I stumbled upon this just now

cimb currency exchange

Apparently it is cheaper than midvalley rate for sgd... I didn't check other currencies though

USD/MYR and SGD/MYR

USD/MYR and SGD/MYR

|

|

Oct 14 2025, 09:13 AM Oct 14 2025, 09:13 AM

Return to original view | IPv6 | Post

#1

|

Senior Member

5,489 posts Joined: Feb 2009 |

I stumbled upon this just now

cimb currency exchange Apparently it is cheaper than midvalley rate for sgd... I didn't check other currencies though |

|

|

|

|

|

Oct 14 2025, 10:19 AM Oct 14 2025, 10:19 AM

Return to original view | IPv6 | Post

#2

|

Senior Member

5,489 posts Joined: Feb 2009 |

Yup yup, it's more convenient to those who will be travelling by flight since the collection location also limited

|

|

|

Nov 15 2025, 01:04 AM Nov 15 2025, 01:04 AM

Return to original view | IPv6 | Post

#3

|

Senior Member

5,489 posts Joined: Feb 2009 |

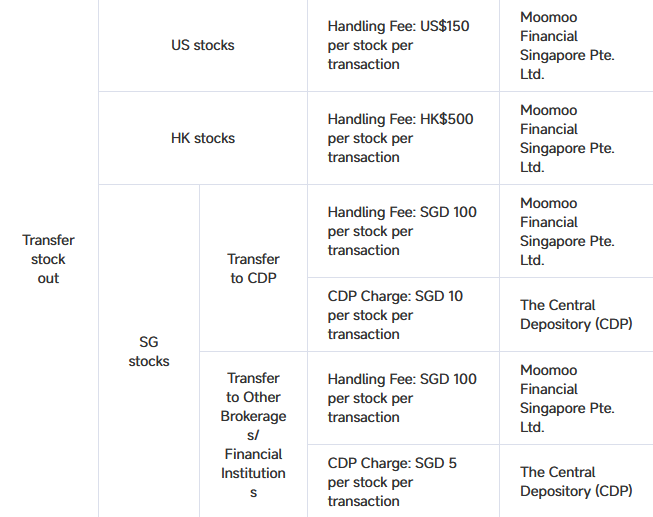

QUOTE(Medufsaid @ Nov 14 2025, 10:53 PM) for those who've invested in SGX stocks, what if you transfer out to a local broker like Moomoo Malaysia https://www.moomoo.com/sg/support/topic5_590. giving an example of Moomoo SG as per below, no idea how much your sg broker will charge Please forgive my ignorance. Let's say I buy 1 lot of DBS via Moomoo SG and I have DBS Vickers account. If I want to transfer my DBS shares to my CDP account, I need to pay 110 SGD (100 to Moomoo SG and 10 to CDP), and the dividend that I will be receiving in the future will continue to credit to my Moomoo SG account, right? anyway i did ask moomoo sg before, no discount if transfer out to moomoo MY |

|

|

Nov 21 2025, 03:56 PM Nov 21 2025, 03:56 PM

Return to original view | IPv6 | Post

#4

|

Senior Member

5,489 posts Joined: Feb 2009 |

Not sure if this document help - from lhdn 5.1.4 Foreign income received in Malaysia that has been taxed by other jurisdictions either through withholding tax or income tax, are eligible for bilateral or unilateral tax credit under the provisions of sections 132 and 133 of the ITA 1967. 5.2.2.1 All foreign income other than partnership income received in Malaysia by a resident individual from 1 January 2022 until 31 December 2026 is exempt from tax provided the income has been subjected to tax in the country of origin. This policy then got extended to 31st December 2036 during budget 2025. source from The Edge Wedchar2912 liked this post

|

|

|

Nov 21 2025, 10:40 PM Nov 21 2025, 10:40 PM

Return to original view | IPv6 | Post

#5

|

Senior Member

5,489 posts Joined: Feb 2009 |

QUOTE(Hansel @ Nov 21 2025, 07:17 PM) So, gentlemen,... since, by their single-tier taxation system, IRAS does not tax further on stock and REIT dividends, do these dividends fall under the bolded part of section 5.2.2.1 above ? If the answer is a YES - then we can remit back as much as we wanted to and show the source of these funds, being dividends. BUT,.... if the answer is a NO - then do not remit back anymore and then no need to declare any remittances. Bro prophetjul,... I think you have a good knowledge abt this. Can you kindly educate us ? QUOTE(dwRK @ Nov 21 2025, 07:27 PM) I found this in the LHDN document.Example 11 Foreign income received in Malaysia is not taxable due to the taxation’s system in the country of origin. Amansyah, a Malaysian resident, worked as a petroleum welder with a company based in Brunei starting from 2020. He receives employment income from Brunei. Based on Brunei's taxation system, employment income received is not subjected to tax. In 2022, Amansyah plans to bring back his income to Malaysia. Income received from employment in Brunei is not subject to tax in Brunei. Therefore, the employment income brought into Malaysia by Amansyah is exempted from tax in Malaysia as the conditions under P.U. (A) 234/2022 and this Guideline has been fulfilled. Since dividend is considered income based on the definition in our income tax agreement, I supposed if REIT dividend is tax exampted in the country that you (as a foreigner) invested, it should continue to be tax exampted when you remit it back to Malaysia? |

|

|

Yesterday, 04:53 PM Yesterday, 04:53 PM

Return to original view | IPv6 | Post

#6

|

Senior Member

5,489 posts Joined: Feb 2009 |

QUOTE(xander2k8 @ Dec 12 2025, 03:38 PM) Strong economy has tight or stagnant currency movements 🤦♀️ ie 2 richest countries in the world starting with S Unlike Malaysia wild swings up and down QUOTE(xander2k8 @ Dec 12 2025, 03:38 PM) Strong economy has tight or stagnant currency movements 🤦♀️ ie 2 richest countries in the world starting with S Many Malaysians are obsessed with ringgit appreciation to a degree that it is almost pathological. Unlike Malaysia wild swings up and down |

|

|

Yesterday, 08:55 PM Yesterday, 08:55 PM

Return to original view | IPv6 | Post

#7

|

Senior Member

5,489 posts Joined: Feb 2009 |

|

| Change to: |  0.0170sec 0.0170sec

0.61 0.61

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 13th December 2025 - 01:32 AM |