I dropped by the Tujuh Residence sales gallery to check out how it is doing, and an external sales agent (not MRCB own sales) there informed me that they have sold around 20-30% units after launching for 3 months. However, I am skeptical because of the following reasons:-

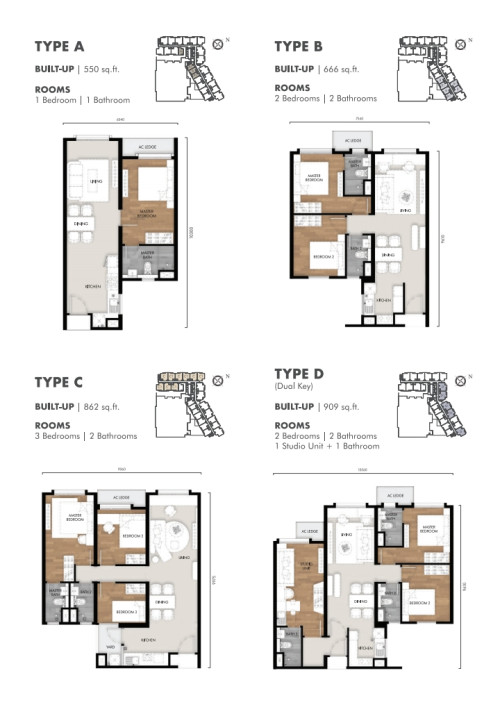

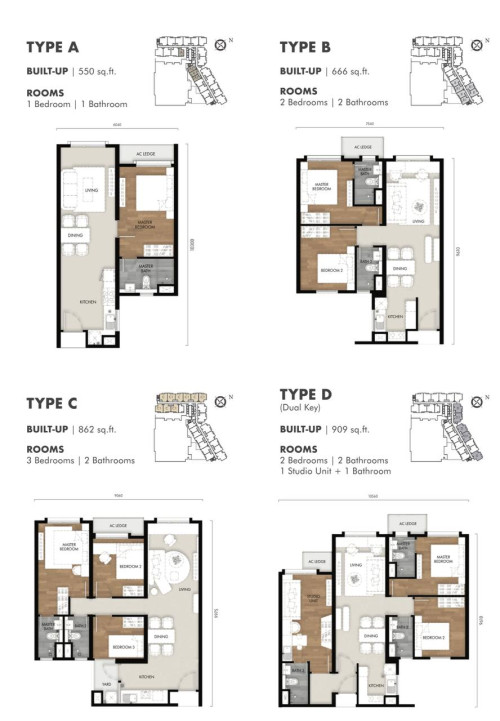

This is a leasehold commercial title development, with basic looking facade, 9 storey car park with no speed ramp, and priced around RM800psf after rebates which is higher than both Mahogany (around RM660psf) and Sunway D’hill (around RM670psf).

The only real selling point for now is the MRT access, and it appears that an uncovered walkway will be built along the MRT track towards the Kwasa Sentral MRT station (marked in yellow). This will make the walking distance to the station around 300+m. However, I noticed from the scale model that there is a bushy slope between the road outside Tujuh Residence and the proposed walkway (marked in red), and there is no proper pathway planned to connect them.

The sales agent told me that this is beyond the developer’s control and remarked that even if there is no proper pathway, people can just walk through the bushy slope to make their own path. Seriously? You expect residents for a development that is selling at a premium price to walk through a bushy slope to reach their uncovered walkway?

I hope that this is just a mistake in the scale model and an uninformed sales agent. Otherwise it is simply unbelievable that a JV between two GLCs backed by EPF, after having so many years to “plan” a township on 2,257 acres of vacant land, still couldn’t figure out how to build a simple proper walkway for their main selling point.

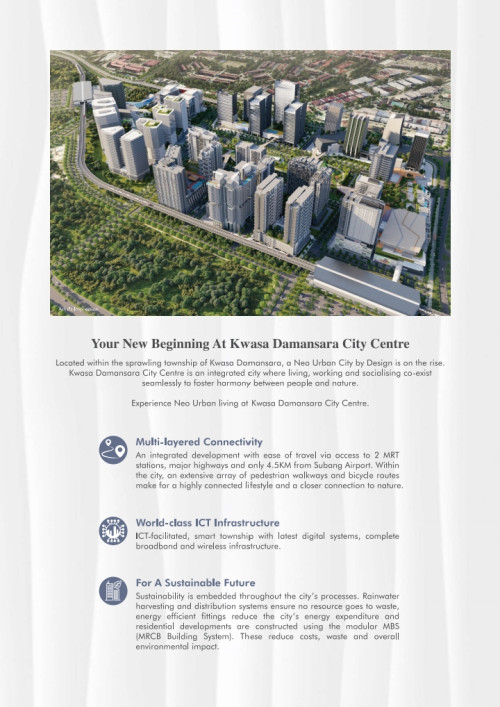

A good first launch could have had a chance of revitalizing interest in the Kwasa Damansara City Centre (KDCC) masterplan, but Tujuh has turned out to be a disappointment for me. The future plans for KDCC also appears to be unrealistic under current economic situation. I think the whole KDCC plan needs a complete revamp or change of leadership for there to be any chance for it to be successful.

Aug 15 2023, 09:12 AM

Aug 15 2023, 09:12 AM

Quote

Quote

0.0255sec

0.0255sec

0.84

0.84

6 queries

6 queries

GZIP Disabled

GZIP Disabled