 AM) ya. i follow your footstep. change a bit everytime since RM 3.25 = 1 SGD. i saw the same chart SGD/MYR in 2008. When it was 2.3ish. I was convinced to hedge against the SGD there and then. However, i didn't expect to 3.5 after only 15 years! |

|

|

|

|

|

prophetjul

|

Mar 6 2024, 11:33 AM Mar 6 2024, 11:33 AM

|

|

QUOTE(CommodoreAmiga @ Mar 6 2024, 11:16 AM) No one can answer you. Dead cat can bounce a bit, but long term is sure win. Our Minister say RM can go back RM4.5 to USD 1 end of the year. You trust? Last year economist also say RM will go back to RM 4.30 in December...LAST YEAR. Now RM 4.8 already. Look at SGD vs RM since Merdeka. If too long, look at the chart the last 20 years only. https://www.chartoasis.com/sgd-myr-forex-ch...-20-years-cop0/ I have absolute confidence in Singapore success and have absolute confidence there is no saving Malaysia. How convicted you are? If you are convicted in either direction, you will take the appropriate action for your conviction. That long term chart is not going to change any time soon. It is a reflection of the culture and leadership of the 2 nations with regards to prosperity and nation building in respect of globalisation. i started in 2008/09 and never looked back. i only looked at this long term chart now and again as a reminder of the future. |

|

|

|

|

|

prophetjul

|

Mar 6 2024, 11:48 AM Mar 6 2024, 11:48 AM

|

|

QUOTE(CommodoreAmiga @ Mar 6 2024, 11:39 AM) You are probably looking back now and laughing gleefully...damn me jeles. There are 2 clear currencies which have appreciated against the Runggit sustainably over time. CHF and SGD. Invested In SGD cos we are nearby. USD is clear. That's why i bought gold. All these were to hedge against the useless Runggit when i get old. This post has been edited by prophetjul: Mar 6 2024, 11:49 AM |

|

|

|

|

|

prophetjul

|

Mar 6 2024, 03:51 PM Mar 6 2024, 03:51 PM

|

|

QUOTE(Ramjade @ Mar 6 2024, 03:38 PM) Nothing to depress. You have been with me since I started my journey. My guess is like me, you move out your wealth into Singapore already? i was asking about tax implication of foreign derived income. What are your thoughts about this? https://forum.lowyat.net/index.php?showtopi...ost&p=109282328This post has been edited by prophetjul: Mar 6 2024, 03:53 PM |

|

|

|

|

|

prophetjul

|

Mar 6 2024, 05:40 PM Mar 6 2024, 05:40 PM

|

|

QUOTE(MGM @ Mar 6 2024, 04:51 PM) U r >60yo n has few millions in epf right? No lah. I am B40 poorfaq. QUOTE(CommodoreAmiga @ Mar 6 2024, 05:18 PM) Boss, i dunno boss. I am in process of moving assets out of Malaysia. Whatever little i earn outside, i just keep it there only. So this haven't cross my mind yet. Another question is, if you trade stocks, do you need to declare? If i bring back some money next time for pockey money once in a while....how? Any expert? Now i am keeping in my broker account only. Also thinking of having another SG broker for SG stocks...don't wanna put all my eggs in one broker. One for US stocks, one for SG stocks. Any recommend SG broker? My questions too. i did not bring anything back. i do DRIP on stocks all this while. No money repatriate to Msia. Next time i bring back a bit for expenses. How? |

|

|

|

|

Jul 11 2023, 09:54 AM

Jul 11 2023, 09:54 AM

Quote

Quote

0.0174sec

0.0174sec

0.60

0.60

7 queries

7 queries

GZIP Disabled

GZIP Disabled