Here's something else. In general, when do you want to sell a stock?

The owner issue.

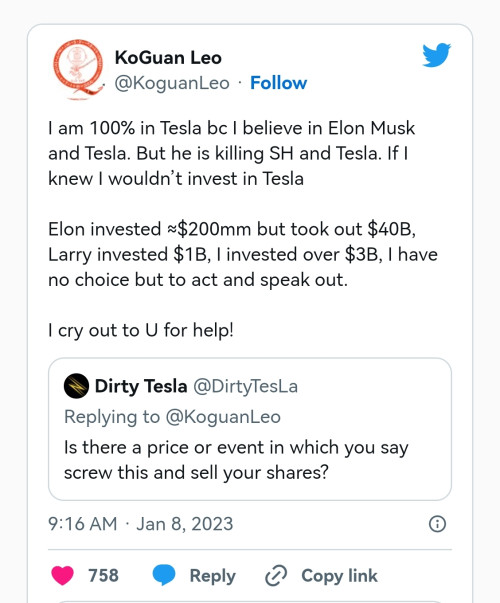

Musk. When he first sold his Tesla shares, he sold it despite promising that during a Tesla shareholder annual meeting almost a decade ago, that his money would be the first in and last out.

so when Musk sold, wasn't it logically to consider selling too?

( now this is a strange behavior for a number of investors. When they see the insiders buy, they get all so bullish. When Musk initially sold, why aren't they bearish? More so, the selling meant Musk broke his words. Words are gold, yes? One doesn't simply chincai make declarations left, right and center, yes? )

was that a good sell point?

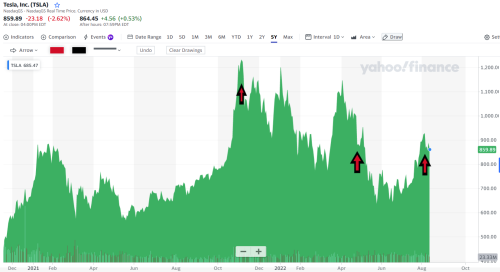

Take a look at the chart below. The arrow indicates when roughly Musk sold his shares! (it EXCLUDES the December 2022 sales, lazy me la.

)

Did he get a good sale or what?

Musk and Twitter.

Need I say more?

Now Tesla is a high growth stock.

Growth stocks are incredibly rewarding for the investor. It is the boom boom factor. But when there is the first sign of slower earnings growth, these growth stock, can really plummet.

We saw it in the gloves sector.

Take Harta. Despite being the best, the best margin, did it matter? Nope.

When the earnings started to decline, Harta and all the other stocks really crashed back to earth.

So for a high growth stock, the biggest risk is the slowdown in the earnings. That's the risk. And if it happens, you want to just the get the hell out. Last thing is to talk stuff like value.

In the stock market, being right is easy to know. The stock goes up. (LOL! one can be wrong and yet the stock goes up too. It happens)

But the hardest thing is... admitting one is wrong even when the price is down.

This post has been edited by Boon3: Jan 12 2023, 01:47 PM

This post has been edited by Boon3: Jan 12 2023, 01:47 PM

Aug 5 2022, 01:39 PM, updated 4y ago

Aug 5 2022, 01:39 PM, updated 4y ago

Quote

Quote

0.0410sec

0.0410sec

0.20

0.20

6 queries

6 queries

GZIP Disabled

GZIP Disabled