QUOTE(eyerule @ Jan 8 2023, 10:05 PM)

i think the public too caught up on musk. they forget to look at the company itself.

their ability to scale manufacturing is insanely fast. they can also adapt their software and hardware.

their margins is so much bigger than other manufacturers. they can afford to cut prices, even undercut competitors and still make a profit. they have pricing power.

The owner issue is so important for me. What he does or doesn't do can drive the share price drastically up or down.

The tedious example again is the issue of Musk and his Tesla shares sale. Nothing wrong in selling his shares but when he keeps doing it time and time again, despite telling the public he won't sell any more shares, puts a massive overhang on the stock. Who wants to carry the stock when the owner can dump a chunk of the shares as and when he pleases?

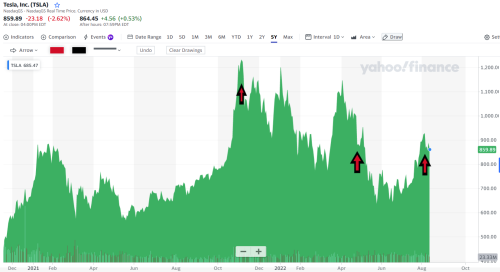

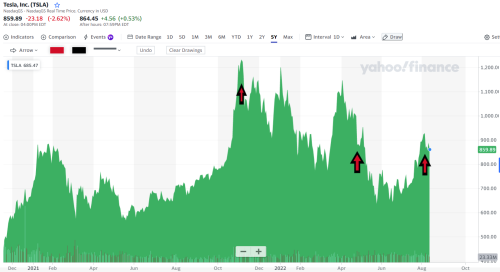

Posted B4 his most recent sale in Dec. See the chart indicating his sales points.

» Click to show Spoiler - click again to hide... «

QUOTE(Boon3 @ Aug 12 2022, 02:03 PM)

Here's the best one...

yup, Musk twitted that ....

what's the thing they say? Mouth say one thing, hands do another?

LOL! Can trust him or not?

Or is it only in the share market, folks can easily trust the taukeh besar?

Arrows shows where he had dumped his shares for a real good profit...

so here's the dumb dumb question...

Musk dumped for real good profit (only ber-billion ), do you think it's smart to buy when he's dumping?

Does this sound wise?

as they say, a leopard never loses its spots...

QUOTE

On Aug. 9, Musk told fans he was done selling Tesla shares to fund a possible Twitter acquisition

https://www.cnbc.com/2022/11/08/elon-musk-s...sla-shares.htmlso how to trust?

How to do business with someone I do not TRUST?

and the big picture... that's so clear, no?

≠====≠============≠=========================

And it's only Dec 15th and we are reading that the same shit is happening again...

Yup.. Musk has announced that last month he has disposed yet another chunk of Tesla shares.

https://www.cnbc.com/amp/2022/12/15/elon-mu...la-shares-.htmlAnd Tesla last traded...err....156.80.

Is simple, no?

If you don't trust the owner, don't buy the shares!!

My stance is clear. If I don't trust the owner, I won't touch the shares.

And neither would I be shorting the stock. Not my cup of kopi.

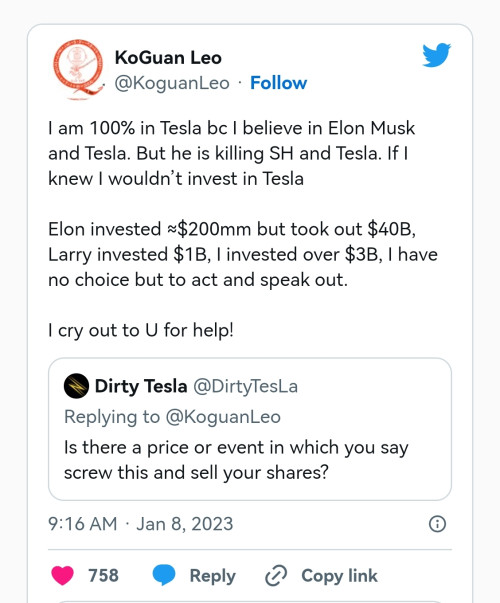

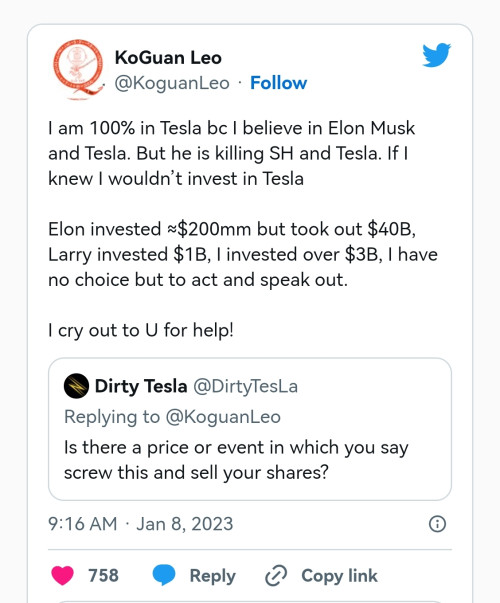

And this is rather interesting on the topic of Musk and his stock sakes. Tesla 3rd largest shareholder making angry statements.

https://finance.yahoo.com/m/d6de3b9d-c824-3...der-mounts.html

Oh yes. Its margins is big but with Tesla dumping car prices in China between 13% and 24% for its model Y and model 3, such a move would eat into future earnings. And would there be any repercussions from other Chinese EV makers? With Chinese companies known as aggressive price dumpers, would this be the start of a price war?

Interesting article :

https://www.investors.com/news/tesla-stock-...ock/?src=A00220This post has been edited by Boon3: Jan 9 2023, 06:35 AM

Jan 8 2023, 02:02 PM

Jan 8 2023, 02:02 PM

Quote

Quote

0.0339sec

0.0339sec

0.35

0.35

6 queries

6 queries

GZIP Disabled

GZIP Disabled